This is the weekly analysis of Merger Arbitrage Spread Performance January 5, 2020. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 30th December – 3rd January. The first section of this report discusses the biggest winners & losers from the T20 portfolio. Then we detail the performance of the overall portfolio. To conclude, we compare this performance with the broader market and the IQ Merger Arbitrage Exchange Traded Fund – MNA. The information contained in this weekly analysis & review assists traders in their merger arbitrage investment decision making.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Portfolio. A list of pending cash merger arbitrage spreads available as at 29th December. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Portfolio. Click this link for the spread performance analysis from the previous week.

Merger Arbitrage Spread Performance January 5, 2020

Red Robin Gourmet Burgers (RRGB)

Red Robin Gourmet Burgers retained is place as the largest mover this week following an SEC Form 13D filing. The filing contains details of an additional activist investor entering the situation. In this case, VIEX Capital Advisors has disclosed a holding of 867,426 shares equating to 6.7%. This explains the rise in the stock and that the announcement is only now being made following the required official filing (as opposed to during the stock’s rise).

The stock continued its upward trajectory during the week by an additional $1.67 to close at $32.70. This leaves the simple spread at 22.32%. This caps an impressive performance since the start of December when the stock dipped below $27. Our intention from early on in this deal was to trade the volatility of this spread rather than hold until deal completion. Now that this announcement has been made, it is possible the stock may drift as investors and traders undertake to analyse the situation in greater detail and try to figure out the next move. Should this be the case we are position to buy back some stock at lower levels which we have recently sold. However the stock may continue to move forward as the story picks up pace. Traders should be prepared for things to move quickly once we get to the business end of this saga.

Bitauto Holdings (BITA)

Bitauto Holdings (BITA) trended upwards throughout the week. Monday saw the announcement of Mr. Xiaoke Liu, the current chief operating officer, being appointed as the president of the Company effective as of January 1, 2020. However, despite there being no specific deal news announced during the week, the stock regained all of last week’s losses and a considerable amount more to close on Friday at $15.18. A rise of 2.92% for the week. This leaves the arbitrage simple spread at only 5.40%. Similar to RRGB, movements of this magnitude indicate some news or an announcement will be forthcoming. We maintain our position as we await news from Tencent Holdings as to their intentions. Should no announcement materialize, we may choose to lighten some of our holding so as to free up capital for alternative opportunities.

Changyou.com (CYOU)

Changeyou.com saw an impressive rise during the week which culminated on Friday morning as the stock rose 1% ABOVE the offer price. This rise, which caught us unaware at the time was and wholly unanticipated although we managed to hit the sell button just in time. We are yet to see any news or announcement explaining this rise. By the close on Friday, the stock had settled at $9.96 up 1.63%. As we previously suggested, we had already initiated our active arbitrage strategy on this deal. This involves actively buying and selling the stock to take advantage of the volatility of deal closing probability (DCP). As the stock rose above the offer price we have now sold our entire holding at a reasonable profit. The rise on Friday morning may imply the possibility of a higher bid forthcoming but as we have seen no evidence of this, we are happy to remain on the sidelines for the time being. Should this be a case of over exuberance, and the stock subsequently declines, we would still not anticipate re-entering a long position in the foreseeable future.

Fitbit (FIT)

A small decline in Fitbit this week was sufficient to see the stock top the list of largest losers. By Friday FIT had closed on $6.44 down $0.04 or 0.62%. This was a highly volatile week for the stock which saw it trade as high $6.59. We would be surprised to see this stock move much lower unless more negative news surrounding the deal is announced. However, as we have previously warned that is not necessarily an endorsement for investment. We would advise traders refrain from making an investment here until further clarification is received from the regulatory point of view. Even then, this would not be for the faint hearted.

Merger Arbitrage Portfolio Performance

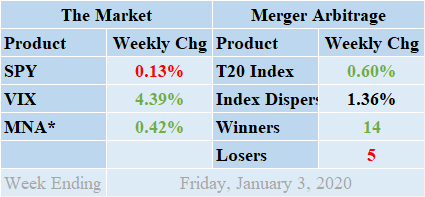

A positive start for the new decade sees winners again lead the losers by a respectable margin of 14 to 5 with 1 non-mover. The portfolio continues to operate with a full complement of 20 cash merger arbitrage and 0 cash positions and has done so for some time. The index builds on a run of consistent gains which saw a strong finish to last year and finishes the week in positive territory up by 0.60%. This week’s gain was primarily attributable to the gains made by RRGB, BITA, & CYOU.

Additional live news updates for these deals can be found on our customized T20 Index news feed. For even more specific merger details & news see also the dedicated news and merger information pages on recently announced deals including RRGB, TGE, LOGM, ARQL, & INST. The standard deviation of the individual index returns for the past week was 1.36%. This figure is in-line with both the short-term and long-term averages.

MNA SPY VIX Returns Table 20200103

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The IQ Merger Arbitrage ETF, MNA, continues its upward momentum achieving another positive week to start the year in the black. By the end of the week, the ETF was in positive territory by 0.42%. This rounds off a final quarter run for Q4 2019 which saw just one negative performance. The broader market however struggled on Friday. During another holiday shortened trading week the domestic political scene dominated market direction at the end of the week. This took the market lower as the market retreated from new all-time highs. The SPDR S&P 500 ETF, SPY, finished down 0.13%. Unsurprisingly however, the VIX index moved lower and by Friday had risen 4.39%.

Following the attacks in Iran we now expect volatility to remain on high alert in the near future. Despite trade negotiations calming the market, this latest political action reminds us never to get complacent with the current administration. However, we continue to see no reason why merger activity should not continue at its current level.

And finally...

The most recent list of the largest spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. This can be used to value the arbitrage spread of any stock-for-stock merger deals you may be interested in trading or additionally used in a pairs trading investment strategy.