This is the weekly analysis of Merger Arbitrage Spread Performance November 24, 2019. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 18th – 22nd November. The first section of this report discusses the biggest winners & losers from the T20 portfolio. Then we detail the performance of the overall portfolio. To conclude, we compare this performance with the broader market and the IQ Merger Arbitrage Exchange Traded Fund – MNA. The information contained in this weekly analysis & review assists traders in their merger arbitrage investment decision making.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Portfolio. A list of pending cash merger arbitrage spreads available as at 17th November. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Portfolio. Click this link for the spread performance analysis from the previous week.

Merger Arbitrage Spread Performance November 24, 2019

Pacific Biosciences of California (PACB)

PACB once again finds itself amongst the largest movers this week. Following an announcement on Wednesday regarding the proposed remedies by the companies to the CMA, PACB stock skyrocketed by over 10%. These are major concessions offered by the companies. Initial speculation was that the CMA appears to be on board with the proposals. Wednesday saw the stock hit an intraday high of above $5.30. However, an Ilumina spokesperson subsequently stated the CMA was yet to formally respond but nonetheless believed the proposed remedies would be satisfactory. There was no update on the expected closing date that was previously extended to March 31, 2020.

The market, despite responding positively however remains cautions. The stock rose by $0.50 during the week to close at $5.17, an increase of 10.71%. This still leaves a spread of 54.74%. This is great news for our position. We will maintain our holding pending further news and look forward to continuing our active arbitrage strategy.

Kemet (KEM)

Kemet was the second largest gainer this week. Despite no new deal news being released, other than the obligatory shareholder investigations, the stock rose by 2.21% to close at $26.81. Excluding the quarterly dividends of $0.05 this gives an annualized return of 1.32% if the maximum date of December 31, 2020 is used. Should the deal close earlier (as we expect it to do), thus improving the annualized return, we still believe there are more attractive merger arbitrage investment opportunities available. We currently have no position and at these levels do not plan to initiate an investment in the near future.

Changyou.com (CYOU)

Changyou.com rebounded this week from last week’s poor showing. The stock finished up 1.80% at $9.64. We are beginning to think this may be a candidate for our active arbitrage strategy. There has been little deal news recently whilst exhibiting a volatile spread. We shall therefore begin our preliminary analysis. We do note however the proximity to the U.S. – China trade negotiations and will thoroughly investigate this issue before initiating a trade. Despite last week’s analysis and recognition of PEAD, we currently have no investment in this stock.

Bitauto Holdings (BITA)

Bitauto Holdings (BITA) topped the largest losers this week. Despite no deal news, the stock declined 0.99% to close at $15.07. This gives a simple spread of 6.17%. We maintain our position and await the review of the special committee on the takeover proposal.

Acacia Communications (ACIA)

Acacia Communications was also in the red this week. We gave an extended analysis last week of why we thought this spread had gone as far as it could for the time being. We felt justified of significantly scaling back our position as the stock declined throughout the week. By Friday, ACIA had fall 0.66% to $66.64 giving a simple spread of 6.17%.

As explained last week, our investment decision was based upon the other investments in our portfolio. A point of view we strongly encouraged our readers to undertake by reviewing their own portfolio of investments. Should progress fail to be made in this deal in the near term, we would naturally expect the price react accordingly. At such lower levels, we may be tempted to renew our investment in this spread should this situation arise. For the meantime, our analysis focusses upon the correlation with other investments in our portfolio and the potential for regulatory delays in completing this deal.

Merger Arbitrage Portfolio Performance

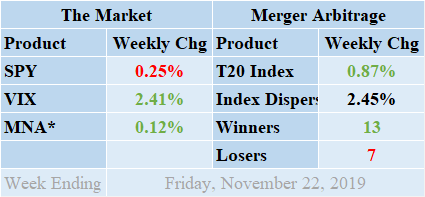

Winners outpaced the losers by 13 to 7 this week with 0 non-movers. The portfolio consisted of 20 stock and 0 cash positions. The portfolio snapped its run of poor performances by finishing firmly in positive territory by 0.87%. This positive performance was primarily attributable to the rebound in PACB, whilst supported by rises in KEM & CYOU. Readers can stay abreast of developments in these deals by following our customized T20 Portfolio news feed. This shows the latest mergers and acquisitions news updates focusing exclusively on the pending cash mergers we consider eligible for investment. We have also introduced dedicated news pages focusing on specific deals such as CISN, FIT, GWR, KEM, ONCE, PEGI, RARX, TIF, WMGI, & ZAYO along with background deal information. Return standard deviation for the past week was 2.45%. This figure is above both the short-term and long-term averages due to the positive returns mentioned above.

MNA SPY VIX Returns Table 20191122

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The IQ Merger Arbitrage ETF, MNA, eventually finished in the black following an indecisive week. By Friday, it had produced a positive return of 0.12% identical to last week. This rise outpaced the broader market. The broader market struggled to recover from Wednesday’s drop as speculation mounted that a breakthrough in the U.S. – China trade negotiations may be delayed. The SPDR S&P 500 ETF, SPY, finished down 0.25%. The VIX index unsurprisingly moved higher for the week. It eventually settled on an increase of 2.41%. Positive sentiment continues within the markets that a deal may be reached, however this has now turned to cautious optimism. Something we have warned of for some time. We expect this state to continue and remain ready to exit positions with ties to China should the opportunity arise.

And finally...

The most recent list of the largest spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. This can be used to value the spread of any stock-for-stock deals you may be interested in.