This is the weekly analysis of Merger Arbitrage Spread Performance December 1, 2019. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 25th – 29th November. The first section of this report discusses the biggest winners & losers from the T20 portfolio. Then we detail the performance of the overall portfolio. To conclude, we compare this performance with the broader market and the IQ Merger Arbitrage Exchange Traded Fund – MNA. The information contained in this weekly analysis & review assists traders in their merger arbitrage investment decision making.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Portfolio. A list of pending cash merger arbitrage spreads available as at 24th November. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Portfolio. Click this link for the spread performance analysis from the previous week.

Merger Arbitrage Spread Performance December 1, 2019

Tiffany & Co. (TIF)

Tiffany & Co. (TIF) is the clear leader this week. The stock rose significantly on Monday following and increased bid from LVMH for $135 per share. This increased offer comes with the proviso of giving LVMH confidential access to its books so as to complete due diligence. This would often be seen as a red flag by most conservative arbitrageurs.

However, following the 6.61% rise in the stock to $133.80, the deal is now offering an investment return of 2.20%. This assumes a closing date in the middle of next year which allows for three dividend payments. This in turn gives an annualized return of 3.81%. Early closing may of course increase this annualized return but at the same time could potentially reduce the number of dividends paid and thus reduce the return. Even though we believe the possibility of this deal falling apart is extremely low, we do not consider this deal to offer a sufficient return worthy of an investment.

Red Robin Gourmet Burgers (RRGB)

Red Robin Gourmet Burgers retained is place amongst the largest movers this week as it rebounded from last week’s disastrous performance. Without any deal news to speak of the stock recovered by $1.19 to close at $27.27. This leaves the simple spread at a whopping 46.68%. The week results are seen as the impetus needed to force management into negotiating a sale of the company. An issue that was not lost on the bargain hunters during the week. We continue to hold our position at least until further news is available.

Fitbit (FIT)

Fitbit had an extremely volatile week. On Tuesday, it was revealed the stock was previously in a private bidding war which was eventually won by Google. On announcement of the news, the stock rallied from $6.78 (the close on Monday) to $7.05. We were somewhat surprised at the move as it seemed unlikely to us there was any more bidding to be made. Subsequently the stock retreated back to the mid $6.80’s. However, Wednesday provided another opportunity for the shorts to trade as the rival bidder was revealed to be Facebook. The stock hit $7.07 only to be sold back down by the early close on Friday to finish the week at $6.96.

We maintain our prior analysis of this stock and remain wary of an investigation to Google’s attitude towards data privacy and the timeline to deal closure. We will await further details of such action before ever initiating a long position here.

Bitauto Holdings (BITA)

Bitauto Holdings (BITA) produced a disastrous set of results during the week. Tuesday’s announcement saw the release of figures showing EPS dropping by $0.29 and revenue missing by $20.38m. This sent the shares tumbling by over 5%. The stock continued to fall during the shortened week and at one point early Friday morning traded at $13.99. However, a strong rally from that moment during Friday’s truncated trading session saw the stock close at $14.86. A drop of only 1.39% for the week. This leaves the arbitrage simple spread at 7.67%.

Fortunately, we refrained from selling our position as we awaited news from Tencent Holdings as to their intentions following the results announcement. We continue to maintain our position.

Changyou.com (CYOU)

In contrast to BITA, Changeyou.com previously announced an EPS beat of $0.21 and a revenue beat of $19.79m. However, this has done little for the subsequent stock price. During a volatile week, the stock continued to trend downwards. By Friday’s close shares were trading at $9.55 down 0.93% for the week. There has been little deal news recently whilst exhibiting a volatile spread. We continue to debate the effectiveness of utilizing an active arbitrage strategy in the stock. That is, trading the stock regularly to profit from the volatility of the spread. We currently have no investment in this stock but may trade into a position during the week without further announcement.

Merger Arbitrage Portfolio Performance

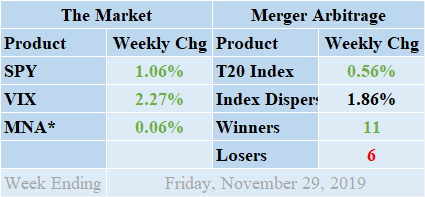

Winners again outpaced the losers this shortened holiday week by 11 to 6 with 3 non-movers. The continues with a full complement of 20 stock and 0 cash positions. The portfolio finished soundly in positive territory by 0.56%. This is the second successive week the index has posted a solid gain. This week’s rise was primarily attributable to the second increased offer in TIF, whilst supported by a rebound in RRGB. Additional live news updates in these deals can be found on the customized T20 Index news feed. This shows the latest mergers and acquisitions news updates focusing exclusively on the pending cash mergers we consider eligible for investment and trading. For specific stock see also the dedicated news and merger information pages on such as CISN, FIT, GWR, KEM, ONCE, PEGI, RARX, TIF, WMGI, & ZAYO. The standard deviation of individual returns for the past week was 1.86%. This figure is below the short-term but consistent with the long-term average.

MNA SPY VIX Returns Table 20191129

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The IQ Merger Arbitrage ETF, MNA, just managed to finish in positive territory following what was initially looking to be a strong week. However, a decline on Friday almost wiped out the entire previous gains. MNA eventually settled on a positive return of 0.06% continuing a positive run now extending back 8 weeks. The broader market behaved in much a similar way during the holiday week although the decline on Friday was much more muted. The market hit yet another all-time high during the week buoyed yet again by hopes of a trade deal between the U.S. and China and domestic economic news reporting a decrease in people applying for first time benefits in October. The SPDR S&P 500 ETF, SPY, finished up 1.06%. Surprisingly however the VIX index also moved higher over the same period. By Friday, the index had risen by 2.27%.

Positive sentiment remains in the markets as hopes continue to be pinned on a Phase 1 trade deal. This is a difficult situation to call for traders. History has taught us to expect the unexpected in these situations and second-guessing the political whims of those involved is fraught with danger. We tentatively expect this state of affairs to continue but remain poised to act should the situation turn sour.

And finally...

The most recent list of the largest spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. This can be used to value the arbitrage spread of any stock-for-stock merger deals you may be interested in trading or additionally used in a pairs trading investment strategy.