This is the analysis of Merger Arbitrage Spread Performance August 25, 2019. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 19th – 23rd August. We produce this report at the end of each week. Firstly, the analysis discusses the biggest winners & losers from the portfolio. Secondly, we highlight the performance of the portfolio and conclude with the broader market as a point of comparison. The information contained in this weekly analysis and review assists traders in their merger arbitrage investment decision making.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Portfolio. A list of pending cash merger arbitrage spreads available as at 18th August. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Portfolio. Click this link for the spread performance analysis from the previous week.

Merger Arbitrage Spread Performance August 25, 2019

Red Robin Gourmet Burgers (RRGB)

Red Robin Gourmet Burgers (RRGB) had a tremendous week following the release of Q2 figures. The stock closed up 10.41% for the week at $34.90. This includes a strong recovery on Friday, the first day after the earnings announcement when the stock moved 5.89% higher. There was no new deal news announced which is understandable considering the current position of this deal. However, these strong results does reinforce the floor price to which the stock would retreat to should the deal negotiations collapse. We maintain our position until further deal news becomes available.

Cray Inc. (CRAY)

Cypress semiconductor continued its march upwards during the week. The stock closed 0.87% higher with the spread now standing at 0.17%. During the week, Cray announced Q2 earnings that missed expectations. However, in a filing they also announced the receipt of HSR regulatory clearance on August 16. This is on top of the already received clearance from both Austria and Germany. The announcement goes on to state,

“The closing of the merger is subject to approval by Cray’s shareholders and the satisfaction of certain other closing conditions set forth in the Merger Agreement, including the receipt of antitrust clearances or expiration of the requisite waiting periods in Japan and South Korea.”

The special meeting is scheduled to be held on August 27. We have no position in this stock.

Pacific Biosciences of California (PACB)

Pacific Biosciences of California (PACB) continues its volatile run. Last week’s best performer is this week’s leading laggard. The stock, up early on in the week, finished down by 2.60% at $5.61. This gives a simple spread of 42.60%. There was no new deal news announced. We continue to await any developments from the investigations currently being carried out by the UK and U.S. regulatory authorities. PacBio, like most others appears to have been caught up in the movements of the broader market as well as some potential profit taking following last week’s gains. The current volatility of this stock would be playing well into our previous active arbitrage strategy. However, we have enforced strictly discipline in this instance. We mainitain our long position.

Mellanox (MLNX)

Mellanox was another decliner this week closing down 1.90%. This was almost entirely due to the decline on Friday and was dragged lower by the series of tweets issued by President Trump. The spread now stands at 17.39% with the stock at $106.48. These tweets showed the action that is to be taken in retaliation to the tariff hikes suggested by the Chinese. Subsequently the semiconductor industry and deal spreads requiring Chinese approval suffered. We maintain our position and will await further clarification in the global trade arena.

Acacia Communications (ACIA)

Acacia Communications was the third largest decliner of note this week. The stock declined 1.75% to close at $62.85. This leaves the spread at 11.38%. However, as mentioned, the decline in the broader market following the escalation of the U.S. China trade war hurt a number of merger arbitrage stocks. As with Mellanox, we maintain our position and will await further clarification in the global trade arena.

Merge Arbitrage Portfolio Performance

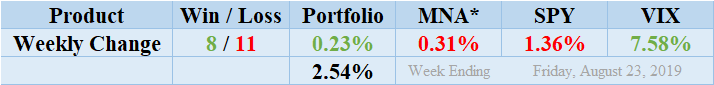

Winners lost out to the losers by a score of 8 to 11 with 1 non-mover this week. The portfolio consisted of 20 stock and 0 cash positions. However, the portfolio showed a reasonable positive performance finishing up for the week by 0.23%. As discussed above, despite the quantity of losses, a solid performance from the RRGB was sufficient to drag the index back into positive territory. Readers can also stay abreast of the developments in these deals by following our customized T20 Portfolio news feed focusing exclusively on the pending cash mergers we are following. Return standard deviation for the past week was 2.54% reflecting in large part the outsized gain recorded by RRGB. This figure is significantly higher than both the long-term and short-term averages.

MNA SPY VIX Returns Table 20190823

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

Losses on the last day of the week left the MNA ETF producing an overall loss for the week and was left showing a loss of 0.31%. This marks yet another week where the IQ Index merger arbitrage ETF continues to hover about the zero return line. The broader market however continues to experience heightened volatility. The S&P 500 ETF, SPY, finished down by 1.36%. The VIX index accordingly moved higher and eventually settled on an increase 7.58% for the week. We had previously suggested volatility would remain higher as we continue through earnings season. However, it was the unexpected announcement from President Trump on Friday that sent the markets into tailspin. This decision adds to the fears of the beginning of a global economic downturn. However, this analysis is counteracted by the FED’s statement of moving interest rates accordingly should this be the case.

And finally…

The most recent list of the largest spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. This can be used to value the spread of any stock-for-stock deals you may be interested in.