This is the analysis of Merger Arbitrage Spread Performance May 5, 2019. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 29th April – 3rd May. We produce this report at the end of each week. Firstly, the analysis discusses the biggest winners & losers from the portfolio. Secondly, we highlight the performance of the portfolio and conclude with the broader market as a point of comparison. The information contained in this weekly analysis assists traders in their merger arbitrage investment decision making.

Stocks mentioned in this report are from the Merger Arbitrage Limited top 20 (T20) list of cash merger arbitrage spreads available as at 28th April. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 list. Click this link for the news and performance analysis from the previous week.

Merger Arbitrage Spread Performance

Bluegreen Vacations Corporation (BXG)

The significant gainer this week for the second week running was Bluegreen Vacations Corporation (BXG). The stock climbed 1.32% to close the week at $15.37 compared to the $16.00 per share offer from BBX. Despite no official filings or official news during the week, the stock continues its rebound.

There was one report suggesting an alternative arbitrage strategy. This involved shorting the target stock because of a high expectation of a deal break. Whilst simultaneously taking a long position in the acquirer. We not do not intend to question the authors reasoning, but we do caution our readers to approach this strategy carefully. The strategy variants considered in the article are not “pure” merger arbitrage. As such, they come with a unique set of risks not considered in the article. An excessive amount of market risk is inherent in this approach and may render this strategy unsuitable for followers of merger arbitrage. The spread has now reduced to 4.10%.

Luxoft Holding (LXFT)

Luxoft Holding (LXFT) was the next best performer with a gain of 1.09% or $0.63. This takes the stock to within $0.32 of the $59.00 offer price from DXC Technology. The spread appears to have moved up in anticipation of pending deal closure. We are happy to maintain our position in this stock.

Pacific Biosciences of California (PACB)

Pacific Biosciences of California (PACB) moved $0.06 higher during the week. This 0.82% increase was enough to trigger yet another trade for us in this stock. We continue our active arbitrage strategy and are now looking to buy back some stock on weakness.

Global Brass and Copper (BRSS)

Global Brass and Copper (BRSS) made a debut entry in the biggest movers category this week. A gain of 0.76% or $0.33 was enough to gain 4th place in a strong week for the portfolio. During the week, the company issued an earnings announcement. Although earnings were light, revenue was above analysts’ expectations. The company declared a dividend of $0.09, which goes ex-div on May 10.

Attunity (ATTU)

As incredible as it sounds the only loser constituent of the portfolio last week was Attunity (ATTU). The stock closed down 0.04% or $0.01. The simple spread is now at 0.34%. The deal is reported to be closing this week.

Portfolio Performance

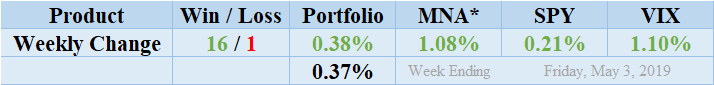

Winners dominated the losers this week by a ratio of 16 to 1 and 1 non-mover. The portfolio consisted of 18 stock positions and 2 cash positions. The portfolio showed a positive performance to finish up for the week by 0.38%. The level of gain this week was surprising for a portfolio consisting of only one losing position. Only ATTU posted a loss this week and that was only 0.04%, equivalent to $0.01! The standard deviation of the returns for the past week was 0.37%. This is lower than in recent times and significantly lower than the longer term average level. This low diversity of returns shows the benefits of including merger arbitrage investments in your portfolio. Consistent returns coupled with a low volatility of returns will improve the sharp ratio of almost all mainstream investments.

MNA SPY VIX Returns Table 20190503

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The MNA ETF rebounded in impressive style this week showing a positive 1.08%. This gain has almost recouped the losses encountered since our analysis began. Recent articles continue to tout the benefits of this product and one has to question the validity of the research. The sharp ratio shows the shortcomings of the hedging strategy employed by this particular product. We are more than happy to discuss this point in detail with our readers. See our Merger Arbitrage ETF Review for more information. The S&P 500 ETF, SPY showed significant gains at one point during the week but finished up a mere 0.21%. The market is now at all-time high levels. Despite the fluctuation experienced by the SPY during the week, the VIX index only increased by 1.10%.

And finally…

The most recent list of the largest spreads is already available. Our free merger arbitrage spread calculator is also available for FREE download. This can be used to value the spread of any stock-for-stock deals you may be interested in.