This is the weekly analysis of Merger Arbitrage Spread Performance January 12, 2020. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 6th January – 10th January. The first section of this report discusses the biggest winners & losers from the T20 portfolio. Then we detail the performance of the overall portfolio. To conclude, we compare this performance with the broader market and the IQ Merger Arbitrage Exchange Traded Fund – MNA. The information contained in this weekly analysis & review assists traders in their merger arbitrage investments and trading.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Index. A list of the largest pending cash merger arbitrage spreads available as at 5th January. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Index. Click this link for an analysis of the spread performances from the previous week.

Merger Arbitrage Spread Performance January 12, 2020

Fitbit (FIT)

On Friday January 3, Fitbit held their special meeting to vote on the takeover proposal from Google (GOOG). The results, filed on the following unsurprisingly showed an overwhelming support for the deal. This help propel the stock forward during the week, and despite a decline on Friday saw a gain of $0.12 to close at $6.56 up 1.86%. We previously commented how we would be surprised to see this stock move much lower unless specific negative news surrounding the deal was announced.

Now the vote has been conducted, traders are awaiting an update of the regulatory position. This is a difficult call. On the one hand, a drawn out regulatory investigation would serve to widen the spread. However, should the deal not be successful, an investigation of this type may deter alternative bidders and thus result in a large drop in the stock as it returns to the floor price. We suspect however that Google has prepared for this investigation, and in light of this we may look to initiate a small position in this stock should it remain at this level in the near future.

Mellanox (MLNX)

Also performing well this week was Mellanox. Despite initially being affected by the U.S. – China trade dispute, it has recovered strongly since the negotiations began to produce some solid foundations. This has helped the stock advance again this week by an additional $1.34 to $118.89. This gives a simple spread of 5.14%. The regulatory review in China, conducted by the SAMR is expected to conclude in February. However, speaking at the JPMorgan Tech/Auto Forum, MLNX management commented that it

“expects to close its $6.9B Mellanox acquisition in early 2020”.

We have already trimmed our position to reduce exposure to any further twists in the trade negotiations. We are happy to hold the remainder of our position for the meantime.

Red Robin Gourmet Burgers (RRGB)

After the market close on Tuesday Red Robin Gourmet Burgers made an SEC filing announcing the termination of employment of Guy J. Constant, the Executive Vice President and Chief Operating Officer. No additional details were given at the time. The stock however offered a muted response the following day although did touch as high as $33.58 early Thursday morning. By the close on Friday however, it had retreated to $33.01, but still up $0.31 or 0.95% for the week. It therefore remains unclear how this may affect the deal with Vintage Capital. However, we welcome the uncertainty and volatility this type of news brings. We continue with our active arbitrage strategy, and, having sold another small portion of our holding during the week, we stand well placed to buy that back at a lower price when the opportunity arises.

Kemet (KEM)

Kemet saw a sharp decline on Friday to become the week’s worst performer. The stock fell $0.23 on Friday to close the week at $26.58, down $0.19 or 0.71%. Excluding the quarterly dividends of $0.05, this gives a simple spread of 2.33%. It appears forecast earnings, which are scheduled to be announced on Jan 31, may be significantly below the prior period. Despite the stock decline we still do not feel this is enough of a return for us to initiate a position. We will however monitor the situation closely in case the situation changes and be ready to act.

Merger Arbitrage Portfolio Performance

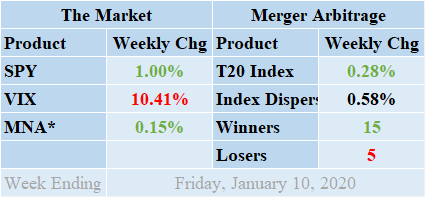

A continued positive start for the New Year sees winners yet again lead the losers this week by an impressive margin of 15 to 5 with 0 non-movers. The portfolio continues to operate with a full complement of 20 cash merger arbitrage and 0 cash positions. The index builds on a run of consistent gains benefitting from the renewed optimism surrounding negotiations with China and a previous slew of deal announcements made in December providing profitable opportunities. The index finishes the week in positive territory up by 0.28%. This week’s gain was primarily attributable to the gains made by FIT, MLNX & RRGB. The standard deviation of the individual index returns for the past week was 0.58%. This figure is uncharacteristically low and significantly below both the short-term and long-term averages.

Additional live news updates for these deals can be found on our customized T20 Index news feed. Even more specific merger details & news can be found on the dedicated news and merger information pages for recently announced deals including DERM, SRNE, HABT, RRGB, & TGE.

MNA SPY VIX Returns Table 20200110

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The IQ Merger Arbitrage ETF, MNA, continues its upward momentum achieving another positive weekly performance. Despite a tight trading range for most of the week, by Friday the ETF was in positive territory by 0.15%. This continues a positive run benefitting greatly from the performance of the broader market. The broader market itself however rose steadily throughout the week although Friday saw the main indices give up some of those gains. This took the market lower although new highs were achieved once again. The SPDR S&P 500 ETF, SPY, finished up 1.00%. Unsurprisingly, the VIX index moved lower and by Friday had declined 10.41%.

Following the attacks in Iran we now expect volatility to remain above recent levels despite political voices calling for hostilities to recede. It would be prudent to suspect there will be more to this story before the situation is fully resolved. On the economic front, the market remains buoyed by the upcoming finalization of a trade deal with China. We see no reason why merger activity should not continue at its current level.

And finally...

The most recent list of the largest spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. Traders can use this tool to value the arbitrage spread of any stock-for-stock merger deals you may be interested in trading. Additionally, the spreadsheet also functions as a valuation tool for a pairs trading or relative value investment strategy.