This is the Merger Arbitrage Spread Performance November 18, 2018 analysis. A review of the top 20 tradeable cash based merger arb spreads in the USA for the week 12th – 16th November. Included in this week’s report are the winners, losers and overall performance of the portfolio. This report is based upon the Merger Arbitrage Limited top 20 (T20) list of cash merger arbitrage spreads available as at 11th November.

Winners

statement on Friday. The deal is expected to close mid way through 2019. The second best performer was FCE.A which was up 0.36%. Forest City Realty Trust shareholders voted to approve the deal on Thursday. The deal is now expected to complete on or before Dec 10. There are no dividends expected to be paid on this stock although the spread is still offfering 0.81%. In our view this presents an attractive opportunity for a short term trade. VVC was up 0.33% on little news and IDTI was up 0.32% on an announcement with Toshiba to supply them with power management IC’s for it’s new solid state hard drives. Other risers were USG and RCII both of which were up 0.21% If you find this information useful please share this page using the links on the toolbar at the left (or bottom for mobile users) of your screen and leave your thoughts and comments or any requests you may have down below in the comments section.

Losers

Portfolio Performance

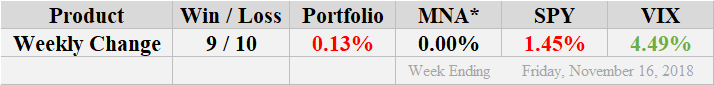

MNA SPY VIX Returns Table 20181116

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

And Finally…

The most recent list of the largest spreads is already available, and you can check out the rules for inclusion here. Our free merger arbitrage spread calculator is also available for FREE download. This can be used to value the spread of any stock-for-stock deals you may be interested in.