Winners

- The only significant gainer this week from the T20 list was Bluegreen Vacations Corporation (BXG). The stock climbed a 1.44% to close the week at $16.20. There was no news announced during the week that caused the movement so it appears that traders are speculating on the possibility of a higher bid. However, suitor BBX Capital Corporation (BBX) is already the beneficial owner of 90% of Bluegreen’s common stock. The stock currently trades at a $0.20 premium to the offer price of $16.00 although a dividend of $0.17 is expected to be paid at the end of next month.

Losers

- This week’s worst performer was Integrated Device Technology (IDTI). The stock declined 1.06% or $0.51. The spread now stands at 2.53% for a deal originally expected to close in the first half of 2019. During the week there had been concerns that there was a problem with the CFIUS review. The deadline for a decision expired on Friday and the stock dropped $0.05 which is mostly attributable to the large decline in the broader market. It strikes us as odd there was not greater coverage of this stock and trader chat seems to have gone quiet. We shall update readers via our twitter feed @MergeArbLimited on any breaking news of significance.

- As appears standard procedure nowadays, Pacific Biosciences of California (PACB) gave up last weeks gains to finish the week down 0.82% at $7.30. There was no news causing the movement and it appears that general market gyrations were the primary driver. This continues to suit our previous stated strategy perfectly. During the previous week we had sold some of our position and this week we were able to buy part of that back in the mid $7.20’s. We will, as always continue to trade the volatility of this spread.

- InfraREIT, Inc. (HIFR) was another loser of note this week down 0.70% or $0.15. This stock has consistently traded at or above the offer price of $21 per share even when dividends have been taken into account. The stock now trades at a 1.30% discount when two dividends are included. As noted last week, the FTC had previously granted early HSR termination but regulatory approval is still needed from the Public Utility Commission of Texas (“PUCT”), Federal Energy Regulatory Commission (“FERC”) and the Committee on Foreign Investment in the United States (“CFIUS”). The company believes the deal will close by mid 2019 and this timelime justifies the inclusion of an additional dividend payment. The stock is due to go ex-div on Thursday.

This week’s other worst performer of note was Spark Therapeutics (ONCE) down 0.52%. This follows on from last weeks poor performance. During the week the company filed a SC 14D9/A which stated “The required waiting period with respect to the Offer was to expire at 11:59 p.m., Eastern Time on March 18, 2019. According to the Offer to Purchase, Roche Holdings has withdrawn the March 1, 2019 filing effective on March 18, 2019. Roche Holdings refiled a Premerger Notification and Report Form under the HSR Act with respect to the Offer and the Merger with the Antitrust Division and the FTC on March 18, 2019.” This new HSR refiling will take 15 days to expire as the deal is structured as a tender offer. Following this drop the spread is now at 1.33% for a deal that is expected to close by the end of Q2. Any further decline coupled with an early closing may make this stock a potential candidate for investment. We shall be watching closely.

Portfolio Performance

We previously added some supplementary information

- The standard deviation of returns for the top 20 in addition to the average return. This gives our readers a better idea as to the movement within the portfolio.

- The change in the VIX (relative percent) is also included as a complimentary figure to the performance of the SPY

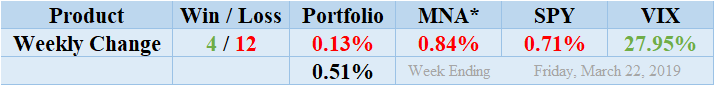

Losers comfortably beat out the winners this week by a margin of 12 winners to 4 losers and 2 non-movers. The portfolio consisted of 18 stock and 2 cash positions due to lack of eligible candidates. The portfolio showed a negative performance and finished the week down by 0.13%. This is the third decline in four weeks and now shows a net loss for that time period. The decline this week was mainly due to the performance of IDTI and PACB. The standard deviation of the returns is 0.51%. This is marginally higher than in recent times but below the longer term average level. PACB once again showed its ability to be a major driver of portfolio returns by reversing last week’s gains.

Market Performance

The MNA ETF returned another negative performance, this time a significantly negative 0.84%. This third weekly drop in a row now puts the MNA ETF almost back to where the the stock was trading when we started calculating and publishing the T20 performance figures once again showing the shortcoming of investing in this particular product. See our Merger Arbitrage ETF Review for more information. The S&P 500 ETF, SPY also showed significant losses due to Friday’s performance and finished the week down 0.71%. Unsurprisingly, following such a dramatic loss in the broader market, the VIX index increased by 27.95%.

MNA SPY VIX Returns Table 20190322

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.