Winners

- Normal service was resumed this week as Pacific Biosciences of California (PACB) regained the title of best performer from the T20 list. The stock climbed a 0.96% to recoup last weeks losses. There was no news that caused the movement and it appears that general market gyrations were the primary driver. This continues to suit our previous stated strategy perfectly. We stated last week we had topped up our position and will continue to trade the volatility of this spread. We have already cut part of that position in accordance with our previous stated strategy guidelines.

- The second best performer this week was Redhat (RHT) which increased 0.59% to $181.78. The main news here this week was a report that CTFN sources claim Redhat are working with the Department of Justice to establish a time line for the deal. This news sent the stock $1.07 for the week. Any shortening of the official time line will provide a handsome annualised return for investors which already stands at 5.74%

- Esterline Technologies Corporation (ESL) was the other gainer of note this week up 0.43%. This deal closed successfully during the week at the original offer price of $122.50. This deal was originally expected to close at the end of April.

Losers

- This week’s worst performer was Attunity (ATTU) down 0.30% at $23.37. ATTU offered little news during the week so it is likely that this was also general market fluctuations causing the stock to move. Despite this drop, the spread is still offering only a 0.56%. Although the deal is expected to close by the end of Q2 we would like to see a little more return from this deal before we establish a position.

- This week’s second worst performer was Spark Therapeutics (ONCE) down 0.18%. This follows on from last weeks 2nd best positive performance. There was a SC 13G/A [Amend] – Statement of acquisition of beneficial ownership by individuals filing made during the week but not much else to report. Following this drop the spread is now at 0.80% for a deal that is expected to close by the end of Q2. Any further decline coupled with an early closing may make this stock a potential candidate for investment. We shall be watching closely.

Portfolio Performance

We’ve previously added some supplementary information

- The standard deviation of returns for the top 20 in addition to the average return. This gives our readers a better idea as to the movement within the portfolio.

- The change in the VIX (relative percent) is also included as a complimentary figure to the performance of the SPY

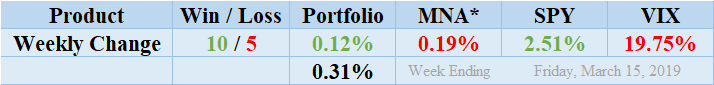

Winners managed to beat out the losers this week yet again by a margin of 10 winners to 5 losers and 2 non-movers. The portfolio consisted of 17 stock and 3 cash positions due to lack of eligible candidates. The portfolio showed a positive performance and finished the week ahead by a respectable 0.12%. This was mainly due to the performance of PACB with support from RHT. The standard deviation of the returns is 0.31%. This is lower than in recent times and below the longer term average level. PACB once again showed its ability to be a major driver of portfolio return by reversing last weeks losses. The MNA ETF returned another negative performance of 0.19% following on from last week’s significant drop. This was despite the S&P 500 ETF, SPY making significant gains to finish the week up 2.51%. Unsurprisingly, following a such a dramatic gain in the broader market, the VIX index decreased by 19.75%.

MNA SPY VIX Returns Table 20190315

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.