Winners

- The standout performer of the week was Integrated Device Technology (IDTI) whose stock climbed a massive 2.53%. The announcement came after the market close at the end of the previous week from CFIUS that “that the investigation of the companies’ proposed merger transaction is complete and that there are no unresolved national security concerns with respect to the transaction.” Inevitably, the following Monday morning saw the stock shoot up to the offer price of $49.00 and stayed there for the rest of the week until the deal was officially closed on Friday.

- Also providing a decent return for investors this week was Spark Therapeutics (ONCE). This follows on from last weeks fall when it was announced that the company had withdrawn and refilied under HSR. We stated last week that this is a tender offer so the waiting period is only 15 days and this is due to expire on April 2nd. We took advantage of the drop and took a small position on the back of this analysis. The stock was up 0.78% and the spread is now only 0.54%

- Redhat reported a mixed bag of earnings last monday. However, with the rise in the broader market the stock still managed to regain some lost ground and finish the week up 0.55% at $182.70. The simple spread is now at 4.00%

- Attunity (ATTU) was the final gainer of note last week. Although there was no deal specific news the stock managed to gain 0.47%. The spread is now just 11 cents at 0.21%

Losers

- In an unusual turn of events last week Pacific Biosciences of California (PACB) continued its losing streak and finished down for the second week in a row. The stock gave up 0.96% to close at $7.23. The spread now stands at 13.31%. Despite there being no news that caused the overall decline it must be noted that on friday the stock spiked down to $7.12 before recovering to $7.23. There has been no explanation for this movement. However, this continues to suit our previous stated strategy perfectly. Once again we managed to sell part of our position and were able to buy that back in the mid $7.10’s. We will, as always continue to trade the volatility of this spread.

Portfolio Performance

We’ve previously added some supplementary information

- The standard deviation of returns for the top 20 in addition to the average return. This gives our readers a better idea as to the movement within the portfolio.

- The change in the VIX (relative percent) is also included as a complimentary figure to the performance of the SPY

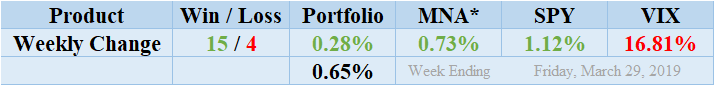

Winners comfortably beat out the losers this week by a margin of 15 winners to 4 losers and no non-movers. The portfolio consisted of 19 stock and 1 cash position due to lack of eligible candidates. The portfolio showed a positive performance and finished the week down by 0.28%. This gain now recoups the losses incurred during the previous weeks. The rise this week was mainly due to the performance of IDTI including the negative impact of PACB. The standard deviation of the returns is 0.65%. This is marginally higher than in recent times but below the longer term average level. PACB once again showed its ability to be a major driver of portfolio returns by reversing last weeks gains. The MNA ETF returned a positive performance, this time a significantly positive 0.73%. This gain is largely attributable to the gains made by Celgene as that stock based deals nears deal completition. This is a quirk of how the MNA ETF is constructed and once again shows the shortcoming of investing in this particular product. See our Merger Arbitrage ETF Review for more information. The S&P 500 ETF, SPY also showed significant gains due to Friday’s performance and finished the week up 1.12%. Unsurprisingly, following a such a dramatic gain in the broader market, the VIX index decreased by 16.81%.

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.