This is the analysis of Merger Arbitrage Spread Performance October 6, 2019. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 30th September – 4th October. We produce this report at the end of each week. Firstly, the analysis discusses the biggest winners & losers from the portfolio. Secondly, we highlight the performance of the portfolio and conclude with the broader market as a point of comparison. The information contained in this weekly analysis and review assists traders in their merger arbitrage investment decision making.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Portfolio. A list of pending cash merger arbitrage spreads available as at 29th September. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Portfolio. Click this link for the spread performance analysis from the previous week.

Merger Arbitrage Spread Performance October 6, 2019

Acacia Communications (ACIA)

Acacia Communications was the biggest winner for the week. In a week of slow merger and acquisition deal news, the stock rose 1.15% to close at $65.35. This leaves the simple spread at 7.12%. This rise marks a pleasant recovery for this spread. However, as noted, the rise in the broader on Friday week helped a number of merger arbitrage stocks. A 4 – Statement of changes in beneficial ownership of securities” was made during the week. However, we view the rise in this spread as a function of the ongoing trade war between the U.S. and China. We are somewhat relieved by this weeks recovery and maintain our position.

Versum Materials (VSM)

The other significant gainer for the week was Versum Materials. Having announced clearance from the Chinese regulators during the week this deal is scheduled to close on Monday. We, along with many others see this as an extremely positive sign and it reinforces our conviction of holding stocks sensitive to the effects of the ongoing trade war. Although we have practiced restraint in this area by applying prudent risk management techniques, we are of course pleased to see this development. We have had small position in VSM for some time and will enjoy taking this small victory.

Red Robin Gourmet Burgers (RRGB)

Red Robin Gourmet Burgers (RRGB) also continued its volatile path this week. Tuesday morning saw the stock at almost $34. Following a slide during the rest of the week, the stock managed a weekly increase of $0.31 or 0.95%. This again was on little news. However, one bearish commentator has suggested the stock was, and is, overpriced and should be sold.

The volatility is this spread is intriguing. We note a pre-offer price of around $30 although we expect the floor price to be below that if the deal were to fail. The turnaround plan does not appear to be convincing the market. Therefore, we would expect to price to drop by a few bucks beyond that level. With such limited downside, should this volatility continue, on little to no official deal news, we will look to take a larger short-term position in this stock. We will however be more comfortable entering closer to the $32 level. The aim here is to trade to volatility and uncertainty surrounding this deal. A significant news announcement may alter this approach materially and with immediate effect.

Pacific Biosciences of California (PACB)

Pacific Biosciences of California (PACB) made yet another appearance at the top of the largest decliners list this week. Despite there being no new deal news, the stock closed below $5.00 for the first time in recent history. By Friday’s close PACB was down 4.60% at $4.98. What may prove newsworthy was the lack of volume of Friday. Despite a 2.54% drop just 33% of the 3-month average volume traded. We have covered PACB updates in many articles recently and will keep readers up to date with any developments as soon as announcements are made.

Genesee & Wyoming (GWR)

What may come as a surprise to some was the performance of Genesee & Wyoming. Friday saw the stock rise $0.23 in line with the broader market. However, the performance for the week was down $0.19 or 0.27% at $110.48. This is despite a positive shareholder vote voting in favor of the proposed offer from Brookfield Infrastructure (BIP). Results of the Genesee & Wyoming shareholder vote are in the table below.

| For | 50,030,723 |

| Against | 63,021 |

| Abstentions | 13,679 |

This was despite some wild claims of undervaluation of the offer. The spread still offers 1.38%. The latest closing guidance from the company indicates closing to be towards the end of the year or early 2020. We maintain our small long position although the minimal return and timeline may lead us to exit the position shortly in absence of any further updates.

Merge Arbitrage Portfolio Performance

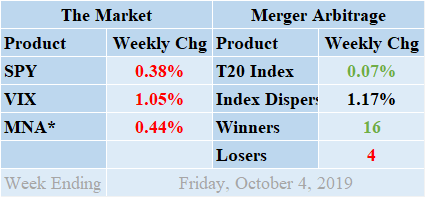

Winners beat out the losers by a score of 16 to 4 with 2 non-movers this week. The portfolio consisted of 20 stock and 0 cash positions. The portfolio showed a positive performance for the week finishing up by 0.07%. The quantity of winners was sufficient to counteract the effect of the outsized loss by PACB. Readers can stay abreast of developments in these deals by following our customized T20 Portfolio news feed. This shows the latest mergers and acquisitions news updates focusing exclusively on the pending cash mergers we consider eligible for investment. We have also introduced selected news feeds focusing on specific deals with background deal information. Return standard deviation for the past week was 1.17%. Despite the loss in PACB, this figure is lower than both the long-term and short-term averages and is the lowest individual reading for some time.

MNA SPY VIX Returns Table 20191004

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

A steady decline through the week left the IQ Merger Arbitrage ETF MNA producing a loss, showing a negative return of 0.44%. This was despite a strong recovery in the broader market towards the end of the week. The broader market saw steep declines on Tuesday and Wednesday only to recover most of the drop by the end of the week. The SPDR S&P 500 ETF, SPY, finished down 0.38% almost identical to last week. The VIX index surprisingly moved lower for the week, helped in great part by the strong market performance on Friday. It eventually settled on a decrease of 1.05%. We previously suggested volatility would remain higher as the market continues speculating on the next action in the ongoing trade war. However, it was a mixture of domestic political machinations countered by an encouraging jobs report that caused market volatility.

And finally…

The most recent list of the largest spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. This can be used to value the spread of any stock-for-stock deals you may be interested in.