This is the weekly analysis of Merger Arbitrage Spread Performance October 13, 2019. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 7th October – 11th October. The first section of this report discusses the biggest winners & losers from the T20 portfolio. Then we detail the performance of the overall portfolio. To conclude, we compare this performance with the broader market and the IQ Merger Arbitrage Exchange Traded Fund – MNA. The information contained in this weekly analysis & review assists traders in their merger arbitrage investment decision making.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Portfolio. A list of pending cash merger arbitrage spreads available as at 6th October. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Portfolio. Click this link for the spread performance analysis from the previous week.

Merger Arbitrage Spread Performance October 13, 2019

Pacific Biosciences of California (PACB)

Pacific Biosciences of California (PACB) made a return to the top of the best performers this week having recently touched fresh lows. It appears bargain hunters and deal speculators are prepared to step in around the $5.00 level. Despite there being no new deal news, the stock rose 3.21% or $0.16 to $5.14. However, it should be noted that like many other stocks this week, the majority of this rise came on Friday and was strongly linked to the rise in the broader market.

Spark Therapeutics (ONCE)

Spark Therapeutics followed last weeks decline with a rebound this week. Despite no new specific deal news, the stock managed a rise of 2.29% to $99.79. We attribute this rise partly to bargain hunting and deal speculation and the broader rise in the market. There is a large potential drop should this deal bust and the stock return to its floor price. Somewhere in the region of $50. However, we maintain our small position and await details of the CMA invitation to comment, which closed October 11 2019.

Bitauto Holdings (BITA)

Bitauto Holdings (BITA) also made one of the best performers this week. The stock has an offer of $16 Tencent Holdings (TCEHY). We note the underperformance of this stock. It dipped below $16 in the first quarter of the year and continued down to below $10. This may lead some stockholders to feel the offer is too low and increase the possibility of negotiating a higher offer. Although Tencent already claims to have the support of a large group of shareholders signifying a high probability of deal success on these terms. However, neither of these possibilities do not appear to be reflected in the stock price.

A committee is currently reviewing the offer so it is yet to have approval from the Board of Directors. We have penciled in an expected closing date during the first quarter of next year which may of course be significantly longer if the geo-political situation turns sour. This explains the wider spread. However, at 4.51% we think the deal should be attractive to most investors. We took a small position in this spread during the week. Admittedly, we had some good fortune following the progress of the trade negotiations on Friday as the stock closed up 1.86% for the week at $15.31.

Red Robin Gourmet Burgers (RRGB)

Red Robin Gourmet Burgers (RRGB) also continued its volatile path this week. Thursday almost saw the stock dip below $30. Following a slide during most of the week, the stock managed a small recovery on Friday but still finished down $1.71 or 5.21% at $31.10.

We noted last week we were looking to implement an active arbitrage strategy, and that “A significant news announcement may alter this approach materially and with immediate effect.” We see the appointment of David A Pace as the new chairman of the board as significant news as this leans in the opposite direction of a deal with Vintage Capital. However, we subsequently increased our position in this stock following that announcement. This was based on the potential downside and our short-term holding period. Although, following weaker restaurant sales data we do acknowledge the downside is greater than before. We will monitor this position very closely in the coming days and will be ready to exit should the news warrant such a move.

Acacia Communications was another significant loser this week. The stock fell 0.93% to close at $64.74. This leaves the simple spread at 8.12%. It appears last week’s rise was short lived. Even with the positivity surrounding the trade talks at the end of the week, we were a little surprised be the muted reaction in the stock. However, in light of the progress being made in the global trade arena we will continue to hold our position.

Merger Arbitrage Portfolio Performance

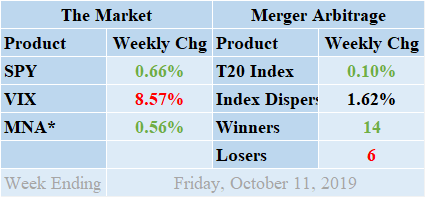

Winners beat out the losers by a score of 14 to 6 with 0 non-movers this week. The portfolio consisted of 20 stock and 0 cash positions. The portfolio showed a positive performance for the week finishing up by 0.10%. The quantity of winners was sufficient to counteract the effect of the outsized loss suffered by RRGB. Readers can stay abreast of developments in these deals by following our customized T20 Portfolio news feed. This shows the latest mergers and acquisitions news updates focusing exclusively on the pending cash mergers we consider eligible for investment. We have also introduced news feeds focusing on specific deals such as BPL, GWR, ONCE, RARX & ZAYO with background deal information. Return standard deviation for the past week was 1.67%. Despite the loss in RRGB, this figure is consistent with both the short-term and long-term averages.

MNA SPY VIX Returns Table 20191011

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

Having remained steady for most of the week the IQ Merger Arbitrage ETF MNA rose sharply on Friday to produce a positive return of 0.56%. This was in keeping with a strong recovery in the broader market on Friday as progress was made in the U.S. China trade talks. This was despite a gloomy start to the week with the broader market seeing steep declines on Tuesday. The SPDR S&P 500 ETF, SPY, finished up 0.66%. The VIX index unsurprisingly moved lower for the week, helped in great part by the strong market performance on Friday. It eventually settled on a decrease of 8.57%. We previously suggested volatility would remain higher as the market continues speculating on the next action in the ongoing trade war. This week saw a mixture of both positive and negative news. However, before the foundations are laid for a return to global growth we caution there is still some way to go in trade negotiations between the U.S. & China and of course Brexit.

And finally...

The most recent list of the largest spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. This can be used to value the spread of any stock-for-stock deals you may be interested in.