This is the weekly analysis of Merger Arbitrage Spread Performance October 20, 2019. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 14th October – 18th October. The first section of this report discusses the biggest winners & losers from the T20 portfolio. Then we detail the performance of the overall portfolio. To conclude, we compare this performance with the broader market and the IQ Merger Arbitrage Exchange Traded Fund – MNA. The information contained in this weekly analysis & review assists traders in their merger arbitrage investment decision making.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Portfolio. A list of pending cash merger arbitrage spreads available as at 13th October. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Portfolio. Click this link for the spread performance analysis from the previous week.

Merger Arbitrage Spread Performance October 20, 2019

Pacific Biosciences of California (PACB)

Pacific Biosciences of California retains its place at the top of the best performer list this week. The stock made an impressive gain of over 7% during trading on Tuesday and managed to retain most of that gain throughout the week. Last week we noted a minor recovery in the stock but it was difficult to distinguish between deal speculation and general market increases. Despite there being no new deal news, the stock rose an impressive 6.23% or $0.42 to $5.46. That still leaves a simple spread of 46.52%. With two impressive weeks worth of returns, we would expect to see some news released soon. The stock has some way to go before we reinstate our active arbitrage strategy. For the time being, we maintain our position.

Red Robin Gourmet Burgers (RRGB)

Red Robin Gourmet Burgers (RRGB) also produced a strong performance this week. The stock climbed throughout the week despite there being little news. A report highlighting the Refinitiv U.S. Retail and Restaurant Q3 earnings index is expected to rise 2.5% did little to dampen the momentum of Red Robin. Despite the stock having the “lowest EPS growth estimate in the sector”, the stock managed to rise 2.74% to $31.95.

We noted last week that we had initiated our active arbitrage strategy at these depressed levels. As the floor price for this stock appears to get lower and lower, thus increasing the downside, we were happy to trade out of part of our position already for a quick short-term profit. As previously stated, we will be looking to buy back on any weakness or sell out more of our position should the stock continue to rise. Should there be any significant deal news we stand ready to alter this approach as necessary.

Zayo (ZAYO)

Zayo made a rare appearance in the best performers this week. The stock climbed 1.12% to $34.33. This gives a simple spread of 1.95%. This deal is expected to close in the first half of next year. Although we expect the deal to close significantly earlier than that expected date, the attractiveness of this spread has severely diminished following this week’s rise.

Ra Pharmaceuticals (RARX)

Ra Pharmaceuticals (RARX) appeared in the largest movers for the first time since the announcement of the deal with UCB on October 10. The stock suffered a large decline on Friday to finish the week down 0.64% at $46.24. This spread is offering 3.81% and the deal is expected to close in the first quarter of 2020. However, target management is on board with the deal and there should be no regulatory surprises in the closing of the deal. Thus, an annualized return is looking rather attractive at around 9%. During the week, there was a flurry of legal investigations launched into the deal as well as Form 4 – Statement of changes in beneficial ownership of securities filings. However, there was no news surrounding the actual state of the deal. We suspect there was a case profit taking by existing shareholders who wish to bank their profits without waiting for consummation of the deal. The premium offered for this takeover was in the region of 100%. Despite the large potential downside, we like this deal and will actively seek to initiate a position in the stock in the coming week.

Merger Arbitrage Portfolio Performance

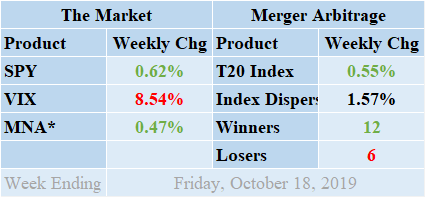

Winners beat out the losers by a score of 12 to 6 with 0 non-movers this week. The portfolio consisted of 18 stock and 2 cash positions. The portfolio showed a positive performance for the week finishing up by 0.55%. This positive performance was primarily attributable to PACB which recovered strongly. Readers can stay abreast of developments in these deals by following our customized T20 Portfolio news feed. This shows the latest mergers and acquisitions news updates focusing exclusively on the pending cash mergers we consider eligible for investment. We have also introduced news feeds focusing on specific deals such as BPL, GWR, ONCE, RARX & ZAYO with background deal information. Return standard deviation for the past week was 1.57%. This figure is consistent with both the short-term and long-term averages.

MNA SPY VIX Returns Table 20191018

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The IQ Merger Arbitrage ETF MNA rose steadily throughout the week to produce a positive return of 0.47%. This was similar to the rise in the broader market. However, the market did see a sharp rise on Tuesday, a gain which it maintained until the end of the week. The SPDR S&P 500 ETF, SPY, finished up 0.62%. The VIX index unsurprisingly moved lower for the week, helped in great part by the strong market performance on Tuesday. It eventually settled on a decrease of 8.54%. We previously suggested volatility would remain higher as the market continues speculating on the next action in the ongoing trade war. In addition to this, we have now entered earnings season. This week saw some positive earnings reports from the banks. We have listed those merger arb stocks who are part of the T20 and are scheduled to report on our Spread tracker page.

And finally...

The most recent list of the largest spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. This can be used to value the spread of any stock-for-stock deals you may be interested in.