This is the analysis of Merger Arbitrage Spread Performance May 19, 2019. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 13th – 17th May. We produce this report at the end of each week. Firstly, the analysis discusses the biggest winners & losers from the portfolio. Secondly, we highlight the performance of the portfolio and conclude with the broader market as a point of comparison. The information contained in this weekly analysis assists traders in their merger arbitrage investment decision making.

Stocks mentioned in this report are from the Merger Arbitrage Limited top 20 (T20) list of cash merger arbitrage spreads available as at 12th May. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 list. Click this link for the news and performance analysis from the previous week.

Merger Arbitrage Spread Performance

WageWorks (WAGE)

A rare bright spark this week was WageWorks (WAGE) up 1.87%. The stock has been extremely volatile during the week. A strong performance on Friday took the price above $50. There was no news official news during the week so we expect that an announcement is imminent. This deal is yet to be agreed by both sides so no official deal terms have been released. A movement such as this may raise a few eyebrows if a higher offer is subsequently announced. In the meantime it appears the accuracy of previous financial reports is not deterring investors. We had been long this stock during the week and have already taken some profits

Redhat (RHT)

Redhat (RHT) also managed to land in positive territory for the week. The stock finished up 0.40% and was the second best performer of the week. The DoJ blessing last week seems to have continued its momentum. Traders now seem aware that no additional Chinese clearance is required. This leaves a relatively straight forward run to deal completion. We continue to foresee (and have always done so) a closing date much sooner than that initially forecasted. This gives an annualized return closer to 9%. For this reason we maintain our long position and may possibly increase it on weakness if the opportunity arises. Alternatively, should the stock continue to rise at this rate we may take profits to redeploy finds elsewhere.

Mellanox (MLNX)

The biggest loser this week was Mellanox (MLNX) down 4.25%. This spread has serious exposure to the whims of the Chinese regulators. As noted last week, “the escalation in the US-China trade war has caused arbitrageurs to run for cover and dump their positions”. This has continued throughout the week inflicting larger losses on the arbs. MLNX now has the largest simple spread in the portfolio at 10.73% up from 6.02% last week. With no immediate resolution in sight, we see this spreads remaining in limbo for some time. Depending on the spread level once the selloff subsides, the stock may provide an attractive opportunity should trade relations show any signs of thawing. Obviously we regret not exiting the position when we suggested and will remain long for the time being.

Pacific Biosciences of California (PACB)

Pacific Biosciences of California has been relatively quiet for some time but exploded into life once again last week. The drop dropped $0.18 to finish down for the week by 2.43%. Traders will be well aware of our strategy by now. We actively trade this stock and are continuously entering and exiting our positions, sometimes multiple times in a single day. We had previously stated we had exited most of our positon and were looking to buy back on weakness. Our wishes have been fulfilled. Once again there was little news so we are happy to scalp the volatility of the market in a merger arbitrage framework.

Travelport (TVPT)

Travelport (TVPT) also suffered this week down 2.13%. The stock now trades at $15.17 against an offer price of $15.75. There was no new news announced during the week. It appears the stock is suffering further from the fear that Russian clearance for the deal is not forthcoming. Combined with the broader market decline the stock has now fallen to its lowest levels since deal announcement. A simple spread of 5.47% makes this spread attractive if you believe the Russian threat is overdone. We are already long this stock. Perhaps prematurely, but we will stick with it for the time being.

Spark Therapeutics (ONCE)

The fourth biggest loser for the week was Spark Therapeutics down 1.96%. This deal is still some way from obtaining the required number of shares to be tendered. In the meantime Roche and Spark announced during the week they would refile (again). Thus giving the government more time to review the deal. This is scheduled to be done on about May 23. The tender offer has been extended until June 7, although it is widely expected to be extended again. We are also long this stock having purchased a small position previously.

Buckeye Partners (BPL), Luxoft Holding (LXFT) & Bluegreen Vacations Corporation (BXG)

This week saw the worst performance of the T20 list since records began. A number of additional large losses also took place lower down the list. We mention these briefly for the sake of completeness. Buckeye Partners (BPL) was down 1.84%. The forecast completion is at the end of the year but with two possible large dividends this could be an attractive spread. Luxoft Holding (LXFT) was down 1.37%. We have taken a position in this stock in the anticipation that the deal will close promptly. Bluegreen Vacations Corporation (BXG) was down 1.25%. We are now looking seriously at using our active arbitrage strategy for this spread. We have already entered and exited this stock multiple time during the week. The difference of opinion regarding the success for this deal make this an ideal candidate for such a strategy.

Portfolio Performance

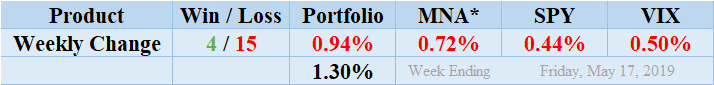

Losers beat out winners again this week by a score of 15 to 4 with 0 non-movers. The portfolio consisted of 18 stock and 2 cash positions. The portfolio showed a negative performance to finish down up for the week by 0.94%. This is the largest loss since our analysis began over 8 months ago. Specific deals have been caught up within the ongoing trade dispute. Their likelihood of closing has been put into doubt as traders speculate on what retaliatory measures the Chinese will implement. The standard deviation of the returns for the past week was 1.30%. This is significantly higher than both the recent and longer term averages. This is mainly due to the disparity in returns from MNLX and WAGE.

MNA SPY VIX Returns Table 20190517

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The stubborn resistance of the MNA ETF this week finally gave in as the week drew on. The ETF performance showing a negative 0.72%. The IQ Index merger arbitrage ETF had previously all but recouped the losses encountered in the preceding weeks. It is now showing a slender loss since our analysis began. However, it should be noted this week’s loss came via the target which were not adequately protected by the shorting of various stock based instruments used by management. We are more than happy to discuss this point in detail with our readers. See our Merger Arbitrage ETF Review for more information. The S&P 500 ETF, SPY showed significant losses at one point during the week but finished down 0.44%. Despite the fluctuation experienced by the SPY during the week, the VIX index was already at a higher level from last week. It therefore decreased marginally by 0.50%. This volatility level is expected to continue.

And finally…

The most recent list of the largest spreads is already available. Our free merger arbitrage spread calculator is also available for FREE download. This can be used to value the spread of any stock-for-stock deals you may be interested in.