This is the analysis of Merger Arbitrage Spread Performance May 12, 2019. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 6th – 10th May. We produce this report at the end of each week. Firstly, the analysis discusses the biggest winners & losers from the portfolio. Secondly, we highlight the performance of the portfolio and conclude with the broader market as a point of comparison. The information contained in this weekly analysis assists traders in their merger arbitrage investment decision making.

Stocks mentioned in this report are from the Merger Arbitrage Limited top 20 (T20) list of cash merger arbitrage spreads available as at 5th May. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 list. Click this link for the news and performance analysis from the previous week.

Merger Arbitrage Spread Performance

Spark Therapeutics (ONCE)

A rare bright spark this week was Spark Therapeutics (ONCE) up 1.63%. The stock recovered $1.76 having been sold off for 4 week in a row. Concerns about the HSR filing and low tender offer take up seem to have been put aside as investors take advantage of a wider spread. We still have our small position here and are happy to sit through it. The large downside makes it difficult to suggest a level at where we might add to this position. In which case this appears unlikely and we will sit tight until more news about the tender offer is released.

RedHat (RHT)

Redhat (RHT) rocketed up on Monday and finished the week up 1.20% or $2.19. On Monday The Department of Justice concluded its review of the Red Hat acquisition without remedies or conditions. This latest regulatory hurdle clears one of the bigger challenges faced in the US. IBM continues to see a H2 closing. An end of year closure gives an annualized return of 2.82%. However, we foresee a closing date much sooner giving an annualized return closer to 10%. For this reason we maintain our long position and may possibly increase it on weakness if the opportunity arises.

Mellanox (MLNX)

The biggest loser this week was Mellanox (MLNX) down 2.10%. This spread has serious exposure to the whims of the Chinese regulators. Thus the escalation in the US-China trade war has caused arbitrageurs to run for cover and dump their positions. MLNX now has the second largest simple spread in the portfolio at 6.02%. With no immediate resolution in sight, we see this spreads remaining in limbo for some time. It is unlikely that this stock will be used as any form of bargaining chip but the trader must be aware the Chinese are unlikely to be in any rush to green light this deal. Depending on the spread level once the selloff subsides, the stock may provide an attractive opportunity should trade relations show any signs of thawing. Obviously we regret not exiting the position when we suggested and will remain long for the time being.

WageWorks (WAGE)

WageWorks (WAGE) also suffered this week down 1.45%. As well as being caught up in the broader market turmoil, WAGE also filed a NT 10-Q. This detailed that WAGE “is unable to file its quarterly report on Form 10-Q for the quarter ended March 31, 2019”. This led to the following statement “certain financial statements for periods in 2016 and 2017 should be restated and should no longer be relied upon.” Accordingly, the stock sold off and the spread widened. The stock continued to be volatile during the rest of the week.

Traders are still trying to determine what a restatement of results may mean for the future of the deal. The deal is not scheduled to close until end of October. We have traded this stock cautiously both long and short. Currently, we are short the $50 call expiring this coming week. We strongly caution traders on being involved in this stock as we expect more volatility and news in the near future.

Bluegreen Vacations Corporation (BXG)

Almost identically, Bluegreen Vacations Corporation (BXG) declined 1.43% thus week. The stock had rebounded in recent weeks but is now back to $15.15 with a spread of 5.61%. Results were announced during where EPS was in line and revenue was higher than expected. With the differences of opinion on the likelihood of a successful deal outcome, we suspect this spread could be a candidate for our active arbitrage strategy. Should we trade this stock in the near future, readers will be kept informed via our twitter feed.

Travelport (TVPT)

The last loser of note was Travelport (TVPT) down 1.27%. Earnings announced on Friday showed EPS was ahead but revenues was light. The stock declined at the close Friday to just below $15.50. We are not sure why our bid was not filled but we would have been happy to own this stock at around the $15.50 level. The previously announced regulatory hold up in Russia may delay approval in that territory. However, even an increase in the deal completion time could provide a generous return. We will try again Monday morning.

Portfolio Performance

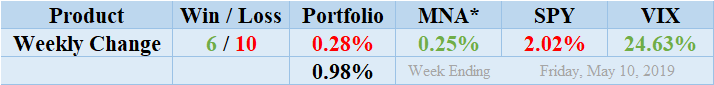

Losers beat out winners this week by a score of 10 to 6 with 1 non-mover. The portfolio consisted of 17 stock positions and 3 cash positions. The portfolio showed a negative performance to down up for the week by 0.28%. This tempered level of loss this week was surprising considering the wider global picture. Once again showing the benefits of this complementary merger arbitrage strategy for a portfolio consisting of only one losing position. The standard deviation of the returns for the past week was 0.98%. This is higher than both the recent and longer term averages. This diversity of returns shows the effects of the broader on a portfolio of deals at different stages of completion and different levels of probability of completion.

MNA SPY VIX Returns Table 20190510

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The MNA ETF held up in impressive style this week showing a positive 0.25%. This gain comes on top of last week’s impressive rebound The IQ Index merger arbitrage ETF has now all but recouped the losses encountered in the preceding weeks. It is now showing a slender profit since our analysis began. However, it should be noted this week’s gains came via the shorting of various stock based instruments which were not necessarily related to the merger arbitrage stocks in the portfolio. We are more than happy to discuss this point in detail with our readers. See our Merger Arbitrage ETF Review for more information. The S&P 500 ETF, SPY showed significant losses at one point during the week but finished down 2.02%. In light of the fluctuation experienced by the SPY during the week, the VIX index increased by 24.63%. This volatility is expected to continue.

And finally…

The most recent list of the largest spreads is already available. Our free merger arbitrage spread calculator is also available for FREE download. This can be used to value the spread of any stock-for-stock deals you may be interested in.