We’ve added some additional information recently

- The standard deviation of returns for the top 20 in addition to the average return. This gives our readers a better idea as to the movement within the portfolio.

- The change in the VIX (relative percent) is also included as a complimentary figure to the performance of the SPY

Winners

This week’s best performer was NxStage Medical, Inc. (NXTM) gaining 1.23%, a rebound from last weeks worst performer status. Its deal to be acquired by Fresenius Medical Care has had a rollercoaster ride of late and provides an opportunity for actively trading the spread for those able to stay abreast of market developments. Belmond (BEL) also performed strongly, up 1.18%. At one point during the week this stock was 1% above its offer price from Louis Vuitton Moet Hennessey as traders speculated on the possibility of a higher bid. Electro Scientific Industries (ESIO) was up 0.67% after Mr. John T C Lee (president of MKS, the acquirer) reiterated the anticipated closure of the deal in Q1 2019 and the appointment of a new vice president for ESI. Naturally, arbs looking for a “sure thing” won’t find many better than this but the spread is already priced accordingly. Finally, Integrated Device Technology Inc (IDTI) was up 0.54%, which on Wednesday received clearance from the State Administration for Market Regulation of the People’s Republic of China (“SAMR”), for its merger with Renesas Electronics Corp. The completion of this important step removes a potential significant roadblock in merger completion and has encouraged a large increase in the number of arbs participating in the deal. With the spread still offering 1.5% this looks to be an attractive situation.

Losers

Portfolio Performance

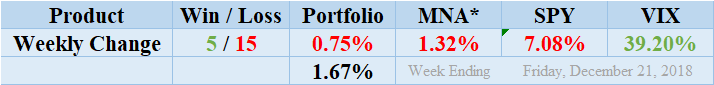

MNA SPY VIX Returns Table 20181221

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

And Finally…

The most recent list of the largest spreads is already available, and you can check out the rules for inclusion here. Our free merger arbitrage spread calculator is also available for FREE download. This can be used to value the spread of any stock-for-stock deals you may be interested in.