This is the analysis of Merger Arbitrage Spread Performance May 26, 2019. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 20th – 24th May. We produce this report at the end of each week. Firstly, the analysis discusses the biggest winners & losers from the portfolio. Secondly, we highlight the performance of the portfolio and conclude with the broader market as a point of comparison. The information contained in this weekly analysis assists traders in their merger arbitrage investment decision making.

Stocks mentioned in this report are from the Merger Arbitrage Limited top 20 (T20) list of cash merger arbitrage spreads available as at 19th May. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 list. Click this link for the news and performance analysis from the previous week.

Merger Arbitrage Spread Performance

Spark Therapeutics (ONCE)

The biggest winner for the week was Spark Therapeutics up 2.50%. This deal is still some way from obtaining the required number of shares to be tendered. However, in accordance with previous guidance we assume the companies have refiled under the HSR program. There were no official filings made during the week and news has been light. We suspect with this rise, traders are looking for profitable opportunities in deals which have recently sold off. Deals which however do not come with associated baggage such as the uncertainty of Russian regulatory clearance. The latest extension to the tender offer is expected to close June 7.

Quantenna Communications (QTNA)

Quantenna Communications (QTNA) was the other significant performer with a gain of 1.09% or $0.26. The spread on this arb is now at 1.37%. It was announced during the week that ON Semiconductor had filed for Chinese regulatory approval of the QTNA purchase. Although we did not originally plan to take a positon, we did so on the market pullback. We decided to exit this positon during the week. With the reduction in upside we felt we could repurpose the funds elsewhere for a greater return.. At these current level, we maintain our previous advice on this stock.

Bluegreen Vacations Corporation (BXG)

The biggest loser this week was Bluegreen Vacations Corporation (BXG) down 18.11%. Following the announcement of BBX Capital’s decision not to pursue the deal the stock plummeted. The decline continued until reaching the $10 a share area. Keeping in line with our policy of deal breaks, we used to first realistic price at which we thought we could exit a long position if required to do so. This was at a price of $12.25. This represents a substantial loss to arb involved in this deal. With BBX still owing 90% there is not much chance of a rival suitor. Unless of course the problems with BASS Pro encourage BBX to exit their holding completely.

This spread has serious consequences for the process of merger arbitrage. A deal which was almost consider a slam-dunk has now fallen apart. The losses for some investors may be as high as 30%. Even with a well-diversified portfolio, this hit still means a long way back to profitability. A number of commentators have already claimed to have seen this situation occurring. However the size and speed of the drop seems to imply the market was caught unaware.

So what can we learn from this situation? To answer that question MergerArbitrageLimited.com is putting together a brief guide to some of the failed deals that have occurred so far this year. This guide is intended to help our readers identify and avoid (or at least reduce) positions in spreads which have the ability to ruin a portfolio.

Pacific Biosciences of California (PACB)

The movement of Pacific Biosciences of California (PACB) had been somewhat subdued but exploded back into life two weeks ago. Last week provided even more opportunities as the stock became the second worst performer and dropped 5.95% to $6.80. Traders will be well aware of our approach to this spread by now. We actively trade this stock and are continuously entering and exiting our positions, sometimes multiple times in a single day. We have continued buying back our position but have ample room for more stock should the price decline further. This of course assumes the deal remains unchanged.

Mellanox (MLNX)

Mellanox (MLNX) also suffered this week down 2.78%. The stock now trades at $109.75 against an offer price of $125.00. This spread is now offering 13.90%. As with QTNA, Nvidia the potential acquirer on the Mellanox deal also filed during the week with Chinese state regulators. However, the market took a more negative views o to this deal being completed as previously expected and the stock declined. Despite this Analyst James Fish of Piper Jaffray sees a “decent fundamental backboard” if the deal is denied with Mellanox at a standalone value of $115/share. There was of course no timeframe associated with this price target. There was no new news announced during the week so it looks like a bet on Chinese authorization. We have taken a small position.

Portfolio Performance

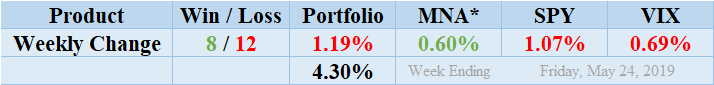

Losers once again beat out winners this week by a score of 12 to 8 with 0 non-movers. The portfolio consisted of 20 stock and 0 cash positions. The portfolio showed a negative performance to finish down up for the week by 1.19%. This is the largest loss since our analysis began over 8 months ago. As discussed above BXG was responsible for the majority of this loss. Whereas specific deals such as TVPT have also been hit. The closing of this deal is under close scrutiny as the market waits upon Russian regulators The standard deviation of the returns for the past week was 4.30%. Clearly this is astronomically higher than both the recent and longer term averages and caused by the BXG loss.

MNA SPY VIX Returns Table 20190524

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The MNA ETF provided a brief spot of joy in the merger arbitrage space this week. The ETF performance showing a posiive 0.60%. The IQ Index merger arbitrage ETF is now back in positive territory since our records began. The gains this week came from the short positions used to hedge the deal spread value. The S&P 500 ETF, SPY showed greater losses during the week but finished down 1.07%. Despite the fluctuation experienced by the SPY during the week, the VIX index marginally by 0.69%. We expect this level of volatilty to continue.

And finally…

The most recent list of the largest spreads is already available. Our free merger arbitrage spread calculator is also available for FREE download. This can be used to value the spread of any stock-for-stock deals you may be interested in.