This is the analysis of Merger Arbitrage Spread Performance June 2, 2019. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 27th – 31st May. We produce this report at the end of each week. Firstly, the analysis discusses the biggest winners & losers from the portfolio. Secondly, we highlight the performance of the portfolio and conclude with the broader market as a point of comparison. The information contained in this weekly analysis assists traders in their merger arbitrage investment decision making.

Stocks mentioned in this report are from the Merger Arbitrage Limited top 20 (T20) list of cash merger arbitrage spreads available as at 26th May. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 list. Click this link for the news and performance analysis from the previous week.

Merger Arbitrage Spread Performance

Travelport (TVPT)

The biggest winner for the week was Travelport (TVPT) up 4.11%. This deal had recently suffered from doubts regarding Russian regulatory clearance causing the spread to widen. Indeed, on Friday 24 May an article appeared in the New York Post suggesting the delay may be delayed up to 9 months. However, by Tuesday morning the deal was all but secured and closed a few days later. Traders must be vigilant and check news sources where possible. We have recently seen and number of conflicting reports on various deals which may cause investors to act unnecessarily. Although reports such as these may create opportunities we generally reserve this kind of trading for specialist situations. We repeat, traders must be vigilant.

Aquantia (AQ)

Aquantia (AQ) was the second best performer this week. The stock closed up 1.08% or $0.14. The only significant news was a preliminary 14A filing. So no official date for a special meeting yet but we can expect one soon. The spread is now at 0.84%. We expect this deal to close within the next 7-9 weeks. Were the spread level to open slightly we may consider a short term position.

Global Brass and Copper (BRSS)

CIRCOR International (CIR)

The biggest loser this week was CIRCOR International (CIR) down 2.63%. Other than a conflict minerals filing there was no other news in the popular press. However, the stock declined sharply on Friday to leave a spread of 6.48%. This deal is still a hostile one so we expect a higher amount of deal spread volatility in the coming days. The fluctuations depend on whether Crane (CR) will walk away, or whether they will make a higher offer.

This is a similar situation to Wageworks (WAGE). In these hostile spreads we try to take advantage of the spread volatility before an agreement is reached. However, we were already long CIR prior to the drop. We shall continue to hold our position and look to take some profits on a rebound. In the meantime, having previously been long WAGE we sold (prematurely again!) just above the $50.00 mark and took a small short position in the options market. We will be happy to exit this position in the low $49’s.

Pacific Biosciences of California (PACB)

Pacific Biosciences of California (PACB) again found itself amongst the biggest losers for the week. This week the stock finished down a further 1.47%. Once again there were no regulatory filings and no new deal news or commentary. However, during the week an initial rise gave us the opportunity to exit part of our position which we have subsequently bought back. This is consistent with our long time strategy of actively trading this spread. For further details one can simply click the PACB tag at the end of this article for a complete listing of our commentary on this spread.

Spark Therapeutics (ONCE)

Spark Therapeutics was the third decliner of note falling 1.21% for the week. The latest closing date for this tender offer is June 14. We expect the latest refiling under the HSR program to expire on Friday. Investors will be watching this date to see if the filing is once again withdrawn thus delaying the deal for potentially 3 more weeks. There does not appear to be any reason why investors would be rushing to tender their shares in light of this HSR uncertainty. We already took a small position in ONCE previously. We have no desire to add to this position just because the stock has fallen back. So in the meantime we will sit tight and wait this one out.

Portfolio Performance

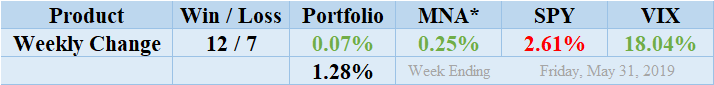

Winners beat out losers this week by a score of 12 to 7 with 0 non-movers. The portfolio consisted of 20 stock and 0 cash positions. The portfolio showed a positive performance to finish up for the week by 0.07%. This is the first gain in four weeks. As discussed above TVPT was responsible for the majority of this gain. This large gain from TVPT was largely tempered by the declines of PACB & CIR. The closing of this deal caught the market by surprise following warnings of Russian regulatory complication in the popular press. The standard deviation of the returns for the past week was 1.28%. This is marginally higher than both the recent and longer term averages and caused by the BXG loss.

MNA SPY VIX Returns Table 20190531

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The MNA ETF provided a brief spot of joy in the merger arbitrage space this week. The ETF performance showing a positive 0.86%. The IQ Index merger arbitrage ETF is now firmly back in positive territory since our records began. The gains this week again came from the short positions used to hedge the deal spread value. The S&P 500 ETF, SPY showed great movement during the week but the decline on Friday cemented a loss for the week of 3.65%. In accordance with these fluctuations by the SPY, the VIX index increased by 17.23%. As noted last week, we expect this level of volatility to continue.

And finally…

The most recent list of the largest spreads is already available. Our free merger arbitrage spread calculator is also available for FREE download. This can be used to value the spread of any stock-for-stock deals you may be interested in.