This is the analysis of Merger Arbitrage Spread Performance June 9, 2019. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 3rd – 7th June. We produce this report at the end of each week. Firstly, the analysis discusses the biggest winners & losers from the portfolio. Secondly, we highlight the performance of the portfolio and conclude with the broader market as a point of comparison. The information contained in this weekly analysis assists traders in their merger arbitrage investment decision making.

Stocks mentioned in this report are from the Merger Arbitrage Limited top 20 (T20) list of cash merger arbitrage spreads available as at 2nd June. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 list. Click this link for the news and performance analysis from the previous week.

Merger Arbitrage Spread Performance

CIRCOR International (CIR)

The biggest winner this week was CIRCOR International (CIR) up an impressive 6.74%. This deal remains an unsolicited approach from Crane. During the week, Crane reiterated their commitment to buy Circor and this sent the stock price soaring. Crane expressed their desire to “enter into meaningful discussions regarding a transaction that would provide a significant premium for CIRCOR shareholders“. However, Crane also stated the $45 initial offer price was a fair one based on publically available information. Investors cheered the prospect of a higher offer based upon the possibility that “CIRCOR management engages with us and provides sufficient justification.” We have sold our position in CIR despite expecting both sets of managements to engage in dialogue in the near future. Speculating on higher offers in these instances can be fraught with danger and may tie up capital for lengthy periods if talks fail to make progress. Following the release of more concrete details, we will be ready to re-enter a positon as necessary.

Wageworks (WAGE)

This is a similar situation to Wageworks (WAGE), another unsolicited bid approach. The stock was the second best performer this week up 3.06%. Last week we stated, “We try to take advantage of the spread volatility before an agreement is reached“. In this situation, we were half-right. The spread volatility exists, but the spread moved in one direction only. Up. That has not worked well for our short call position. The market is also expecting the announcement of a higher offer in which case we will be keen to exit this position on any pull back.

Pacific Biosciences of California (PACB)

Pacific Biosciences of California (PACB) again found itself amongst the biggest movers for the week. This week the stock finished 2.84% higher at $6.89. Once again, there were no regulatory filings and no new deal news or commentary. However, during the week an initial rise gave us the opportunity to exit part of our position around the $7.00 level. This is consistent with our long time strategy of actively trading this spread. We are still long for the time being. For further details, one can simply click the PACB tag at the end of this article for a complete listing of our commentary on this spread.

Mellanox (MLNX)

Mellanox (MLNX) was the fourth biggest gainer this week up 1.70%. The stock now trades at $111.65 against an offer price of $125.00. This spread is now offering 11.96%. There was no deal news announced during the week. However, the large spread does make this deal more exposed to general market volatility. As such, a rise in the broader market has helped increase the stock. We maintain our small position and await further clarity from Chinese authorities.

Luxoft Holding (LXFT)

Luxoft Holding (LXFT) was up 1.37%. We posted previously “have taken a position in this stock in the anticipation that the deal will close promptly“. This broader market rise has certainly helped this stock during the week but there is still $0.64 left in the spread. Based on the potential annualised return we shall continue to hold.

Advanced Disposal Services (ADSW)

Advanced Disposal Services (ADSW) was the worst performer this week declining 0.28% or $0.09. Clearly this is not a significant drop but is mentioned for the sake of completion. With no news announced, the stock appears to have succumbed to a bout of profit taking. This deal has a large closure window and may be deterring investors who seek faster profits elsewhere. We have previously stated “We have no position in this stock but may initiate a position if the spread widens further“. This appears to be a relatively safe deal with existing commentary praising the merits of the deal. We maintain this advice but again caution investors that should the spread widen there is still a long time to completion.

Portfolio Performance

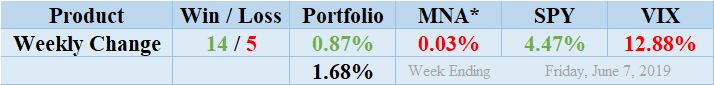

Winners beat out the losers for the second week running by a score of 14 to 5 with 0 non-movers. The portfolio consisted of 20 stock and 0 cash positions. The portfolio showed a positive performance to finish up for the week by 0.87%. As discussed above, the vast majority of this gain is attributable to the increase in CIR. This demonstrates a huge comeback for CIR which was one of the significant losers for the previous week. Readers can stay abreast of the developments in this deal by following our twitter feed or our customised news feed. The standard deviation of the returns for the past week was 1.68%. This is extremely higher than both the recent and longer term averages and caused by the CIR gain.

MNA SPY VIX Returns Table 20190607

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The MNA ETF continues its run of uncorrelated returns with the broader market. The ETF performance showing a marginally negative 0.03%. The IQ Index merger arbitrage ETF retains its position in positive territory since our records began. The losses this week again came from the short hedging positions in the face of a broader market increase. The S&P 500 ETF, SPY spent the week increasing and by Friday cemented a gain for the week of 4.47%. This more than reversed the loss from the previous week. In accordance with this increase, the VIX index decreased by 12.88%. We continue to expect his level of volatility to continue.

And finally…

The most recent list of the largest spreads is already available. Our free merger arbitrage spread calculator is also available for FREE download. This can be used to value the spread of any stock-for-stock deals you may be interested in.