This is the weekly analysis of Merger Arbitrage Spread Performance October 27, 2019. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 21st – 25th October. The first section of this report discusses the biggest winners & losers from the T20 portfolio. Then we detail the performance of the overall portfolio. To conclude, we compare this performance with the broader market and the IQ Merger Arbitrage Exchange Traded Fund – MNA. The information contained in this weekly analysis & review assists traders in their merger arbitrage investment decision making.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Portfolio. A list of pending cash merger arbitrage spreads available as at 20th October. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Portfolio. Click this link for the spread performance analysis from the previous week.

Merger Arbitrage Spread Performance October 27, 2019

Spark Therapeutics (ONCE)

Finally some good news from Spark Therapeutics this week. Although the CMA decision still hangs in the balance, FTC staff have issued their recommendation. Following an analysis of hemophilia treatments, staff have recommended the approval of the acquisition without requiring any asset sales. This news on Thursday afternoon sent the stock soaring more that 8%. ONCE closed for the week up $8.96 at $109.00. This gives a spread of 5.05%

The reason for this spread is the initiation of the recently announced investigation by the CMA. The timetable for which is shown in the following table.

| Phase 1 Date | Action |

| 16 December 2019 | Deadline for phase 1 decision* |

| 21 October 2019 | Launch of merger inquiry |

| 25 September – 11 October 2019 | Invitation to comment |

| 6 June 2019 | Initial enforcement order |

* This date is the current statutory deadline by when the decision will be announced.

This delay whilst the CMA completes its own investigation, and the (reduced) possibility of a phase II investigation should keep the spread stable for the time being. For a merger stock with such a large downside, this was always a riskier play. Hence our smaller position. The FTC’s blessing is by no means a guarantee the CMA will follow suit. However, we maintain our position but may look to exit if more immediate profitable opportunities arise elsewhere.

Ra Pharmaceuticals (RARX)

Ra Pharmaceuticals (RARX) appears in the largest movers this week for the second time since the announcement of the deal with UCB on October 10. This week the stock moved up $0.67 to close at $46.91. This gives a merger arbitrage spread of 2.32%. We noted last week we would look to take a position in this stock and subsequently did so. As most of the move for the week happened on Thursday, we can confidently state it was due to the positive sentiment surrounding the FTC recommendation regarding ONCE deal clearance. A tidy profit in such a short space of time might encourage some traders to flip this position and move on. However, with little deal specific news to go on, we will maintain our position for the time being, but may look to take partial profits should the stock move higher during the coming week.

Pacific Biosciences of California (PACB)

Pacific Biosciences of California returns to its place at the top of the worst performer list this week. Once again, the CMA is involved. On Thursday, the CMA released its provisional findings regarding the merger with Illuminia stating,

“As a result of our inquiry and our assessment, we have provisionally concluded that the anticipated acquisition by Illumina of PacBio would result in the creation of a relevant merger situation.“

and

“The CMA prefers structural remedies, such as divestiture or prohibition, over than behavioural remedies…At this stage, the only structural remedy that CMA has identified as being likely to be effective would be prohibition of the Proposed Merger.”

This sent the stock price tumbling by over 13% during the day and finished the week at $4.71 down $0.75 or 13.75%. It appears this deal is now dead in the water. The CMA has now moved in to a Phase II investigation with a statutory deadline of December 11 2019.

Volume since the announcement has been around 10m shares in total compared to approximately 153m in issue. We calculate the stock is trading relatively close to its floor price somewhere in the region of $4.40 – $4.50. For this reason, we believe many arbitrageurs are holding their position in the hope the deal can be salvaged or to see if the prospects for PACB as a standalone business as rosy as they claim. At these levels, we have also maintained our position and will do so for the time being. Traders looking to make a quick trade in this situation are advised to fully research the risks of investing in a deal with such a low probability of closure and not be misled by the potentially large profits.

Red Robin Gourmet Burgers (RRGB)

Red Robin Gourmet Burgers (RRGB) was also another decliner this week. The only news being the release date for earnings will be November 5. The stock fell by 0.59% to $31.76. We stated last week we would be looking to buy back on weakness and thus top up the position we sold previously. Thursday’s decline gave us that opportunity. We shall continue in this vein as long as the stock continues to behave in this volatile manner.

Bitauto Holdings (BITA)

Bitauto Holdings (BITA) also made the largest decliners list this week. The stock gently retreated throughout the week to finish at $15.20 down 0.59%. During the week, the company announced the appointment of an independent financial advisor to the special committee to review the takeover proposal. We maintain our position.

Merger Arbitrage Portfolio Performance

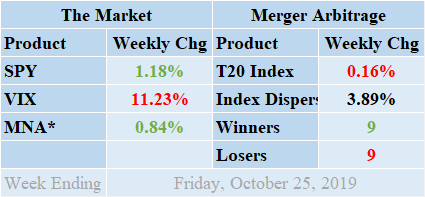

Winners were tied with the losers with 9 each and 1 non-mover this week. The portfolio consisted of 19 stock and 1 cash position. The portfolio showed a mildly negative performance for the week finishing down by 0.16%. This negative performance was primarily attributable to PACB which suffered heavy losses. Readers can stay abreast of developments in these deals by following our customized T20 Portfolio news feed. This shows the latest mergers and acquisitions news updates focusing exclusively on the pending cash mergers we consider eligible for investment. We have also introduced dedicated news pages focusing on specific deals such as BPL, CISN, GWR, ONCE, RARX & ZAYO along with background deal information. Return standard deviation for the past week was 3.89%. This figure is more than double both the short-term and long-term averages for the above reasons.

MNA SPY VIX Returns Table 20191025

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The IQ Merger Arbitrage ETF MNA rose significantly on Thursday to produce a positive return of 0.84%. This was similar to the rise in the broader market. However, the market did see a more consistent rise throughout the week by comparison. The SPDR S&P 500 ETF, SPY, finished up 1.18%. The VIX index unsurprisingly moved lower for the week. It eventually settled on a decrease of 11.23%. We previously suggested volatility would remain higher as the market continues speculating on the next action in the ongoing trade war. However, speculation increases regarding a partial resolution, but we have now entered earnings season. So far, earnings are looking robust across the board but it remains to be seen if this momentum can continue. We have listed those merger arb stocks who are part of the T20 and are scheduled to report on our Spread tracker page.

And finally...

The most recent list of the largest spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. This can be used to value the spread of any stock-for-stock deals you may be interested in.