Winners

- This week’s surprise best performer was Ellie Mae (ELLI). The stock climbed a 0.53% for the week or $0.52. What makes this situation all the more interesting is the spread now stands at a 0.52% PREMIUM. ELLI filed it’s annual report during the week along with an S-4. The report clearly states the “Go-shop” period lasts until March 18. Whether or not the price rise is connected to a superior offer remains to be seen but no other news was immediately apparent.

- The second best performer this week was Tribune Media Company (TRCO) which increased 0.48% to $46.42. We warned last week that a drop on the preceding Friday may signal a negative outcome to the required asset disposals. However, this weeks rise which reverses that loss and comes on the back of the earnings announcement. The numbers came in ahead of expectations and the dividend of $0.25 was declared as expected. The simple spread now stands at 0.71% or 1.26% if you believe the deal won’t close until two further dividend payments are made.

- InfraREIT, Inc. (HIFR) was the other gainer of note this week up 0.38%. HIFR also announced results and an identical $0.25 dividend to TRCO. This stock has consistently traded at or above the offer price of $21 per share even when dividends have been taken into account. The stock now trades at a 0.47% discount when two dividends are included. The FTC had previously granted early HSR termination. Despite regulatory approval still needed from the Public Utility Commission of Texas (“PUCT”), Federal Energy Regulatory Commission (“FERC”) and the Committee on Foreign Investment in the United States (“CFIUS”) the company still believes the deal will close by mid 2019. This justifies an additional dividend payment.

Losers

- This week’s worst performer was USG Corporation (USG) down 0.42% at $43.10. There was little news on this stock other than a “Statement of changes in beneficial ownership of securities” filing during the week. The simple spread is now at 0.93% for a deal originally expected to close in “early 2019”.

- This week’s second worst performer was Integrated Device Technology (IDTI). The stock declined 0.39% or $0.19. The spread now stands at 1.37% for a deal that was originally expected to close in the first half of 2019. However, since the recent government shutdown this date has been pushed back towards the end of July. If this stock declines further we will be very interested in taking a long position.

Portfolio Performance

We’ve previously added some supplementary information

- The standard deviation of returns for the top 20 in addition to the average return. This gives our readers a better idea as to the movement within the portfolio.

- The change in the VIX (relative percent) is also included as a complimentary figure to the performance of the SPY

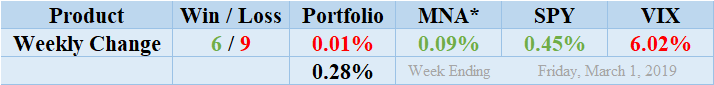

Winners and losers were split fairly evenly this week with winners losing out by 6 to 9 with 1 non-mover and 4 cash positions due to lack of eligible candidates. The portfolio showed an almost stagnant performance and finished the week just slightly negative at 0.01%. This was mainly due to the trade off (performance wise) between ELLI and the decline in IDTI. The standard deviation of the returns is 0.28%. This is far below the average level and again reflects the lack of movement and overall tightness of the merger arbitrage spread market. PACB continues to be the primary instigator of portfolio deviation but had a relatively quite week. There were no dividends paid during the week from the T20 list. The MNA ETF returned a mildly positive performance of 0.09%. The S&P 500 ETF, SPY however managed to post a a positive 0.45% during a volatile. Surprisingly, following another week of rises for the broader market the VIX index declined by a further 6.02%.

MNA SPY VIX Returns Table 20190301

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.