This is the weekly analysis of Merger Arbitrage Spread Performance December 22, 2019. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 16th – 20th December. The first section of this report discusses the biggest winners & losers from the T20 portfolio. Then we detail the performance of the overall portfolio. To conclude, we compare this performance with the broader market and the IQ Merger Arbitrage Exchange Traded Fund – MNA. The information contained in this weekly analysis & review assists traders in their merger arbitrage investment decision making.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Portfolio. A list of pending cash merger arbitrage spreads available as at 15th December. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Portfolio. Click this link for the spread performance analysis from the previous week.

Merger Arbitrage Spread Performance December 22, 2019

Red Robin Gourmet Burgers (RRGB)

Red Robin Gourmet Burgers retained is place amongst the largest movers this week and continued its upward momentum. Without any new deal news in the popular press, the stock continued its recovery by an additional $2.28 to close at $30.18. This leaves the simple spread at 32.54%. The only filing made during the week was a Form 4 – Statement of changes in beneficial ownership of securities. This reported an insider purchase of 5,000 shares by RRGB director Gerard Hart dated December 13. Although seen as a positive news item we doubt this was the catalyst for the large upwards move. We continue to hold our position at least until further news is available clarifying the takeover situation.

Spark Therapeutics (ONCE)

Spark Therapeutics was an additional source strong returns this week. Although this deal is now closed it is important to note the following points going forward. The CMA, despite commentary to the contrary online is not anti-business neither does it display bias to firms from one country or another. Having followed their actions for some time were are yet to see any evidence of these claims. It is important that traders and investors are not influenced by these senseless ramblings in various comments sections dotted around the internet. Also, as we had previously disclosed to our readers, is the importance of dates and stated timetables. The CMA is extremely transparent in detailing its decision framework. The CMA had for some time given December 16 as the deadline for its Phase I decision, and we used that date in our return calculations. It was not until recently however that Spark extended the tender offer to coincide with that date. In this case, regulatory proceedings and the timeframe attached to them trump any indications made by the company.

Wright Medical (WMGI)

A rumor on Thursday sent WMGI scorching higher as the market tried to verify the truthfulness of Smith & Nephew bid topping Strykers current bid for the firm. The stock went on to close Friday up $0.37 at $30.15. This is still $0.60 below the $30.75 offer price from Stryker and offers a simple spread of 1.99%. We did not take a position in this stock but may initiate one if a higher offer emerges.

Pacific Biosciences of California (PACB)

Incredible, but certainly not uncommon to regular readers of this column, is the performance of last week’s two biggest winners followed by Merger Arbitrage Limited. PACB tops the charts again this week but as the largest loser. This move comes during a highly volatile week which saw the stock trade as high as $5.69 and as low as $5.04. On Tuesday, the U.S. Federal Trade Commission publicly announced that it has authorized a legal action to block the Merger as disclosed in an 8-K Current report filing by PACB. Naturally, this sent the stock tumbling but recovered somewhat as it became clear Illumina were not giving up on the deal and extended the end time to March 31, 2020. We expect more volatility to come in this spread. We will continue to hold our position until further details are disclosed.

Bitauto Holdings (BITA)

Bitauto Holdings (BITA) trended downward throughout the week. Despite there being no new deal news announced during the week, the stock continuously fell to close on Friday at $14.94. A fall of 1.58% for the week. This leaves the arbitrage simple spread at just 7.10%. Following the recent strong performance of this spread and the favorable political environment at present we suspect this is nothing more than some profit taking at the end of the year. We still believe movements of this magnitude indicate some news or an announcement will be forthcoming. We maintain our position as we await news from Tencent Holdings as to their intentions.

Merger Arbitrage Portfolio Performance

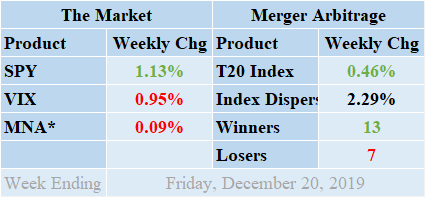

For what is becoming commonplace recently the winners again led the losers this week by a respectable margin of 13 to 7 with 0 non-movers this week. The portfolio continues to operate with a full complement of 20 cash merger arbitrage and 0 cash positions with a great deal more to choose from should any more deals close in the near future. The index builds on last week’s gains to finish once again in positive territory up by 0.46%. This week’s gain was primarily attributable to the impressive rise in RRGB, supported by the closure of ONCE and WMGI. Additional live news updates for these deals can be found on our customized T20 Index news feed. For even more specific merger details & news see also the dedicated news and merger information pages on deals such as LOGM, ARQL, INST, FIT, KEM, & TIF. The standard deviation of the individual index returns for the past week was 2.29%. This figure is markedly above both the short-term and long-term averages due to the recovery in RRGB.

MNA SPY VIX Returns Table 20191220

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The IQ Merger Arbitrage ETF, MNA, despite being on course for yet another positive week finally slipped into the red following Friday’s braoder market decline. By the end of the week, the ETF was in negative territory by 0.09%. This ends a positive run extending back for almost 3 months. The broader market however managed to produce a positive return over the same period. The domestic political scene does not appear to have a negative effect on the markets as they power onwards to yet more all-time highs. With trade deal news taking a back seat over this coming shortened holiday trading week it seemes there is little to disrupt the market’s progress. The SPDR S&P 500 ETF, SPY, finished up 1.13%. Unsurprisingly the VIX index moved lower but by Friday had only fallen 0.95%.

As market activity quietens down for the festive period, we would expect volatility to remain subdued following the progress in the trade negotiations. With interest rate policy clarified and inflation not being a concern (at least for the time being), we were expecting the major potential source of volatility to come from the White House. However, although this was the dominant news source, the markets took it all in its stride. With this in mind, we currently see no reason why merger activity should not continue at its current level.

And finally...

The most recent list of the largest spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. This can be used to value the arbitrage spread of any stock-for-stock merger deals you may be interested in trading or additionally used in a pairs trading investment strategy.