This is the weekly analysis of Merger Arbitrage Spread Performance April 5, 2020. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 30th March – 3rd April. The first section of this report discusses the biggest winners & losers from the T20 portfolio. Then we detail the performance of the overall portfolio. To conclude, we compare this performance with the broader market and the IQ Merger Arbitrage Exchange Traded Fund – MNA. The information contained in this weekly analysis & review assists traders in their merger arbitrage investments and trading.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Index. A list of the largest pending cash merger arbitrage spreads available as at 29th March. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Index. Click this link for an analysis of the spread performances from the previous week.

Merger Arbitrage Spread Performance April 5, 2020

Kemet (KEM)

We have decided to include Kemet in our analysis this week simply because we couldn’t bring ourselves to have yet another week’s report made up entirely of losing stocks. (We could have mentioned Ra Pharmaceuticals (RARX), for both its positive movement and that the deal closed, but of course it’s no longer an investable proposition). Nothing more than a statement of beneficial ownership filing with the SEC was sufficient to move the stock upwards by $0.44 to $24.42, a rise of 1.83%. We have no position in this spread although this rise has piqued our interest. The simple spread is still offering 11.38%. There is a possibility we may make an investment and buy stock in this company in the near future.Red Robin Gourmet Burgers (RRGB)

Red Robin continued its volatile roller coaster ride this week. Following the previous period’s 50%+ rebounded, last week the stock slipped back. Interestingly, many of the new reports surrounding the stock appeared to focus upon issues already discussed in this column. Topics such as activist holdings & agreements and the effect of the ongoing coronavirus pandemic. Despite the broader market slipping back we were initially surprised by the level of profit taking in RRGB forcing the stock lower. Especially, following on from what we considered good news in terms of management’s relationship with Vintage Capital. However, on closer inspection, the new shareholder base of RRGB provides ample explanation. As we highlighted before, although technically a takeover stock, the RRGB share price is now dominated by short term speculators. The potential demise of the entire firm provides ample opportunity for wild price swings. A situation we expect to continue for the foreseeable future. Despite a rally late on Friday afternoon, the stock closed at the end of the week down $2.90 at $7.37, a drop of 28.24% that now leaves the simple spread at a whopping 442.74%. This is against the original bid from Vintage Capital for $40 per share.Wright Medical (WMGI)

Wright Medical was also amongst the biggest losers this week. The stock had recovered from its mid-March lows to come within 5% of the offer price from Stryker. However, two weeks of poor performances have seen the stock fall away. There was no new deal news announced during the week and we were a little surprised to see the stock decline as much as it did. By Friday’s close, the stock was down $3.68 at $26.32, a rise of 9.24%. This leaves the simple at 16.83%. A previously announced extraordinary shareholder meeting is scheduled to be held on April 24, 2020. To comply with ever evolving coronavirus guidelines, the company has indicated this maybe become a virtual special meeting if necessary. Therefore the meeting would reasonably be expected to take place. As things stand, we are yet to initiate a position, but have a strong inclination to do so in the coming week.Adesto Technologies (IOTS)

Adesto Technologies was another significant decliner during the week. Multiple Form 4 – Statement of changes in beneficial ownership of securities were filed with the SEC during the week. However, there was little specific deal news to report. This could also be another case of profit taking following a strong performance last week. By Friday’s close, the stock was down $0.73 at $10.47, a fall of 6.52%. The simple spread is now almost 20% in this deal and provides an attractive return. As in the notes above, it would not be a stretch of the imagination if we bought stock in this firm in the coming week.Merger Arbitrage Portfolio Performance

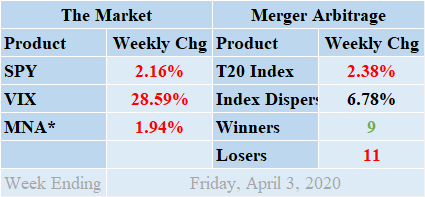

Cash merger arbitrage spreads again came under pressure last week. Following last week’s impressive rebound the index once again fails to sustain the momentum. As is becoming commonplace nowadays, all significant movers went in the same direction pointing to the overriding economic effect of the pandemic as opposed to deal specific issues. This time out, the losers triumphed over the winners with a score of to 11 to 9 with 0 non-movers. The index was comprised of a full selection of 20 merger arbitrage deals and 0 cash positions. The index closed down for the week by 2.38%. This loss was primarily attributable to the decline in RRGB whilst accompanied by WMGI, IOTS, & BITA. The standard deviation of the individual index returns for the past week was still elevated at 6.78%. As expected, these figures continue to be significantly above the historical averages.

Additional live news updates for these deals can be found on our customized T20 Index news feed. Even more specific merger details & news can be found on the dedicated news and merger information pages for recently announced deals including WUBA, AON, TGNA, & RRGB.

MNA SPY VIX Returns Table 20200403

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The IQ Merger Arbitrage ETF, MNA, embarked upon what appeared to be a gentle decline lasting the entire week. Trading volumes were significantly lower towards the end of the week as the market almost behaved with some sense of normality. Although the past week’s movement reveres half of the gains made previously, the movement was inline with the broader market. By the close on Friday, the IQ Merger Arbitrage ETF was down 1.94%. The broader market however begun the week in a sprightly mood. Wednesday’s decline following disappointing economic data soured the mood and the index preceded to decline for the remainder of the week. Jobless claims hit a modern all-time high as traders tried to speculate on the future effects of this lack of consumer purchasing power. By the end of the week the SPDR S&P 500 ETF, SPY, managed to finish down 2.16%. The VIX however, quite surprisingly fell from its recent highs. By Friday the index had declined marginally by 28.59%.

The U.S. continues to suffer in the wake of the virus. The effect in New York has been particularly devastating and we may still be two weeks from the peak effect. It is still too early to assess the effect this will have on the domestic economy although the jobless claims figure paints a harrowing image. Restaurant and travel stocks especially continue to be particularly hard hit.

In light of popular feedback from previous postings (thank you very much) we shall continue to repeat the following section from our previous analysis

- It is important for traders of merger arbitrage to consider how each of their individual positions will be affected by a continued spread of the coronavirus.

- How can this affect the granting of regulatory approval in China?

- Are delays inevitable?

- Will a slowdown in the global economy lead acquirers to rethink their acquisition strategy?

- Also important is that merger arbitrage stocks which were supported by higher floor prices may now have some of that protection removed.