Covid-19 and merger arbitrage trading has a relationship extending far beyond the immediate profitability of this event driven strategy. As many of the event driven investment funds suffer, we take a look at how the virus if forcing traders to re-evaluate their portfolios of risk arbitrage investments and what the global Covid-19 pandemic will mean for the future of this strategy.

The Effect on Profitability

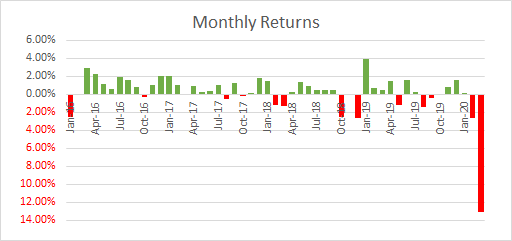

The graph says it all. Actively managed event driven fund returns are down. The preliminary figure for March as calculated by BarclayHedge suggests average performance of the 28 funds that have thus far reported in the event driven index category declined by 13.10%. The magnitude of this drop is shown below in the graph of monthly returns since the start of 2016. As far as merger arbitrage cash deals are concerned, Merger Arbitrage Limited reports that the average performance has declined by 7.99% for the five weeks ending Friday April 3, 2020 (visit the calculation methodology page for more further details on how the Merger Arbitrage Limited T20 Index is constructed).

| Product | Return |

|---|---|

| T20 Index (Merger Arbitrage Limited) | -7.99% |

| BarclayHedge Event Driven Index | -13.10% |

| IQ Merger Arbitrage ETF (MNA) | -8.56% |

| JPMorgan Event Driven ETF (JPED) | -13.04% |

| SPY | -12.58% |

Despite these losses, a common thread amongst standard merger arbitrage investments is they would not be obliged to lock in these declines unless the deals were abandoned. The current paper losses may be recouped if positions can be maintained and deals consummate as expected. Let’s take a closer look at what has caused the merger spreads to widen and whether this approach is feasible.

The Declining Floor Price

Cash deals do not hedge market risk. In a rising market, the potential loss is reduced as the floor price, the price to which a target stock will return should the deal fail, also rises. In a declining market, the opposite is true. As the broader market falls sharply, so does the price to where the target stock will revert to in the event of a deal break. This increases the potential loss to traders dramatically, or in other words, risk. Theoretically, the Deal Closing Probability (DCP), or the likelihood that a deal will consummate as expected, can remain constant in this scenario. Thus, the same level of return is still available for each unit of risk. In this case, as the offer price remains the same, the spread widens, offering what appears to be a greater level of dollar profitability, but for greater risk. Existing investors however will show a paper loss as the value of their investment declines.

The unwinding of highly leveraged positions, as discussed by Fabienne Cretin of Candriam in the podcast “An Update on Risk Arbitrage Management“, explains how aggressive selling and a liquidity shortage forced the price of these stocks lower. This exaggerated the losses and causing a vicious cycle leading to lower prices and more selling pressure and even greater losses.

Deal Extension Risk

The time taken to complete a deal clearly effects profitability levels. There is an inverse relationship between annualized return and the length of the closing timeline. With restricted work practices in place, it is a fair assumption to make that some deals, especially those requiring regulatory reviews may take longer than expected. Thus, causing a widening of the merger arbitrage spread.

Deal Closing Probability

If the DCP does decline, as it becomes apparent that the deal may not be as certain to close as expected, similarly, the trader will lose on their existing investment. The Covid-19 pandemic has caused many traders to ask such questions as

This list is not exhaustive, there are many additional potential issues that may cause a significant change in the markets belief that a merger will or will not close. As closing probabilities have declined across the board, traders have experienced unprecedented losses.

Hostile Bids

Amongst these deals, hostile bids are even more susceptible. Where previously the potential acquirers advances were spurned, they now have the ability to walk away without penalty should they choose to do so. The DCP in this class of deal would have already been low, thus making the stock price more sensitive to movements in the broader market and wider economy. Factors such as the Covid-19 pandemic. Most traders should however have been practicing adequate risk management techniques and holding smaller positions in this class of takeovers.

Outcome

As trader and investment fund performance suffers such extreme changes due to declining stock price of the target, managers have been forced to liquidate part of their position. This is especially true for those using leverage as mentioned above. As such, they have not been able to remain consistent with a standard cash deal merger arbitrage investment strategy. Locking in the loss at these lowers levels makes a return to profitability extremely difficult. In addition, the level of volatility in the markets, or fund P&L movement, may also require the execution of an exit trade so as to limit P&L fluctuation. Therefore putting additional pressure on traders.

Deal Resolutions and Merger Arbitrage Profitability

But Deals are Failing

Woodward (WWD) and Hexcel (HXL) is the most recent example of an abandoned deal following the coronavirus outbreak. This was a stock deal, so not subject to the floor price machinations explained above so limiting losses in that respect. However, on the day of the announced abandonment, WWD rose 16.50%, whilst HXL declined 0.95%. Traders will of course lost money on the decline in HXL whilst simultaneously losing on the short positon held in WWD. The short position would have been implemented using the exchange ratio to “lock-in” the value of the spread at the time of the trade. The companies were quoted as saying

The pandemic has resulted in a need for each company to focus on its respective businesses and has impacted the companies’ ability to realize the benefits of the merger during these unprecedented times

The hostile bid for HP (HPQ) by Xerox (XRX) is another example of deal abandonment. It is likely other acquirers are also reviewing their current corporate strategy. Writing in Andrew Ross Sorkin‘s DealBook column published in the New York Times on April 7, 2020, Steven Davidoff Solomon aka “The Deal Professor”, discusses three ways in which potential acquirers could back out of a deal

- material adverse change

- the target company operated according to the ordinary course of business before being acquired – Is abruptly and aggressively tapping credit lines the ordinary course of business?

- regulatory issues

It is a very real possibility more deals could break in the near future. Red Robin Gourmet Burgers (RRGB) has seen trade decline by such an extent that at one point the mere survival of the firm was in doubt. Vintage capital have since agreed to work with RRGB management and thus informally suspending their hostile takeover. In the weeks leading up to the Coronavirus pandemic, interest rates were already low, which helped keep cash merger arbitrage spreads reasonably tight. At levels such as those, it only takes 1 or 2 failed deals out of ten positions to potentially ruin the annual profitability of the strategy.

But it’s not all doom and gloom. Just nearly. Some deals have closed successfully. Ra Pharmaceuticals (RARX) for example closed recently and traders cheered as the spread narrowed sharply to its offer price. AYR, AVX & Instructure (INST) amongst others have also closed during the turmoil. Although, these deals were all reasonably far advanced along the closing process with the most recent of those mentioned being announced on December 6.

The Future of Covid-19 and Merger Arbitrage Trading

So, assuming traders, investors and event driven hedge funds are able to survive this storm what does the future hold? Well, at best, it’s bleak. The outcome for the economy is to difficult to call with any precision. What does that tell us? Investment will be restricted. Management will be in no rush to jump aboard the takeover train in such an uncertain economic climate. Clarity and stability are what is required for an active mergers & acquisitions market. Since the global lock down there has been one potential merger arbitrage opportunity announced as followed by Merger Arbitrage Limited.

Some existing deals have closed, but as they are not replaced by new deals, the opportunities for investment are drying up fast. Even then, an increase, or buoyant M&A market is no guarantee merger arbitrage trading will be profitable or will supply profitable opportunities.

On top of all of this is the difficulty faced by potential acquirers going forward. Many companies have already began adopting a limited time Shareholder Rights Plan. Commonly known as a poison pill. This plan pays out, as a dividend, the right to shareholders to acquire an additional share. It is triggered when an unwanted or unsolicited shareholder increases their holding above a predefined level of stock ownership in the target company. Once activated, the position of the large shareholder becomes vastly diluted. This is intended to make acquiring the target firm prohibitively expensive. Companies are adopting this approach as a takeover defense tactic to avoid being acquired by opportunistic low-ball bidding by acquiring firms. Hexcel (HXL) is the latest firm to adopt this tactic.

Is There Anything Positive?

There may be less players. It is realistic to expect not all fund managers will be in business this time next year. Poor returns will hit income hard and many smaller funds may not have the resources to stay in business until more profitable times reappear. Withdrawal of funds by investors may also cause the investment funds to close their doors. As assets under management (AUM) dwindle and investors move their capital to less risky assets, management fees may no longer be sufficient to cover costs. The capital flow figures of how much investment is being withdrawn from these funds will making interesting, if not sobering reading in the weeks ahead.

Errr…Positive?

However, for those who do survive, a lessening of competition is always welcomed. Less capital chasing the same investment opportunities “may” lead to wider arbitrage spreads. In addition, managers will be forced to reevaluate their strategies. With necessity being the “mother of invention” we expect, finally, the standard merger arbitrage strategy will be dragged out of the 20th century and be rebooted for modern investment environment. Merger Arbitrage Limited, as always, will be there to help.

Stay safe.

Finding this information useful? Here's what you can do to help...

- Share this page using the toolbar links at the left of your screen or at the bottom for mobile users on your preferred social network

- Sina Weibo

- Twitter etc.

- Follow us on twitter @MergeArbLimited.

- Become friends with us on Facebook

- Register for news alerts and merger arbitrage deal analysis postings via email using the sign up form.

- In addition to these, an RSS feed is also available at the bottom right of the page.

- Contact us using the details given on the Contact Us page.

- Donate using the paypal widget in the sidebar. It’s gladly appreciated and we need the coffee! See the Paypal section for additional incentives

- Share this page using the toolbar links at the left of your screen or at the bottom for mobile users on your preferred social network

Thanks for reading!