This is the weekly analysis of Merger Arbitrage Spread Performance March 1, 2020. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 24th February – 28st February. The first section of this report discusses the biggest winners & losers from the T20 portfolio. Then we detail the performance of the overall portfolio. To conclude, we compare this performance with the broader market and the IQ Merger Arbitrage Exchange Traded Fund – MNA. The information contained in this weekly analysis & review assists traders in their merger arbitrage investments and trading.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Index. A list of the largest pending cash merger arbitrage spreads available as at 23rd February. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Index. Click this link for an analysis of the spread performances from the previous week.

Merger Arbitrage Spread Performance March 1, 2020

Winners

…next time… 🙁

Red Robin Gourmet Burgers (RRGB)

Red Robin suffered the worst decline in its history last week as a set of less than impressive results were announced. Despite managements attempts to present the numbers in a positive light, the figures were well short of analysts expectations. This led to two consecutive days were the stock was crushed by more than 10% each time. By Friday, RRGB had closed down for the week by $9.19 at $27.50, a fall of 25.05% leaving the simple spread at 45.45%. This closing level was almost $2 above the low of the week. A rebound fueled by the announcement that Vintage Capital had nominated 4 directors for election to the board. The date of which is yet to be announced. In response to the nominations RRGB management reaffirm their commitment to the strategic plan and long term success of the company and implement a share buy back program. All whilst continuing dialogue with Vintage.

Going forward we continue with our active arbitrage strategy and exploit this unprecedented level of volatility. We clearly stated how we had reduced our position as the stock rose thus protecting us from significant losses during this recent fall. Although we bought back a large amount of stock at higher levels, we were still able to benefit from the lower levels on Wednesday and subsequently start selling again by Friday for a profit. We shall continue with our strategy for the immediate future.

Mellanox (MLNX)

MLNX was also a poor performer this week reversing some previous significant gains. The stock had moved higher following NVIDIA (NVDA) strong results but with no new deal news announced this week, it appears to have been caught up in the broader market turmoil. As the discussions with Chinese regulators are still “progressing” it may be speculated that the disease outbreak may cause some kind of delay. With the spread having been so tight, it would appear prudent that some traders would take profits instead of hoping for a higher bid from NVIDIA in light of recent company performance. The stock gained an additional $3.20 to $119.42. This gives a simple spread of 4.67%. We no longer have a position in this stock, although we shall monitor this spread closely for possible re-entry.

Craft Brew Alliance (BREW)

Despite over whelming shareholder support of the deal with AB-InBev, as demonstrated by 98% of stockholders (including a majority of the outstanding shares held by investors other than A-B or its affiliates) voting in favor of the deal at the recent extraordinary meeting held during the week, CraftBrew Alliance still managed to post a significant decline. By Friday’s close the stock was down $0.28 at $15.91, a fall of 1.73%. However, without any update to the request from the DOJ for additional information in relation to the merger and an expected completion update simply given as “the transaction is expected to close in 2020″ traders, in such a volatile market seemed happy to exit their positions.

Cypress Semiconductor (CY)

Another significant decliner this week was Cypress Semiconductor. The stock fell 1.32% to close at $23.09. This leaves the simple spread at 3.29%. The offer from Infineon (IFNNY) is for $23.85. Although there was no specific deal news announced the spread has succumbed to the influences of the broader market. Similar to MLNX, we no longer have a position in this spread but may be tempted to renter should market volatility subside in the near future.

Merger Arbitrage Portfolio Performance

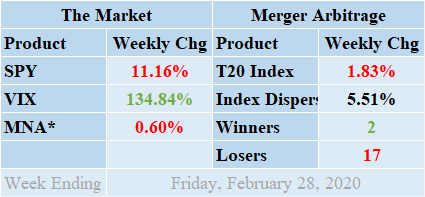

In comparison to the broader markets indices, it’s fair to say cash merger arbitrage returns performed well during a tumultuous week. However, there’s no hiding the fact that this was a difficult week for all concerned. Losers trounced the winners during the previous week by a margin of 17 to 2 with 1 non-mover. The portfolio operates with a full selection of 20 merger arbitrage deals and 0 cash positions. Earnings season has all but finished with just a few final stocks reposting this coming week. The index closed on Friday down by a disastrous 1.83% for the week. This loss was primarily attributable to the fall in RRGB. The standard deviation of the individual index returns for the past week was 5.51%. As expected, this figure is wildly above any previous metric and sets a new all time high.

Additional live news updates for these deals can be found on our customized T20 Index news feed. Even more specific merger details & news can be found on the dedicated news and merger information pages for recently announced deals including GCAP, IOTS, MS-ETFC, RESI, & RRGB.

MNA SPY VIX Returns Table 20200221

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The IQ Merger Arbitrage ETF, MNA, desperately tried to remain in positive territory during the week. In fact, mid-week the ETF was showing a 0.25% increase, a function of the shorting strategy employ by the fund loosely based on a recognizable merger arbitrage trading strategy. However, a drop on Friday saw the ETF finally settle on the red. By the close on Friday, the IQ Merger Arbitrage ETF was down 0.60%. The broader market itself however, troubled by the possible effects to the global economy by the coronavirus was travelling in one direction only. Despite a strong rally from the opening drop on Friday, the S&P 500 still posted one of the worst week’s on record. The volume on Friday was the highest since August 24, 2015. The SPDR S&P 500 ETF, SPY, finished down 11.16%. The VIX index more than doubled in response and by Friday had risen 134.88%.

Domestically, news of the spread of the virus has finally caught up with the markets. The effect to the global economy is now a very real threat as multiple new cases are reported in multiple countries. It should be noted however, two thirds of the drop this week from the T20 portfolio was due to RRGB. This puts the drop inline with that of the MNA ETF. It is important for traders of merger arbitrage to consider how each of their individual positions will be affected by a continued spread of the virus. For example, how can this affect the granting of regulatory approval in China? Are delays inevitable? Will a slowdown in the global economy lead acquirers to rethink their acquisition strategy? Also important is that merger arbitrage stocks which were supported by higher floor prices may now have some of that protection removed.

And finally...

The most recent list of the largest spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. Traders can use this tool to value the arbitrage spread of any stock-for-stock merger deals you may be interested in trading. Additionally, the spreadsheet also functions as a valuation tool for a pairs trading or relative value investment strategy.