This is the weekly analysis of Merger Arbitrage Spread Performance January 26, 2020. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 21st January – 24th January. The first section of this report discusses the biggest winners & losers from the T20 portfolio. Then we detail the performance of the overall portfolio. To conclude, we compare this performance with the broader market and the IQ Merger Arbitrage Exchange Traded Fund – MNA. The information contained in this weekly analysis & review assists traders in their merger arbitrage investments and trading.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Index. A list of the largest pending cash merger arbitrage spreads available as at 19th January. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Index. Click this link for an analysis of the spread performances from the previous week.

Merger Arbitrage Spread Performance January 26, 2020

Wright Medical (WMGI)

A trio of filings during the week saw Wright Medical offer clarification on the upcoming lawsuits lodged against the company. These all relate to the proposed acquisition from Stryker (SYK) in which they claim the “Schedule 14D-9 false and misleading”. Having issued an amended SC 14D9/A the stock began to climb and continued until the end of the week. By close on Friday, the stock stood at $30.32, up $0.22 leaving a simple spread of 1.42%. The tender offer from Stryker is for $30.75 and scheduled to close on February 27. We have not yet taken a position in this stock but have not ruled out doing so in the future. Although, we suspect the stock will now continue to move towards the offer price without much interruption.

WABCO Holdings (WBC)

WABCO announced some positive news during the week which helped its stock become the second best performer. Thursday saw the DoJ announce,

it is requiring ZF Friedrichshafen AG (ZF) and WABCO Holdings Inc. to divest WABCO’s North American steering components business before it will approve their pending merger.

This caused the stock to increase rapidly and close up $0.44, or 0.32% at $135.87. Leaving the simple spread at just 0.46% against an offer price of $136.50 from ZF Friedrichshafen AG (ZF). This deal, which has been on the books for almost 10 months was originally expected to close by the end of this month. The announcement from the DoJ goes on to say,

The proposed settlement, along with a competitive impact statement, will be published in the Federal Register, after which a 60-day public comment period will open for anyone wanting to submit written comments. The court can then enter a final judgment after determining whether the merger is in the public interest.

We previously had a position in this spread but sold some time ago when we considered profits were for the taking. With this delay, all be it a small one, and with such a small spread, we would advise traders to consider doing the same.

Bitauto Holdings (BITA)

With all the talk this week centering on the outbreak of the coronavirus, it is no surprise some of the hardest hit stocks during the week had strong Chinese connections. Even those involved in pending mergers and acquisitions were not exempt. Bitauto Holdings (BITA) steadily declined during the shortened week as more news emerged about the scale of the health issue. The stock closed down for the week at $14.72. A fall of $0.60 or 3.92%. This leaves the arbitrage simple spread at 8.70%, double its value last week.

Following our previous analysis, we did manage to exit some of our position although with hindsight we feel we should have been more aggressive with our selling. At some level, BITA will of course become an attractive investment once again. However, we suggest that moment will not arise until a more accurate assessment of the virus outbreak is obtained. Then, and only then shall we consider topping up our position in this spread.

Merger Arbitrage Portfolio Performance

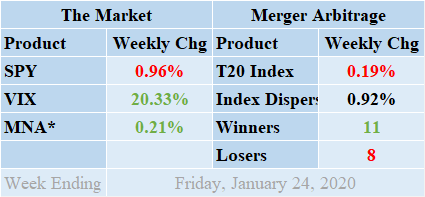

Merger arbitrage returns battled during the week but finally succumbed to a losing score. Winners however once again beat the losers during the previous week by a margin of 11 to 8 with 1 non-mover. The portfolio operates with a full selection of 20 merger arbitrage deals and 0 cash positions. The index, like most major markets during the week experienced a mixed week as the focus shifted to the outbreak of the coronavirus in China. Despite the continuation of earnings season, of which a number of merger arbitrage stocks are scheduled to report this week, we expect the focus to be on China, at least in the short-term. The index closed on Friday in negative territory down by 0.19% for the week. This loss was attributable to the fall in BITA. The standard deviation of the individual index returns for the past week was 0.92%. This figure is well below both the short-term and long-term averages.

Additional live news updates for these deals can be found on our customized T20 Index news feed. Even more specific merger details & news can be found on the dedicated news and merger information pages for recently announced deals including XRX-HPQ, WWD-HXL, DERM, SRNE, & RRGB.

MNA SPY VIX Returns Table 20200124

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The IQ Merger Arbitrage ETF, MNA, also continued its upward run despite global health concerns during the week to deliver yet another positive result. What was destined to be a subdued holiday shortened trading week livened up on Friday as the ETF moved into positive territory. By the close on Friday, the ETF closed up 0.21%, an identical return to the previous week. The broader market itself however moved in the opposite direction. Despite flirting with new highs, Friday saw a sharp decline as fears of China’s ability to contain the virus outbreak grew. The SPDR S&P 500 ETF, SPY, finished down 0.96%. Unsurprisingly, the VIX index moved higher and by Friday had risen 20.33%.

The troubles in the Middle East, specifically Iran, appear to be a distant memory. Likewise, earnings announcements seem to have taken a back seat. Even domestic political machinations have taken second place to the constant demand for updates surrounding the spread of the coronavirus. It would be prudent therefore for investors to expect volatility to remain higher until more accurate and reliable information can be gleaned on the situation.

And finally...

The most recent list of the largest spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. Traders can use this tool to value the arbitrage spread of any stock-for-stock merger deals you may be interested in trading. Additionally, the spreadsheet also functions as a valuation tool for a pairs trading or relative value investment strategy.