This is the weekly analysis of Merger Arbitrage Spread Performance February 2, 2020. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 27th January – 31st January. The first section of this report discusses the biggest winners & losers from the T20 portfolio. Then we detail the performance of the overall portfolio. To conclude, we compare this performance with the broader market and the IQ Merger Arbitrage Exchange Traded Fund – MNA. The information contained in this weekly analysis & review assists traders in their merger arbitrage investments and trading.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Index. A list of the largest pending cash merger arbitrage spreads available as at 26th January. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Index. Click this link for an analysis of the spread performances from the previous week.

Merger Arbitrage Spread Performance February 2, 2020

Bitauto Holdings (BITA)

As would be expected this week, the spreads with the greatest volatility were those with Chinese connections. The outbreak of the coronavirus has, and will continue to dominate market chatter for the foreseeable future. Bitauto Holdings (BITA), which had steadily declined on a daily basis throughout the previous week, reversed that momentum this week and regained a significant portion of what was given up a week ago. The stock closed up for the week at $15.10. A rise of $0.38 or 2.58%. This leaves the arbitrage simple spread at 5.96%.

We stated previously how we should have been more aggressive in our selling when the stock was close to the $15.30 level. We also stated we would not add to our position following the drop until the coronavirus situation became clearer. Although we may have missed a (small) opportunity for profit on this recent fall and subsequent rise, we are happy with our risk management approach. As there was no new deal news announced, we shall maintain our current sentiments. In the absence of further deal news, should the stock move higher, we will look to trim our position further. Should the stock decline we will refrain from adding to our position, thus temporarily suspending our active arbitrage strategy.

Mellanox (MLNX)

Another strong performer this week Mellanox. Another deal spread with ties to China, Mellanox advanced again this week by an additional $1.45 to $120.90. This gives a simple spread of 3.39%. Thoughts of the impending SAMR regulatory decision were cast aside as the company announced Q4 earnings. With GAAP EPS of $1.29 beating by $0.35, and Revenue of $379.80M beating by $46.45M the stock went into overdrive late on Wednesday afternoon.

This is a great set of results for Mellanox. In a recent exclusive Seeking Alpha interview we discussed the rising floor price using the example of ACIA. This is the value that the stock will theoretically fall to should the deal fail. As markets have risen and company results have improved so has the theoretical floor price. This reduces the downside risk, ie the potential loss, whilst maintaining the upside reward. For that reason, and that we have already trimmed our holding, we are happy to maintain the remainder of our position.

Red Robin Gourmet Burgers (RRGB)

Despite not being directly linked to Chinese influences, Red Robin Gourmet Burgers still managed to find itself amongst the largest movers this week. This time on the negative side. No new deal news was announced but the stock managed to get caught up in the broader market sell-off. By Friday, RRGB was down $1.92 at $32.87, a fall of 5.52%. This leaves the simple spread at 21.69%.

Heightened market volatility and no deal news. This appears to be a sweet spot for this spread. The deal closing probability is such that market movements can still significantly affect the spread movement, whilst the possibility of a successful remains. A perfect combination for our active arbitrage strategy. We shall continue in this vein whilst these conditions continue but possibly be in less of a rush to buy than previously on any downward movements.

Fitbit (FIT)

Fitbit also managed to get involved in the market sell off on Friday. Like RRGB, FIT also has a lower DCP and is thus more susceptible to movements in the broader market. The stock closed down for the week by $0.17 at $6.52, a drop of 2.54% leaving the simple spread at 12.73%. We had previously commented when the stock was in the $6.40’s, how we would be surprised to see it move lower unless specific negative news was announced. However, this was before the virus outbreak. Despite this, should the stock decline a little further we still feel inclined to pick up a small position.

Merger Arbitrage Portfolio Performance

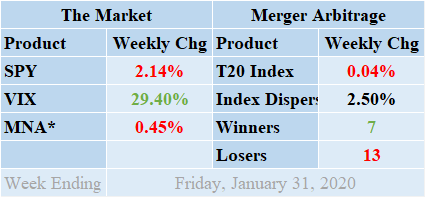

Merger arbitrage returns held up well during the week despite the volatility, but finally succumbed to a losing score. Loses beat out the winners during the previous week by a margin of 13 to 7 with 0 non-movers. The portfolio operates with a full selection of 20 merger arbitrage deals and 0 cash positions. The index, like most major markets, endured a volatile week as traders focused their attention on the global spread of the coronavirus. Despite earnings season rolling on and interest rates being kept on hold underpinning the domestic economy, the focus will remain on China at least in the short-term. The index closed on Friday in marginally negative territory down by 0.04% for the week. This loss was attributable to the fall in RRGB and FIT. The standard deviation of the individual index returns for the past week was 2.50%. This figure is well above both the historic short-term and long-term averages.

Additional live news updates for these deals can be found on our customized T20 Index news feed. Even more specific merger details & news can be found on the dedicated news and merger information pages for recently announced deals including NAV, BWA-DLPH, XRX-HPQ, WWD-HXL & RRGB.

MNA SPY VIX Returns Table 20200131

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The IQ Merger Arbitrage ETF, MNA, also struggled this week amid global health concerns and reported what is becoming a rare negative performance. A sharp decline on Friday moved the ETF into negative territory. By the close on Friday, the ETF closed down 0.45%. The broader market itself continued in the same direction but to a much greater extent. A hugely volatile week saw the market almost recover at one stage only to fall heavily on Friday as news of the coronavirus spreading beyond China became apparent. The SPDR S&P 500 ETF, SPY, finished down 2.14%. The VIX index continued its rise and moved sharply higher and by Friday had risen 29.40%.

Domestically, interest rates have been kept on hold and earnings announcements continue to be positive but both have been put on the back burner. Politically the impeachment trial seems to be over but the focus remains on the spread of the coronavirus. Stock in the pharmaceuticals industry and those connected to china will continue to experience volatility in excess to that experienced by the broader market.

And finally...

The most recent list of the largest spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. Traders can use this tool to value the arbitrage spread of any stock-for-stock merger deals you may be interested in trading. Additionally, the spreadsheet also functions as a valuation tool for a pairs trading or relative value investment strategy.