This is the analysis of Merger Arbitrage Spread Performance January 6, 2019. A review of the top 20 tradeable cash based merger arb spreads in the USA for the week 31st Dec – 4th January. Included in this week’s report are the winners, losers and overall performance of the portfolio. This report is based upon the Merger Arbitrage Limited top 20 (T20) list of cash merger arbitrage spreads available as at 30th December.

We’ve added some additional information recently

- The standard deviation of returns for the top 20 in addition to the average return. This gives our readers a better idea as to the movement within the portfolio.

- The change in the VIX (relative percent) is also included as a complimentary figure to the performance of the SPY

Happy New Year to all our readers/subscribers/affiliates/viewers/fans etc…

Winners

- This week’s best performer was Converge One Holdings (CVON) gaining 1.54%. This is the only deal from last weeks list to complete during the week. CVC Capital Partners closed this deal just 4 days after it’s officially expected closing date of 31st December taking just under two months.

- This week’s 2nd best performer was Essendant Inc (ESND) gaining a further 1.52% following on from last weeks strong performance. Its deal to be acquired by Staples has now seen the tender offer acceptance level breach the 70% mark and has been extended for another week. This caps a remarkable change in fortune for the stock which previously traded as low as $12. Although the deal is still waiting for the expiration of the HSR waiting period the deal is expected to close in “early 2019”. We have been long this spread for some time. This spread is still offering 1.19% and provides an attractive annualised opportunity for those who believe the deal will indeed close in the near future.

- Tesaro, Inc. (TSRO) was up 1.36% on news that “the applicable waiting period under the HSR Act expired”. Glaxo Smithkline’s offer of $75 per share now only leaves 0.27% spread available for a deal that is expected to close in 1Q19. Despite the possibility of an early close, thus increasing the annualised return, we have decided to take some money off the table.

- Dun & Bradstreet Corp (DNB) was also a strong performer up 1.03%. There was little news surrounding the proposed takeover by CC Capital, Cannae Holdings and Thomas H. Lee Partners so this rise could in most part be down to an upturn in the broader market.

- Another significant gainer was TransMontaigne Partners (TLP) up 0.84%, due to be acquired by ArcLight Energy Partners at $41. This rebound on no news follows from last weeks drop of 0.52%.

- Civitas Solutions (CIVI) was up 0.74%. Celtic Intermediate’s offer at $17.75 per share is expected to close in 1Q19. This spread still offers 0.68% and with early closing could be attractive on an annualised basis

Losers

- This week worst performer was Esterline Technologies Corporation (ESL) down 0.91%. Transdigm Group Inc. Despite this drop the deal is still only offering a 1.79% spread and is not officially expected to close until 1H19. Unless something has gone unreported, this could just be a case of profit taking seeing as the broader market improved

- Avista Corp (AVA) was down a further 0.87%. This weeks dose of negative news concerns the Idaho Public Utilities Commission denying its pending merger with Hydro One. The reason given by the PUC is that state law prohibits the transfer of assets from a regulated electric utility to an entity that is “owned or controlled, directly or indirectly, by… any other state.” Canada’s Ontario province owns 47% of the outstanding shares. This deal, whilst technically remaining live is now even more highly speculative than before and is best traded by those with specialist knowledge of the legal situation. Although the spread is now so significantly large traders may be tempted to make a small investment on the possibility of “some” positive deal news or a broader market recovery

- Pacific Biosciences of California (PACB) down 0.55%, declined following the announcement that they and acquirer Illumina had received a second request for information from the Federal Trade Commission. This request may now extend the waiting period until the 30th day after “substantial compliance” by both target and acquirer. The merger is still expected to close in mid-2019. A simple spread of 9.74% could provide an opportunity for investment for a small position as second requests need not be necessarily fatal to the deals chance of success

- Redhat (RHT) had yet another volatile week and was often in positive territory but finished down 0.34%. A filing was made during the week with IBM to “to moot plaintiffs’ disclosure claims” amongst other reasons with regards to the proxy statement. This active and volatile spread has already provided us with a number of entry and exits points and we will continue to trade this spread accordingly. The spread available is 9.20%

Portfolio Performance

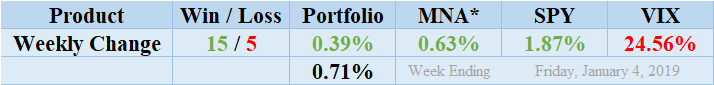

Winners thoroughly outpaced losers this week by 15 to 5 and in line with this ratio saw the portfolio return a positive performance of 0.39%. The standard deviation of the returns is 0.71%. This is a return to the normal range for standard deviation compared to the previous few weeks where deal specific news has caused large outliers. There were no dividends paid during the week from the T20 list. The MNA ETF returned a positive result for the second week running up 0.63%. The S&P 500 ETF, SPY which endured yet another hugely volatile week despite there only being 4 days, rocketed into positive territory on the final day of the week to close up 1.87%. Following Fridays remarkable performance of the SPY on Friday the VIX index decreased by 24.56%.

MNA SPY VIX Returns Table 20190104

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.