This is the analysis of Merger Arbitrage Spread Performance February 10, 2019. A review of the top 20 tradeable cash based merger arb spreads in the USA for the week 4th – 8th February. Included in this week’s report are the winners, losers and overall performance of the portfolio. This report is based upon the Merger Arbitrage Limited top 20 (T20) list of cash merger arbitrage spreads available as at 3rd February.

We’ve added some additional information recently

- The standard deviation of returns for the top 20 in addition to the average return. This gives our readers a better idea as to the movement within the portfolio.

- The change in the VIX (relative percent) is also included as a complimentary figure to the performance of the SPY

Winners

- This week’s stand out best performer was Pacific Biosciences of California (PACB). The stock appreciated an incredible 5.12% or $0.35. This rise is marginally more than last week’s decline. The only official news during the week was an SC 13G/A filing which detailed the acquisition of beneficial ownership by individuals. It would appear the decline from the previous week was somewhat overdone following this week’s recovery. We are now actively trading the volatility of this spread and are keen to take profits as and when they arise.

- Aspen (AHL) was up 1.70% for the week having reported results for the fourth quarter. Despite Chris O’Kane, Chief Executive Officer, commenting: “Aspen’s fourth quarter 2018 results were impacted by the significant natural catastrophe activity that we witnessed across the industry during the period” the most important piece of information was “the maintenance of certain financial strength ratings by Aspen’s subsidiaries”. In light of this aversion of a MAC clause the spread declined considerably and is now only at 0.45% having been less than half that during pre-market trading.

- Redhat (RHT) had another strong week and finished up 0.55%. Despite there being company specific news there was little advancement on the deal. However the spread cam in by $0.99 and now stands at 5.93%. Although we still maintain our long position, this continued rise leaves us very close to taking some money off the table in light of the expected timetable of completion. Should this be the case, we will be ready to jump back in should the opportunity arise especially if the market undergoes a broader pullback.

- Luxoft Holding (LXFT) was also up this week rising 0.48%. Once again there was very little news in this deal but the spread continued to tighten and now stands at 1.11%. This deal is expected to close mid 2019 but even with an early completion there is not an extraordinary amount of edge left in this spread.

- MindBody (MB) was up 0.44% for the week. There was a number of filings relating to statements of beneficial ownership changes made during the week but perhaps the most important filing was one relating to shareholder litigation to which the company responded by furnishing additional information about the deal. The market seems to have welcomed this as the stock is now $0.01 back above the offer price

Losers

- Integrated Device Technology (IDTI) was the week biggest loser falling by 0.86% to $48.37. This was on the announcement that CFIUS has extended its national security review of Renesas’ purchase and is now expected to finish no later than March 22 instead of by February 5. Despite this drop the spread has only widened to 1.30%. We were expecting a little bit more of a panic here due not only to the delay but also the increased uncertainty caused by a review extension. The market however appears reasonably convinced the deal is of high quality and the spread remains relatively tight. At this time we have refrained from taking a new position but remain ready to do so if the sock pulls back a little more.

- InfraREIT, Inc. (HIFR) was the other loser of note this week down 0.38%. This was during the week when the Company’s stockholders voted to adopt the Merger Agreement and approve the acquisition of the Company by affiliates of Oncoron. The overwhelming support for the merger was not unexpected. Should the deal close early shareholders might not be entitled to the dividend if it is not declared. This could be impacting the performance of the stock and no other news was immediately obvious.

Portfolio Performance

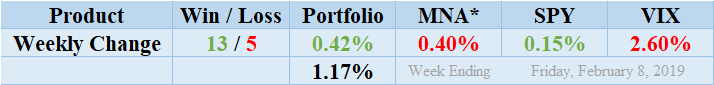

Winners continued to dominate losers this week winning by a margin of 13 to 5 with 2 non-movers. This portfolio return shows a surprising superior positive performance of 0.42% due to the performance of PACB. The standard deviation of the returns is 1.17%. This is slightly lower than the average level and again reflects the dispersion of returns caused by PACB. Without this performance the dispersion of returns would be significantly lower. There were no dividends paid during the week from the T20 list. The MNA ETF finally returned a negative result and missed continuing its run of six positive weeks by declining 0.40%. The S&P 500 ETF, SPY which returned its best January ever also put up a barely positive 0.15% for the week. Surprisingly, despite the week of limited movement, the reminder of on-going trade tensions did not trouble the VIX index and it declined further by 2.60%.

MNA SPY VIX Returns Table 20190208

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.