This is the weekly analysis of Merger Arbitrage Spread Performance February 9, 2020. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 3rd February – 7th February. The first section of this report discusses the biggest winners & losers from the T20 portfolio. Then we detail the performance of the overall portfolio. To conclude, we compare this performance with the broader market and the IQ Merger Arbitrage Exchange Traded Fund – MNA. The information contained in this weekly analysis & review assists traders in their merger arbitrage investments and trading.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Index. A list of the largest pending cash merger arbitrage spreads available as at 2nd February. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Index. Click this link for an analysis of the spread performances from the previous week.

Merger Arbitrage Spread Performance February 9, 2020

Red Robin Gourmet Burgers (RRGB)

Red Robin had a complete reversal from the prior weeks negative performance. Traders may be forgiven for thinking the appointment of a new independent director may have been the catalyst for the rise. However, this announcement came only at the end of the week. On Tuesday, a SC 13G/A was filed with the SEC – a statement of acquisition of beneficial ownership by individuals. This detailed a position of 2,058,635 shares owned by Blackrock representing 15.9% of the outstanding shares. Traders clearly welcomed the news. The stock closed up for the week by $1.48 at $34.35, a rise of 4.50% leaving the simple spread at 16.45%. In light of this, we expect some new deal news in the coming weeks.

As we posited last week, this level appears to be a sweet spot for this merger spread. Broader market movements still significantly affect the spread movement and now the possibility of a successful deal closure has increased significantly. Our active arbitrage strategy continues to reap the benefits of the spread movement. We are now more inclined to buy a full quota should the stock succumb to any profit taking reversing our previous conservative view. We shall continue to trim our position should the stock continue to increase.

Fitbit (FIT)

More SC 13G filings were are made in respect to Fitbit. This time Blackrock, Goldman Sachs & Citigroup all filed revealing holdings of 6.8%, 8.6% & 6.1% respectively. During what was looking like being a quiet week for Fitbit the stock started to climb once the filings become public. This help to lift the stock up for the week by $0.12 at $6.64, a rise of 1.84% leaving the simple spread at 10.69%. We commented that when the stock was in the $6.40’s we would be surprised to see it move in absence of specific negative news. Since that time we have waited for an opportunity to buy the stock should it retreat. With the above news, we are inclined to raise our buy level to the $6.50’s and will look to initiate a position should the opportunity arise.

Craft Brew Alliance (BREW)

Craft Brew Alliance makes a rare appearance into the largest movers this week. What initially looked like a straight forward deal has subsequently run into regulatory problems. At the start of the year, the stock was trading within 2 cents of the $16.50 offer price from Anheuser-Busch, and in fact, it was at $16.45 during the middle of the week of last week. However, by Friday’s close the stock was down $0.29 at $16.11, a fall of 1.77%.

The reason for the drop was a request from the DOJ for additional information in relation to the merger. Previously Craft Brew had withdrawn the initial filing made on December 6, 2019 and refiled on January 6, 2020. Not only does this action reduce the DCP, but also extends the potential closing date should the deal still prove to be successful. We shall investigate the effects of this action and what traders of merger arbitrage can learn in stand alone article. We currently have no position in this stock, and will not initiate one until further details are disclosed. Of great importance here is the refiling by Craft Brew, suggesting there is a great deal more to be researched on this deal before any position could be contemplated.

Ra Pharmaceuticals (RARX)

Also making a rare appearance in the largest movers is Ra Pharmaceuticals. Although there was no new deal news announced during the week, the stock still managed to post a consistent gentle decline across five days to finish the week down $0.57 at $46.30. This was a drop of 1.22% and leaves the simple spread at 3.67%. The deal was originally expected to close in the first quarter of 2020. We have no position in this spread.

Merger Arbitrage Portfolio Performance

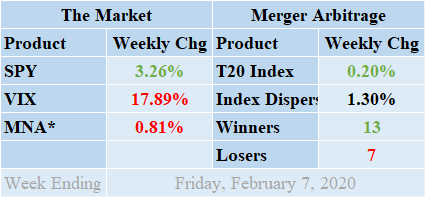

Cash merger arbitrage returns performed well during a week full of positive news. Winners beat out the losers during the previous week by a margin of 13 to 7 with 0 non-movers. The portfolio operates with a full selection of 20 merger arbitrage deals and 0 cash positions. The merger arbitrage index had a reasonably solid daily performance as traders focused their attention on domestic issues. The majority of earnings have now been reported and the final report card is looking good. Although the focus shifted away from China during the week we suspect there will be more news to come at least in the short-term. The index closed on Friday up by a reasonable 0.20% for the week. This gain was attributable to the rise in RRGB and supported by FIT. The standard deviation of the individual index returns for the past week was 1.30%. This figure is well below both the historic short-term and long-term averages.

Additional live news updates for these deals can be found on our customized T20 Index news feed. Even more specific merger details & news can be found on the dedicated news and merger information pages for recently announced deals including FSCT, NAV, BWA-DLPH, XRX-HPQ & RRGB.

MNA SPY VIX Returns Table 20200207

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The IQ Merger Arbitrage ETF, MNA, suffered this week and endured one of its worst performances for a number of months. What started out as a reasonably quiet week was shattered by a sharp drop on Friday moving the ETF into negative territory. By the close on Friday, the ETF closed down 0.81%. The broader market itself however stormed ahead all week although also retreated slightly on Friday. The SPDR S&P 500 ETF, SPY, finished up 3.26%. The VIX index swung sharply lower in response and by Friday had declined 17.89%.

Domestically, economic news such as increasing jobs figures, wage growth and an increase in the January PMI helped underpin the broader market. Earnings season has been largely positive providing yet more market positivity. Receding fears about the extent of the coronavirus and its effect on the global economy have been brushed aside as the markets raced higher. This still managed to have a negative effect on merger arbitrage spreads that have Chinese connections however. We suspect, this story will continue to unfold, but for the time being domestic market resilience continues to prevail.

And finally...

The most recent list of the largest spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. Traders can use this tool to value the arbitrage spread of any stock-for-stock merger deals you may be interested in trading. Additionally, the spreadsheet also functions as a valuation tool for a pairs trading or relative value investment strategy.