This is the weekly analysis of Merger Arbitrage Spread Performance January 19, 2020. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 13th January – 17th January. The first section of this report discusses the biggest winners & losers from the T20 portfolio. Then we detail the performance of the overall portfolio. To conclude, we compare this performance with the broader market and the IQ Merger Arbitrage Exchange Traded Fund – MNA. The information contained in this weekly analysis & review assists traders in their merger arbitrage investments and trading.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Index. A list of the largest pending cash merger arbitrage spreads available as at 12th January. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Index. Click this link for an analysis of the spread performances from the previous week.

Merger Arbitrage Spread Performance January 19, 2020

Red Robin Gourmet Burgers (RRGB)

Monday saw the unusual move of Red Robin Gourmet Burgers announcing preliminary results. This decision was made to coincide with the presentation taking place at the ICR conference during the first part of the week. Initial figures point to a slight outperformance of analyst’s forecasts. Despite Q4 revenue falling 1.3% to $302.9M, it still outperformed the consensus of $301.4M. What really ignited the stock however was Wednesday’s presentation at the ICR Conference of the proposed turnaround plan. This sent the stock sharply higher, although it did succumb to some profit taking on Friday. By the close however, it had advanced $34.95, up $1.94 or 5.88% for the week.

It therefore remains unclear how this may affect the deal with Vintage Capital as no mention of the buyout was made during the presentation. However, we continue to welcome this uncertainty and volatility in the spread. Our active arbitrage strategy as discussed in previous articles is in full operation. Having sold another portion of our holding during the week, we are ready to top up our position should further profit taking occur forcing the price lower.

Fitbit (FIT)

Fitbit continues to move ahead following last week’s successful shareholder vote approving the buyout offer from Google (GOOG). The stock closed the week up by an additional $0.12 to close at $6.68 up 1.83%. We had previously commented, when the stock was in the $6.40’s, how we would be surprised to see it move lower unless specific negative news was announced. As spreads have broadly narrowed in recent weeks, traders have been looking for bargains and have been tempted by the Fitbit risk/reward payoff.

Sentiment surrounding the DoJ investigation is now the dominant factor guiding the stock price. Should this result in a negative outcome with Google exiting the deal, we expect the stock to drop significantly despite the termination fee being worth approximately $1 a share to Fitbit. It is unlikely Google will walk away without a fight however, due to the interest in Fitbit from rival Facebook (FB). However, we previously said we may initiate a small position at the previous lower price which we did not do. At this higher level, we are less inclined to be involved at this price.

Bitauto Holdings (BITA)

Bitauto Holdings (BITA) had a mixed week but still managed to put in a positive performance. Despite there being no specific deal news announced during the week, the stock continued its upward momentum to close on Friday at $15.32. A rise of 0.86% for the week. This leaves the arbitrage simple spread at only 4.44%. Following this extended up move we would have expected some sort of announcement regarding the deal. We can assume however, the stock is benefitting from the signing of the U.S. – China Phase I trade deal. Should no fresh deal details materialize, we will lighten some of our holding in the coming week to reduce our exposure, in line with other holdings.

Wright Medical (WMGI)

Wright Medical was the only significant decliner this week. The rumor some weeks ago, suggesting Smith & Nephew may top Strykers current bid for the firm has subsequently failed to materialize. The stock moved sharply lower on Wednesday to close down for the week at $30.10, down $0.35. This is still $0.65 below the $30.75 offer price from Stryker and offers a simple spread of 2.16%. We have not yet taken a position in this stock but have not ruled out doing so in the future.

Merger Arbitrage Portfolio Performance

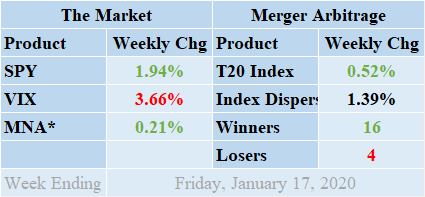

Merger arbitrage returns continue to produce positive results marking an impressive start to the New Year as winners one again beat the losers during the previous week by an ever increasing margin of 16 to 4 with 0 non-movers. The portfolio operates with a full selection of 20 merger arbitrage deals and 0 cash positions. The index continues to benefit from the U.S. – China trade deal which has now officially entered Phase I as fears recede of Chinese retaliatory actions. Deal announcements have slowed over the past few weeks although there remains an number of opportunities available. The index closed on Friday in positive territory up by 0.52% for the week. This gain was primarily attributable to the gain made by RRGB as well as support from FIT. The standard deviation of the individual index returns for the past week was 1.39%. This figure is below both the short-term and long-term averages.

Additional live news updates for these deals can be found on our customized T20 Index news feed. Even more specific merger details & news can be found on the dedicated news and merger information pages for recently announced deals including WWD-HXL, DERM, SRNE, HABT, & RRGB.

MNA SPY VIX Returns Table 20200117

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The IQ Merger Arbitrage ETF, MNA, also continued its upward run mirroring the broader market by posting yet another positive weekly performance. A slow start to the week was put in high gear on Thursday and despite a small decline on Friday, the ETF closed in positive territory up 0.21%. The broader market itself however rose steadily throughout the week following a combination of domestic economic announcements and a positive start to earnings season. This took the market to new highs once again. The SPDR S&P 500 ETF, SPY, finished up an impressive 1.94%. Unsurprisingly, the VIX index moved lower but by Friday had only declined 3.66%.

The attacks in Iran seem to have been forgotten too quickly as the markets focus on the plethora of good news announced during the week. We suspect this is the reason why the VIX has not declined as expected following a large rise in the broader market. Traders are advised to be vigilant and be ready to act should isolated incidents have a targeted effect on specific deals. On the economic front, the market remains buoyed by the upcoming earnings announcements. With this in mind, we expect new deal announcements to be made over the near term.

And finally...

The most recent list of the largest spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. Traders can use this tool to value the arbitrage spread of any stock-for-stock merger deals you may be interested in trading. Additionally, the spreadsheet also functions as a valuation tool for a pairs trading or relative value investment strategy.