This is the analysis of Merger Arbitrage Spread Performance July 28, 2019. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 22nd – 26th July. We produce this report at the end of each week. Firstly, the analysis discusses the biggest winners & losers from the portfolio. Secondly, we highlight the performance of the portfolio and conclude with the broader market as a point of comparison. The information contained in this weekly analysis and review assists traders in their merger arbitrage investment decision making.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Portfolio. A list of pending cash merger arbitrage spreads available as at 21st July. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Portfolio. Click this link for the spread performance analysis from the previous week.

Merger Arbitrage Spread Performance July 28, 2019

CIRCOR International (CIR)

The biggest gainer this week was a deal cancellation! What a crazy world. Despite a tender offer take up of 2/3 of the shareholders the CIR deal failed to proceed. We don’t need to cover this deal anymore than is necessary, suffice to say the deal has now been removed from the eligibility pool. We took a price of $40, which we felt was achievable on Monday morning. Should this deal re-emerge as a possibility then we will continue coverage.

Cypress Semiconductor (CY)

Cypress semiconductor was up 2.69% this week following last week’s significant decline. The stock now trades at $22.88. This gives a spread of 8.03% against an offer price from Infineon (IFNNY) of $23.85. The narrowing of the spread during the week was due to the better than expected results announced on Wednesday. With this is mind, we feel our downside becomes limited especially with the current optimism surrounding the broader market. From last week,

“the company filed a Schedule 14A stating the special meeting for the stockholders vote will be held on August 27th. Then on Thursday, the company also announced the withdrawal and refiling under the HSR premerger program.”

We are happy to maintain our position for the time being until a further significant narrowing of the spread.

Mellanox (MLNX)

On Wednesday Mellanox (MNLX) posted worse than expected earnings. Despite this, the stock improved 1.93% for the week to $113.70. This leaves the spread at 9.94%. No other deal news was released during the week and we view the increase as being effected by the broader market. We maintain our position in this deal and await further developments.

Array BioPharma (ARRY)

Pacific Biosciences of California (PACB)

Pacific Biosciences of California (PACB) continued its downward trend during the week. The stock dropped an additional 1.69% as the market further digested the CMA decision to launch a Phase 2 review.

As noted in an article by Stephen Simpson CFA

“In short, they (the CMA) believe that short-read and long-read sequencing technologies are not fundamentally or effectively different and that Illumina’s acquisition, therefore, represents further consolidation of a market that it already dominates.

The spread now offers 52.67% with a potential closing date extremely difficult to judge, if indeed the deal were to be successful. We maintain our tentative floor price calculation of around $4.60 should the deal break. Our active arbitrage strategy has served us well and although currently dormant, we continue to hold our position until further deal development clarification.

Portfolio Performance

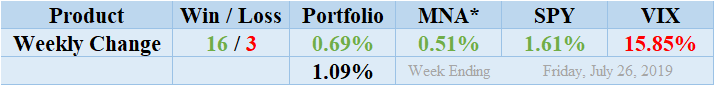

Winners beat out the losers by a score of 16 to 3 with 1 non-mover. The portfolio consisted of 20 stock and 0 cash positions. The portfolio showed a significantly positive performance finishing up for the week by 0.69%. As discussed above, the vast majority of this loss is attributable to the decline of CIR & PACB. Readers can also stay abreast of the developments in these deals by following our customized portfolio news feed focusing exclusively on the pending cash mergers we are following. Return standard deviation for the past week was 2.90%. This is significantly higher than last week and is the highest number ever recorded.

MNA SPY VIX Returns Table 20190726

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The MNA ETF outperformed the broader market producing a slightly positive return of 0.51%. The IQ Index merger arbitrage ETF continues to hover about the zero return line since our records began. Following Friday’s recovery, the S&P 500 ETF, SPY, scaled with new highs and finished the week up by 1.61%. The VIX index accordingly increased during the week by 15.85%. We now expect volatility to continue at current level following the geo-political tensions in the Gulf. Stock specific volatility and market direction going forward will be governed by earnings season announcements.

And finally…

The most recent list of the largest spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. This can be used to value the spread of any stock-for-stock deals you may be interested in.