This is the weekly analysis of Merger Arbitrage Spread Performance November 3, 2019. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 28th October – 1st November. The first section of this report discusses the biggest winners & losers from the T20 portfolio. Then we detail the performance of the overall portfolio. To conclude, we compare this performance with the broader market and the IQ Merger Arbitrage Exchange Traded Fund – MNA. The information contained in this weekly analysis & review assists traders in their merger arbitrage investment decision making.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Portfolio. A list of pending cash merger arbitrage spreads available as at 27th October. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Portfolio. Click this link for the spread performance analysis from the previous week.

Merger Arbitrage Spread Performance November 3, 2019

Pacific Biosciences of California (PACB)

A recovery from last week’s nosedive sent Pacific Biosciences of California to the top of the best performers this week. The stock price finished the week at $4.90 up 4.03%. This leaves the spread at 63.27%. As expected, there was no deal news announced this week. Traders are braced for the CMA decision following their Phase II investigation. This has a statutory deadline of December 11 2019. At these levels, we have maintained our position and will do so for the time being.

Mellanox (MLNX)

Mellanox makes a welcome return to the best performers. News on this deal has been quiet of late, but during the week, the company announced earning above of analysts forecasts. This helped propel the stock to recent highs. Rising $3.11 for the week, or 2.81%, the stock closed at $113.76. The spread is now 9.88%.

Also helping the stock was renewed optimism regarding a solution to the U.S. – China trade dispute. The ongoing review period of the SAMR review is set to conclude in February next year. However, with the global trade situation beginning to settle this could prove to be an attractive opportunity for new investors. We already have a position, and with the additional comfort of a positive earnings release supporting the floor price, we are happy to maintain it.

Acacia Communications (ACIA)

Acacia Communications was another big winner as a result of earnings last week. The stock rose 2.17% to close at $66.26. This leaves the simple spread at 5.60%. This rise marks a pleasant recovery for this spread. The latest earnings beat on both EPS and revenue, which, like MLNX, supports the floor price should the deal not be successful. Solid earnings are also reassuring and (almost) the possibility of poor performance being used to invoke a MAC clause. We are happy to maintain our position here.

Red Robin Gourmet Burgers (RRGB)

Red Robin Gourmet Burgers was the largest decliner this week. The only news being the release date for earnings will be November 5. The stock fell by 1.79% to $31.19. Our active arbitrage strategy is now in full swing and we continue to trade in and out of the position as the market moves. We shall continue this strategy as long as the stock continues to behave in this volatile manner. However, we will be exercising additional caution over the earnings announcement.

El Paso Electric (EE)

The other significant decliner for the week was El Paso Electric. Despite there being no deal news announced during the week, it appears the stock have succumb to some pre earnings announcement nerves. There was however an announcement from Moody’s on Friday stating the completion a periodic review of the ratings of the company. This could be the reason for the large volume recorded on Thursday. The stock closed down 0.56% at $66.96. The spread continues to remain as additional regulatory clearances are yet to be obtained. We stated before we have continuously missed the boat on this deal. This latest pull back may provide the opportunity we are looking for. A dividend of $0.385 was announced with the stock going ex-div on December 12. We will be looking to take a position in this stock in the coming week.

Merger Arbitrage Portfolio Performance

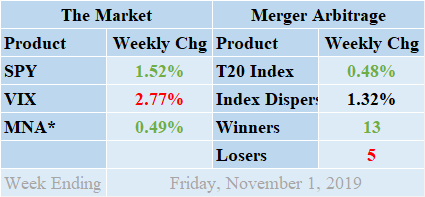

Winners outpaced the losers by 13 to 5 this week with 0 non-movers. The portfolio consisted of 18 stock and 2 cash positions. The portfolio showed a healthy positive performance for the week finishing up by 0.48%. This positive performance was primarily attributable to rebound in PACB and supported by MLNX & ACIA. Readers can stay abreast of developments in these deals by following our customized T20 Portfolio news feed. This shows the latest mergers and acquisitions news updates focusing exclusively on the pending cash mergers we consider eligible for investment. We have also introduced dedicated news pages focusing on specific deals such as CISN, FIT, GWR, ONCE, RARX, TIF & ZAYO along with background deal information. Return standard deviation for the past week was 1.32%. This figure is below both the short-term and long-term averages which had risen sharply following significant individual stock losses.

MNA SPY VIX Returns Table 20191101

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The IQ Merger Arbitrage ETF, MNA, despite turning negative in the middle of the week, rose significantly on Friday to produce a positive return of 0.49%. This fell short of the rise in the broader market. However, the market did see an explosive rise on Friday by comparison. The SPDR S&P 500 ETF, SPY, finished up 1.52%. The VIX index surprisingly only just managed to move lower for the week. It eventually settled on a decrease of 2.77%. We previously suggested volatility would enter an elevated period but a number of factors have coincided to reduce this threat. Namely, a further reduction in interest rates, an encouraging jobs report and a significant reduction in U.S./China trade tensions. Earnings season continues to deliver robust results. We have listed those merger arb stocks who are part of the T20 and are scheduled to report on our Spread tracker page.

And finally...

The most recent list of the largest spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. This can be used to value the spread of any stock-for-stock deals you may be interested in.