This is the Merger Arbitrage Spread Performance December 9, 2018 analysis. A review of the top 20 tradeable cash based merger arb spreads in the USA for the week 3rd – 7th December. Included in this week’s report are the winners, losers and overall performance of the portfolio. This report is based upon the Merger Arbitrage Limited top 20 (T20) list of cash merger arbitrage spreads available as at 2nd December.

We’ve recently added some additional information

- The standard deviation of returns for the top 20 in addition to the average return. This gives our readers a better idea as to the movement within the portfolio.

- The change in the VIX (relative percent) is also included as a complimentary figure to the performance of the SPY

Winners

This week’s best performer was Esterline Technologies Corporation (ESL) gaining 2.54%. This follows the filing of various forms with the SEC during the week including Form SC 13D/A (General statement of acquisition of beneficial ownership) and Form 8-K giving more information on the proposed takeover. Also performing strongly was NxStage Medical (NXTM) finishing up 2.20% for this shortened trading week. This follows last weeks poor performance as traders look to pick up bargin arbitrage positions. Other risers of note were Endocyte, Inc. (ECYT) up 0.85% and XO Group Inc. (XOXO) up 0.40%.

Losers

This week’s worst performer is Avista Corp (AVA) down 15.63%. This catastrophic loss was caused by Hydro One’s failure to obtain approval from Washington State regulators. The reason given was “meddling by the province of Ontario in Hydro One Ltd.’s management“. The companies are quoted as saying they are “reviewing the order in detail and will determine the appropriate next steps”. This decision again highlights the difficulty of merger arbitrage involving (but not limited to)

- Foreign entities

- Utilities or other protected industries

- Ego.

The involvement of local and state politicians and the uncertainty they can cause in the deal process must be factored into the deal spread before an investment can be made. Of course, that’s easily said with hindsight, but a lesson learned/reiterated none the less. Other significant losers tis week were Rent-A-Center (RCII), down 1.50% and Redhat (RHT), down 0.80% both being caught up in the general market decline.

Portfolio Performance

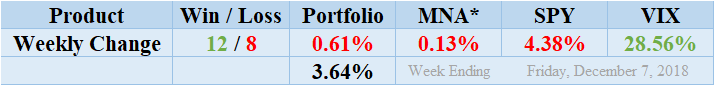

MNA SPY VIX Returns Table 20181207

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

And Finally…

The most recent list of the largest spreads is already available, and you can check out the rules for inclusion here. Our free merger arbitrage spread calculator is also available for FREE download. This can be used to value the spread of any stock-for-stock deals you may be interested in.