This is the Merger Arbitrage Spread Performance December 2, 2018 analysis. A review of the top 20 tradeable cash based merger arb spreads in the USA for the week 26th – 30th November. Included in this week’s report are the winners, losers and overall performance of the portfolio. This report is based upon the Merger Arbitrage Limited top 20 (T20) list of cash merger arbitrage spreads available as at 25th November.

We’ve added some additional information recently

- The standard deviation of returns for the top 20 in addition to the average return. This gives our readers a better idea as to the movement within the portfolio.

- The change in the VIX (relative percent) is also included as a complimentary figure to the performance of the SPY

Winners

This week’s best performer (by an extraordinay margin) was AFSI gaining an incredible 5.51%. This deal closed during the week and following the announcement of the approval saw its stock price immediately rise from $14.00 to the offer price of $14.75. Congratulations to all the arbs out there who were long at the time. This deal completed 1 month early. The second best performer was IDTI, up 2.30%. In third place was RHT which was up a further 1.95% following last weeks gain of 0.95%. RHT acquired NooBaa, a hybrid cloud data management provider during the week. MITL was also up an impressive 1.73% having filed an S-8 POS on Friday signifying the completion of this deal at $11.15 exactly 1 month early. Another honorable mention is ESL which finished the week up 1.11% following its announcement of a special shareholder meeting to vote on the proposed merger scheduled for January 17th, 2019.

Losers

Portfolio Performance

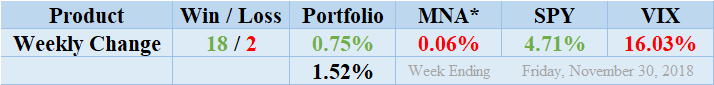

MNA SPY VIX Returns Table 20181130

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

And Finally…

The most recent list of the largest spreads is already available, and you can check out the rules for inclusion here. Our free merger arbitrage spread calculator is also available for FREE download. This can be used to value the spread of any stock-for-stock deals you may be interested in.