This is the analysis of Merger Arbitrage Spread Performance April 28, 2019. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 22nd – 26th April. We produce this report at the end of each week. Firstly, the analysis discusses the biggest winners & losers from the portfolio. Secondly, we highlight the performance of the portfolio and conclude with the broader market as a point of comparison. The information contained in this weekly analysis assists traders in their merger arbitrage investment decision making.

Stocks mentioned in this report are from the Merger Arbitrage Limited top 20 (T20) list of cash merger arbitrage spreads available as at 21st April. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 list. Click this link for the news and performance analysis from the previous week.

Merger Arbitrage Spread Performance

Bluegreen Vacations Corporation (BXG)

The significant gainer this week from the T20 list was Bluegreen Vacations Corporation (BXG). The stock climbed 1.74% to close the week at $15.17 compared to the $16.00 per share offer from BBX. There were no filings made during the week. We put this week’s gain down to two factors. Firstly, bargain hunting, as investors look to pick up the stock cheaply following last week’s decline.

Secondly, the ongoing disagreement with Bass Pro regarding the cancelation of the Company’s access to the Bass Pro marketing channels. BXG received a letter from Bass Pro on April 18, extending the time frame to cure until April 27 “so as “To allow time for further review and good faith discussion…”. In a press release dated April 22, BXG added that their exposure level to this issue “would be less than $20 million”. Having read the details of this release, and in light of these comments, we expect a satisfactory resolution to this disagreement. We expect the deal to complete successfully even if it takes a bit longer than we originally forecasted. We were keen to add to our small positon in BXG around the $14.50 level at the start of the week.

Unfortunately we just missed our chance and we do not see the need to add to our positon at these higher levels. The spread is still attractive currently offering 6.67%. A dividend of $0.17 is payable on May 15 with the stock going ex-div on Tuesday, April 30.

Quantenna Communications (QTNA)

Quantenna Communications (QTNA) was the next best performer with a gain of 0.49% or $0.12. This takes the stock to within $0.10 of the $24.50 offer price from ON Semiconductor. The spread on this arb is now at 0.41%. Completion of this deal is officially expected in Q2 of this year. For this reason, the annualised return is not sufficiently appealing even with an early closing. As mentioned last week, we do not have plans to initiate a position in this stock. The possibility of a higher offer always exists and we encourage and welcome intelligent discussion on this topic in the comments below. Nevertheless, with such a small profit available and extended completion timeline we would advise taking some money off the table and redeploying the capital elsewhere.

Spark Therapeutics (ONCE)

This week’s standout worst performer was Spark Therapeutics (ONCE). The stock declined an additional 2.49% or $2.75, to continue a series of weekly declines. The spread now stands at 6.15%. The tender offer was originally expected to close April 2. However, the second tender offer deadline saw only 26.1% of the outstanding stock tendered. This is down from 29.4% when the original closing date passed. The extension now runs until June 7. As before, the parties have withdrawn the HSR filing and intend to refile on or around May 9. Clearance is then be expected on May 24. As this is a tender offer, the waiting period will expire 15 days later.

This low take up of the tender offer continues to weigh on the stock. A prior comment from Roche, “All terms and conditions of the offer shall remain unchanged during the extended period” has clearly not inspired traders to speculate on a higher bid forthcoming. The large downside should the offer not complete makes this deal extremely risky. Although we took a small position previously we now believe that was somewhat premature. Even so, the HSR refiling is not expected to be an issue and the premium offered to ONCE stockholders should be sufficient to obtain the required tender threshold. However, we expect more spread volatility in the near future.

Advanced Disposal Services (ADSW)

Advanced Disposal Services (ADSW) was the second worst performer this week declining 1.32%. With no news announced, the stock appears to have succumbed to a bout of profit taking following the initial deal euphoria. The spread has subsequently widened to 2.38%. We have no position in this stock but may initiate a position if the spread widens further. This appears to be a relatively safe deal with existing commentary praising the merits of the deal.

Luxoft Holding (LXFT)

Luxoft Holding (LXFT) was another faller this week declining 1.26%. Again, with little news announced, the stock had moved towards closure of the deal and within $0.22 of the $59 offer price. However, this week has seen the spread widen to 2.38%. We have no position in this stock.

Global Brass and Copper (BRSS)

The final worst performer this week and yet another 1%+ decliner was Global Brass and Copper (BRSS), which decreased 1.05% to $43.32.

Portfolio Performance

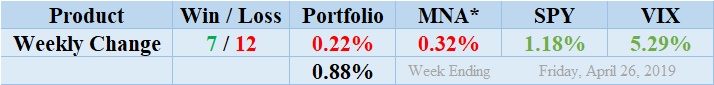

Losers outpaced the winners this week for the first time in 5 weeks by a ratio of 12 to 7 with no non-movers. The portfolio consisted of 19 stock positions and 1 cash position. The portfolio showed a negative performance to finish the week down by 0.22%. The loss this week was surprisingly muted as four stocks, ONCE, ADSW, LXFT, & BRSS all declined by more than 1%. Only BXG posted a gain of any significance. This was in response to last week’s decline and shows the volatile nature of this spread. The standard deviation of the returns for the past week was 0.88%. This is higher than in recent times and marginally lower than the longer term average level. This diversity of returns do not reflect the broader market performance but instead demonstrate the effects on the portfolio of stock specific news.

MNA SPY VIX Returns Table 20190426

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The MNA ETF continued its latest negative run. The ETF finished the week showing a negative 0.32%. This loss has not only reversed the gains made at the start of the month but also drags the ETF to almost 1% lower than when our coverage started over 6 months ago. Recent articles touting the benefits of this product appear to be misguided. We are more than happy to discuss this point in detail with our readers. The decline once again shows the shortcomings of the hedging strategy employed by this particular product. See our Merger Arbitrage ETF Review for more information. The S&P 500 ETF, SPY showed significant gains throughout the week and finished up 1.18% as the market approached all-time highs. Surprisingly, following another gain in the broader market, the VIX index also increased again by 5.29%.

And finally…

The most recent list of the largest spreads is already available. Our free merger arbitrage spread calculator is also available for FREE download. This can be used to value the spread of any stock-for-stock deals you may be interested in.