This is the analysis of Merger Arbitrage Spread Performance January 13, 2019. A review of the top 20 tradeable cash based merger arb spreads in the USA for the week 7th – 11th January. Included in this week’s report are the winners, losers and overall performance of the portfolio. This report is based upon the Merger Arbitrage Limited top 20 (T20) list of cash merger arbitrage spreads available as at 6th January.

We’ve added some additional information recently

- The standard deviation of returns for the top 20 in addition to the average return. This gives our readers a better idea as to the movement within the portfolio.

- The change in the VIX (relative percent) is also included as a complimentary figure to the performance of the SPY

Winners

- This week’s best performer was Travelport (TVPT) gaining 2.08%. Despite there being little official news during the week, this stock has now moved to within 3 cents of the offer price from Toro Private Holdings and has subsequently dropped out of this weeks T20 list of largest spreads. Even though the deal has a 2nd quarter closing date, we expect this deal to close considerably earlier.

- This week’s 2nd best performer was Athenahealth (ATHN) gaining a further 1.45%. Its deal to be acquired by Veritas Capital & Evergreen Coast Capital saw the spread close to within 1.21% this week on little news. We expect this deal to close in the near future and will wait to see any announcements before taking any profits.

- Redhat (RHT) had yet another volatile week and finished in positive territory up 1.19%. The introduction of Red Hat Ansible Tower 3.4 which introduces new workflow features and security standards, is designed for simplified and more secure management across hybrid IT environments was received positively by the market. IBM’s offer of $190 per share still leaves a 7.92% spread. The deal is slated to close by the end of the year but an early completion would enhance the annualised return considerably. If this rise continues into this week we will be looking to take some money off the table.

- NxStage Medical (NXTM) was also a strong performer up 0.94%. This deal which was originally expected to close at the end of last year is still offering a 3.81% spread as Fresenius Medical Care AG & Co. struggle to close the deal. There was little news surrounding the proposed takeover and this rise could in most part be down to an upturn in the broader market. We maintain our long position.

- Last weeks worst performer, Esterline Technologies Corporation (ESL) was up 0.92%. The proposed deal from Transdigm Group Inc. now only offers a 0.86% spread and is not officially expected to close until 1H19. We suggested last week that the decline may have been due to profit taking. Those investors who picked up on this and bought the stock would have made a nice profit and we would suggest taking some profits unless you have reason to believe this deal will close spectacularly early.

- Another significant gainer was TransMontaigne Partners (TLP) up 0.71%, due to be acquired by ArcLight Energy Partners at $41. The continued strong performance has left the spread at a negative level and is now trading 12 cents above the offer price. A dividend of $0.805 is due to be paid before the deal closes

Losers

- Avista Corp (AVA) was down a further 2.02%. This weeks decline further compounds the negative news and concerns the Idaho Public Utilities Commission denying its pending merger with Hydro One and the denial of Washington state to review the case. This all but kills the deal although Avista and Hydro One continue to weigh their options. This deal, whilst technically remaining live is now even more highly speculative than before and is best traded by those with specialist knowledge of the legal situation. Although the spread is now so significantly large traders may be tempted to make a small investment on the possibility of “some” positive deal news or some kind of alternative deal

- Pacific Biosciences of California (PACB) down 0.96%, declined further following the announcement that they and acquirer Illumina had received a second request for information from the Federal Trade Commission during the week before last. This request may now extend the waiting period until the 30th day after “substantial compliance” by both target and acquirer. The merger is still expected to close in mid-2019. As traders weigh the significance of this request the stock price has suffered and the simple spread now stands at 10.80%. This could provide an opportunity for investment for a small position as second requests need not be necessarily fatal to the deals chance of success.

Portfolio Performance

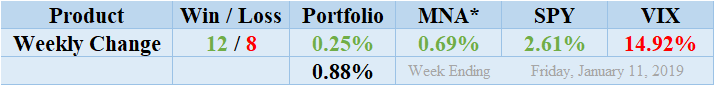

Winners marginally outpaced losers this week by 12 to 8 and in line with this ratio saw the portfolio return a positive performance of 0.25%. The standard deviation of the returns is 0.88%. This is marginally higher than normal and reflects the dispersion of returns at the extreme end of the scale. Namely AVA and TVPT. There were no dividends paid during the week from the T20 list. The MNA ETF returned a positive result for the third straight week running up 0.69%. The S&P 500 ETF, SPY produced a perfect week of positive returns to close up 2.61%. Accordingly the VIX index decreased by a further 14.92%.

MNA SPY VIX Returns Table 20190111 *We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.