This is the weekly analysis of Merger Arbitrage Spread Performance February 16, 2020. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 10th February – 14th February. The first section of this report discusses the biggest winners & losers from the T20 portfolio. Then we detail the performance of the overall portfolio. To conclude, we compare this performance with the broader market and the IQ Merger Arbitrage Exchange Traded Fund – MNA. The information contained in this weekly analysis & review assists traders in their merger arbitrage investments and trading.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Index. A list of the largest pending cash merger arbitrage spreads available as at 9th February. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Index. Click this link for an analysis of the spread performances from the previous week.

Merger Arbitrage Spread Performance February 16, 2020

Pattern Energy Group (PEGI)

Pattern Energy Group makes a rare appearance into the largest movers this week. The stock which started the week $0.08 higher than the current offer price began to drift upwards but really took off on Thursday. The stock eventually closed the week up $0.75 at $27.58. This is $0.83 above the $26.75 offer price from the Canada Pension Plan Investment Board. There is also a dividend of $0.422 payable quarterly. This five day winning streak was also accompanied by a surge in daily traded volume.

The only official news during the week was the consecutive SC 13G filings made on Wednesday, Thursday and Friday by Vanguard, Signature Global Asset Management and Nomura. These filings disclosed holdings of 9.55%, 0.04% and 7.78% respectively. Signature Global Asset Management is a subsidiary of CI Investments, a Canadian fund manager. It appears that following these announcements, arbitrageurs are suggesting a higher bid is a possibility. We shall conduct further investigations into this issue. In the meantime, we have no position and no immediate intention of initiating one.

Red Robin Gourmet Burgers (RRGB)

Red Robin surged ahead yet again building on last week’s gains. During the week there was a slew of SC 13G filings from firms such as American Century, Vanguard, Dimensional Fund Advisors and T. Rowe Price. It appears this increase in stock buying activity has emboldened the arbs. The pressure will be mounting on management to provide sufficient reason as to why they are pursuing a just say no defense especially as official results are set to be announced on February 25. The stock closed up for the week by $0.86 at $35.21, a rise of 2.50% leaving the simple spread at 13.60%.

This attitude of management continues to play well into our strategy. During the past week we have continued trading the stock back and forth. This is known as our active arbitrage strategy. The volatility caused by an increasing presence of investors looking for the board to make a deal, contrasted with their response makes this an ideal time to profit from the indecision. We shall continue this strategy for the foreseeable future.

Mellanox (MLNX)

Another strong performer this week was Mellanox. The stock moved higher as potential suitor NVIDIA (NVDA) announced a strong set of results. This shows the strength of the industry at present and again underlines what a great dal NVIDIA is getting. Despite the impending SAMR regulatory decision the stock gained an additional $1.61 to $121.17. This gives a simple spread of 3.16%.

Fitbit (FIT)

Fitbit followed an almost metronomic decline throughout the week to finish down by $0.22 at $6.42, a fall of 3.31% leaving the simple spread at 14.49%. This is despite Prem Watsa, the Canadian investor taking a stake as announced on Thursday. Fitbit is due to announce earnings after market close (AMC) on Thursday, February 20.

We have written extensively on FIT in the past and have stated that should the stock return to the $6.50 level we would look to initiate a small position. This we have now done. We suspect the deal may take longer to close than originally forecast, but we are prepared for that risk when buying the stock at this level.

Merger Arbitrage Portfolio Performance

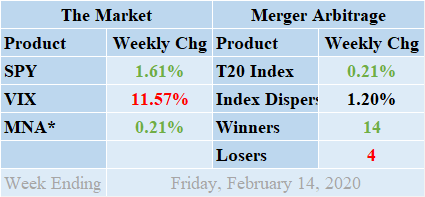

Cash merger arbitrage returns again performed well during a week. Winners beat out the losers during the previous week by a margin of 14 to 4 with 2 non-movers. The portfolio operates with a full selection of 20 merger arbitrage deals and 0 cash positions. The merger arbitrage index had a reasonably solid daily performance as during a quiet news week (economically) traders focused on specific deal issues. Earnings season is almost completely behind us and has provided a solid platform although the future economic effect in China due to the coronavirus is becoming a source of speculation in the short-term. The index closed on Friday up by a reasonable 0.21% for the week. This gain was attributable to the rise in PEGI & RRGB despite FIT trying to spoil the party. The standard deviation of the individual index returns for the past week was 1.20%. This figure is well below both the historic short-term and long-term averages.

Additional live news updates for these deals can be found on our customized T20 Index news feed. Even more specific merger details & news can be found on the dedicated news and merger information pages for recently announced deals including FSCT, NAV, BWA-DLPH & RRGB.

MNA SPY VIX Returns Table 20200214

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The IQ Merger Arbitrage ETF, MNA, returned to positive territory this week after enduring one of its worst performances previously. A short lived spike on Tuesday was soon corrected in what was otherwise a quiet week. By the close on Friday, the ETF closed up 0.21%. The broader market itself continued to power ahead after a strong start to the week. The SPDR S&P 500 ETF, SPY, finished up an additional 1.61%. The VIX index declined as expected and by Friday had fallen 11.57%.

Domestically, economic news was quiet and as earnings season draws to a close. On balance, analysts have been cheered by corporate results but attentions now turns to macro economic issues. China has now gone back to work following an extended new year break and the markets waits to see the economic effect of the coronavirus outbreak. However, domestic markets have moved higher which suggests disruption will be minimal, but at the same times leaves plenty of potential downside.

And finally...

The most recent list of the largest spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. Traders can use this tool to value the arbitrage spread of any stock-for-stock merger deals you may be interested in trading. Additionally, the spreadsheet also functions as a valuation tool for a pairs trading or relative value investment strategy.