This is the analysis of Merger Arbitrage Spread Performance September 29, 2019. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 23rd – 27th September. We produce this report at the end of each week. Firstly, the analysis discusses the biggest winners & losers from the portfolio. Secondly, we highlight the performance of the portfolio and conclude with the broader market as a point of comparison. The information contained in this weekly analysis and review assists traders in their merger arbitrage investment decision making.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Portfolio. A list of pending cash merger arbitrage spreads available as at 22nd September. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Portfolio. Click this link for the spread performance analysis from the previous week.

Merger Arbitrage Spread Performance September 29, 2019

Presidio (PSDO)

Presidio (PSDO) provided the vast majority of investor cheer in the merger arbitrage segment last week. The company announced that,

“In response to an alternative acquisition proposal received during the go-shop period, the Company and BC Partners agreed to an amendment to the Merger Agreement to increase the per-share consideration payable to Presidio’s stockholders to $16.60 per share from $16.00 per share, a 3.75% increase.”

The stock is now trading over 1% higher than this revised offer price at $16.79. Investors are anticipating a bidding war as BC Partners demonstrates its commitment to making the deal. The board of directors continue to recommend stockholders vote in favor of the BC Partners deal. The special meeting is yet to be announced.

Having just received a 5% windfall it seems unlikely stockholders will be in a rush to cash out. A bidding war could take the stock to dizzying heights whilst the downside is limited to $0.19 per share. The stock traded as high as $17.49 in February and there have been a number of lawsuits claiming the offer undervalues the company. We may be tempted to take a position only on a pull back. However, we would suggest existing shareholders sit tight and enjoy the ride.

El Paso Electric (EE)

The other significant gainer for the week was El Paso Electric. Despite there being no deal news announced during the week, it appears the positive sentiment following last week’s successful shareholder vote has continued the upward momentum. The stock closed up 0.72% at $67.27. The spread continues to remain as additional regulatory clearances are yet to be obtained. We have continuously missed the boat on this deal. Whilst waiting for a pullback following our analysis the stock have continued to move higher.

Pacific Biosciences of California (PACB)

Pacific Biosciences of California (PACB) returned to top the largest decliners once again. On Tuesday, the stock declined more than 10% to hit a low of $5.00. Although the stock traded a fraction under this level, it finished the week at $5.22 down 7.28%. The news was subsequently revealed in an SEC filing late on Wednesday that Illuminia (ILMN) and PACB have agreed to extend the closing date until March 31, 2020. Hardly surprising considering the ongoing investigation by the CMA. On Wednesday, an additional third party submission was released by the CMA. This time, Shawn C. Baker, Ph.D. gave his views on why the deal should be allowed to proceed. Whether or not this was the catalyst for Friday’s recovery we do not know.

Large movements in this stock appear to predate news flow. The deal extension date does not come as any real surprise despite the company’s previous insistence of deal closing before the end of the year. As evidence both for and against the deal is release we maintain our previous guidance. We maintain our long position and await further clarification.

Spark Therapeutics (ONCE)

Spark Therapeutics followed last weeks decline with an additional drop this week. The stock slipped 4.87% to $97.41. The currect tender offer is scheduled to expire October 01 so expect an extension announcement during the week. Although no new deal news was announced, we have previously highlighted to ongoing investigation by the CMA. On Wednesday, the CMA initiated its invitation to comment stating,

“To assist it with this assessment, the CMA invites comments on the transaction from any interested party.”

This window closes October 11 2019. The statutory timetable currently reads as follows

| Phase 1 Date | Action |

| TBC | Deadline for phase 1 decision* |

| TBC | Launch of merger inquiry |

| 25 September – 11 October 2019 | Invitation to comment |

| 6 June 2019 | Initial enforcement order |

The uncertainty this creates has caused the spread to widen. In addition, deadline date given is subject to change as the investigation evolves. It appears last weeks drop may have been foreseeing this announcement. However, we maintain our position and await further announcements.

Red Robin Gourmet Burgers (RRGB)

Red Robin Gourmet Burgers (RRGB) also continued its downward trend this week. The stock finished down $1.57 or 4.61% at $32.50. There was no deal news announced during the week. We continue to monitor this stock as a candidate for our active arbitrage strategy but would like to see more concrete deal news first. We maintain our position and await further news.

Merge Arbitrage Portfolio Performance

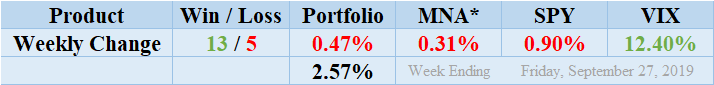

Winners beat out the losers by a score of 13 to 5 with 2 non-movers this week. The portfolio consisted of 20 stock and 0 cash positions. The portfolio showed a negative performance finishing down for the week by 0.47%. The quantity of losses this week was sufficient to counteract the effect of the outsized gain achieved by PSDO. Readers can also stay abreast of the developments in these deals by following our customized T20 Portfolio news feed. The latest mergers and acquisitions news updates focusing exclusively on the pending cash mergers we consider eligible for investment. Return standard deviation for the past week was 2.57% reflecting the extreme PSDO gain and the decline in PACB. This figure is significantly higher than both the long-term and short-term averages and is the highest individual result for some time.

MNA SPY VIX Returns Table 20190927

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

Volatility throughout the week left the MNA ETF producing an overall loss and was left showing a negative return of 0.31%. This ends an upwards run of performances stretching back the last few months. The broader market however continues to experience heightened volatility. The S&P 500 ETF, SPY, finished down 0.90% almost identical to last week. The VIX index accordingly moved higher and eventually settled on an increase of 12.40% for the week. We had previously suggested volatility would remain higher as the market continues speculating on the next action in the ongoing trade war. However, political machinations that caused market jitters throughout the week. The market remains on tenterhooks awaiting the latest developments with China.

And finally…

The most recent list of the largest spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. This can be used to value the spread of any stock-for-stock deals you may be interested in.