This is the analysis of Merger Arbitrage Spread Performance August 4, 2019. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 29th – 2nd August. We produce this report at the end of each week. Firstly, the analysis discusses the biggest winners & losers from the portfolio. Secondly, we highlight the performance of the portfolio and conclude with the broader market as a point of comparison. The information contained in this weekly analysis and review assists traders in their merger arbitrage investment decision making.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Portfolio. A list of pending cash merger arbitrage spreads available as at 28th July. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Portfolio. Click this link for the spread performance analysis from the previous week.

Merger Arbitrage Spread Performance August 4, 2019

Pacific Biosciences of California (PACB)

Pacific Biosciences of California (PACB) staged a comeback during the week. At first glance, it would appear bargain hunters stepping in as no news was immediately apparent. However, on closer inspection Illumina reiterated their expectation of Q4 closing in the latest filing following the announcement of their own earnings. This helped the stock close up $0.19 or 3.63% for the week at $5.43. The spread remains wide at 47.33%. Although the closing date may be difficult to judge, Illumina have stated that they expect an FTC decision before the CMA of the UK that also added a tiny bit more clarity to the expected proceedings. Also in the news was a report of Syquant Capital Sas, which had increased its position in PACB by 216,101 shares during the previous quarter. We have temporarily halted our active arbitrage strategy but continue to maintain our position whilst awaiting further news.

Spark Therapeutics (ONCE)

Spark Therapeutics was the second largest gainer this week up 3.52% at $101.53. The big announcement made during the week was the extension of the tender offer until September 3. Clearly, the market does not realistically expected the deal to have cleared the necessary regulatory hurdles by that time. However, it does reaffirm Roche’s intent to stick with the deal. This rebound brings to an end a series of weekly declines. Without further news available, we maintain our small position.

Acacia Communications (ACIA)

Acacia Communications (ACIA) was only the third best performer this week despite increasing in price by 2.38%. At $66.65, the spread is still 5.03%. With no discernable news released during the week it appears traders may be speculating on regulatory approvals and a strong possibility of early closing. At present, the expected closing date is given as the end of May Next year. As stated last week, we were looking to take a position in this stock and have now done so. However, even with early closing we may looking to take some profits is the stock continues to rise in the short term.

Array BioPharma (ARRY)

Red Robin Gourmet Burgers (RRGB)

Red Robin was this week’s worst performer and despite a rebound on Friday still finished the week down 5.15% at $32.87. This leaves the spread at 21.69%. This deal is still non-binding although the parties involved have admitted to having constructive conversation. However, a poison pill does remain in effect. Vintage capital already own a sizable stake in RRGB. We suspect traders maybe doubting the true motive of Vintage Capitals proposal. It is a possibility that they intend to flush out a rival bidder to whom they can sell their stake. As things stand this deal is much more speculative than most and we feel the wide spread is justified. However, we have already taken a small positon and await further developments.

Mellanox (MLNX)

The recovery of Mellanox stalled during the week as the stock tumbled 2.03% and gave up most of the positive returns recently achieved. The reigniting of the US-China trade dispute continues to negatively affect this deal. As stated before, we expected this volatility to continue until things are resolved between the two trading partners but we have no yet instigated an active arbitrage strategy. We currently maintain our position.

Portfolio Performance

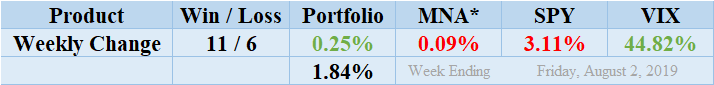

Winners again beat out the losers by a score of 11 to 6 with 3 non-movers this week. The portfolio consisted of 20 stock and 0 cash positions. The portfolio showed a solid positive performance finishing up for the week by 0.25%. As discussed above, despite the loss from RRGB the rebounding of PACB & ONCE was enough to drag the index into positive territory. Readers can also stay abreast of the developments in these deals by following our customized portfolio news feed focusing exclusively on the pending cash mergers we are following. Return standard deviation for the past week was 1.84%. Despite being lower than last week this figure is significantly higher than the short and long term averages.

MNA SPY VIX Returns Table 20190802

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The MNA ETF held stead by producing a minor loss to finish down 0.09%. for the week. The IQ Index merger arbitrage ETF continues to hover about the zero return line since our records began. Following a tough week, the S&P 500 ETF, SPY, retreated sharply from the new highs of last week and finished down by 3.11%. The VIX index accordingly rocketed skywards increasing 44.82% for the week. We had previously suggested volatility would remain higher as we continue through earnings season and tensions in the Gulf. However, the ongoing China-US trade dispute continues to catch markets of guard and dominate proceedings.

And finally…

The most recent list of the largest spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. This can be used to value the spread of any stock-for-stock deals you may be interested in.