This is the analysis of Merger Arbitrage Spread Performance June 23, 2019. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 17th – 21th June. We produce this report at the end of each week. Firstly, the analysis discusses the biggest winners & losers from the portfolio. Secondly, we highlight the performance of the portfolio and conclude with the broader market as a point of comparison. The information contained in this weekly analysis assists traders in their merger arbitrage investment decision making.

Stocks mentioned in this report are from the Merger Arbitrage Limited top 20 (T20) list of cash merger arbitrage spreads available as at 16th June. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 list. Click this link for the news and performance analysis from the previous week.

Merger Arbitrage Spread Performance June 23, 2019

Spark Therapeutics (ONCE)

Spark Therapeutics was the largest gainer this week rising 7.54% to $105.07. This is an increase of $7.37. The rise follows last weeks fall due to the simultaneous announcement of regulatory intervention by the FTC and the CMA in the UK. Despite no official news, being released during the week and no filings made the stock has rebounded strongly. In fact, immediately following the announcement last week the stock dropped into the low $90’s pre market. It appears bargain hunters have been attracted at these prices. Investors have also taken heart from Roche’s stated commitment to the deal. Analysts have stressed the importance of this deal for Roche as signified by the hefty takeover premium offered. We maintain our small position in this deal and await further news.

CIRCOR International (CIR)

CIRCOR was the second best performer this week. This is an unsolicited deal from Crane at $45 per share by way of tender offer. CIRCOR had initially rebuffed the deal but have now agreed to review the terms of the offer. Since that announcement on Monday, the stock has risen to $45.84 and is now almost 2% above the offer price. Traders are clearly anticipating a higher offer. The stock advanced 2.34% during the week.

The important news to note here is in a filing made by CIRCOR on June 17,

‘The CIRCOR board of directors intends to make its recommendation with respect to the tender offer to shareholders within ten business days”

This 10-day window could take us through to Monday July 1, or possibly beforehand. Watch out for some volatility in this stock during the week as traders positions themselves for an announcement.

Zayo (ZAYO)

During the week, Zayo Group announced it has been “selected by a major news broadcaster to provide a managed video network” However, there was no mention of the pending takeover. Zayo was the third best performer up by 1.35% for the week. This is the first significant movement since the official announcement of a deal. We took a small position previously and were contemplating exiting the position based on the lack of movement and the length of time until deal completion. We may now look to exit the position following this rise and redeploy the funds.

Mellanox (MLNX)

Mellanox (MLNX) was the fourth biggest gainer of the week up 1.29%. The stock struggled to hold on to early gains and was initially above $113. On Thursday, the company held its special meeting and shareholders overwhelmingly voted in favor of the deal. However, a drop on Friday of $1.42 saw the stock close at $111.49.

Redhat (RHT)

Although Redhat was only the fifth largest gainer this week, we include a brief note based upon the news announcement and a position update. Firstly, the company announced a solid set of results for the latest quarter ahead of expectations. Secondly, the stock closed up 1.27% for the week on news that EU antitrust regulators are expected to clear IBM’s proposed takeover. This sent the stock to a spread of less than 1%. Unfortunately, we got a touch greedy and held out for a slightly higher price that was not quite reached. The plan was to redeploy funds elsewhere. For the meantime we will continue to hold, but may sell on any new announcement if alternative opportunities are available.

Pacific Biosciences of California (PACB)

Pacific Biosciences of California (PACB) again found itself amongst the biggest movers for the week. This week the stock was again the biggest decliner and fell a further 6.32%. The merger arbitrage spread is now at 28.41%. However, unlike previous weeks, this week’s drop was accompanied by a significant announcement. It does seem incredible that the spread has continued to widen during the past few weeks on no news but now we have found out why. On Tuesday morning, an announcement was made stating

“the Competition and Markets Authority of the United Kingdom (“CMA”) announced the completion of its Phase 1 review of the Merger and that it will refer the Merger for a Phase 2 review if the Company and Illumina are unable to address the CMA’s concerns“

This does not necessarily mean that a Phase II investigation will be initiated. The companies have until next week to respond to questions raised by the CMA investigation. The stock however, rebounded slightly only to fall away again by the end of the week. The companies expect the deal to close in the fourth quarter.

We have made readers fully aware of our strategy with this deal. Last week we warned that we might not add to the position if the stock dropped further. This was the reason why. We were unable to forecast this announcement but it was clear that something was brewing having seen the stock decline on such little news. We believe, this lack of news, coupled with stock movement is news in itself and will continue to update readers to this effect. We maintain our long position and now look forward to the extended time frame of completion where we can continue to execute our active arbitrage strategy.

Medidata Solutions (MDSO)

The only other decliner of note this week was Medidata Solutions (MDSO). The stock was down 0.53% on no significant deal news. With 7 months to go until expected deal completion, we have no rush to enter into a position in this stock.

Portfolio Performance

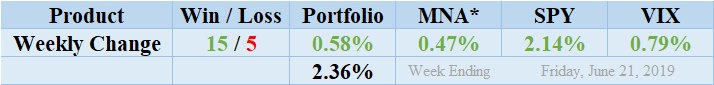

Winners beat out the losers by a score of 15 to 5 with 0 non-movers. The portfolio consisted of 20 stock and 0 cash positions. The portfolio showed a positive performance to finish up for the week by 0.58%. As discussed above, the vast majority of this gain is attributable to the advance of ONCE. Investors have reasoned that a second request does not necessarily mean the end of the deal and have bought the stock cheaply. Readers can stay abreast of the developments in this deal by following our twitter feed or our customised news feed. The standard deviation of the returns for the past week was 2.36%. This remains extremely higher than both the recent and longer-term averages and caused by the PACB drop and the ONCE advance.

MNA SPY VIX Returns Table 20190621

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The MNA ETF performed in line with the broader market. The ETF performance showing a positive 0.47%. The IQ Index merger arbitrage ETF now returns to positive territory since our records began. The S&P 500 ETF, SPY spent the week building on early gains and by Friday finished up for the week by 2.14%. This includes a quarterly dividend of $1.432. Strangely, the VIX index also increased by 0.79%. We continue to expect his level of volatility to continue.

And finally…

The most recent list of the largest spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. This can be used to value the spread of any stock-for-stock deals you may be interested in.