Winners

- This week’s surprise best performer was Ultimate Software (ULTI). The stock climbed a 0.60% for the week or $1.99. What makes this situation all the more interesting is the spread now stands at a 0.58% PREMIUM. The only official news announced during the week was the award of two Excellence in Technology 2018 awards from Brandon Hall Group. Traders clearly expected a revision the the initial deal terms here although there is no public speculation on the details.

- The second best performer this week was Spark Therapeutics (ONCE) which increased 0.45% to $113.79. The main news here this week was the official commencement of the tender offer from Roche. The offer is valued at $114.50. We have said before we liked this deal and if the time frame is as short as we expect it to be the annualised return should be a healthy one.

- Luxoft Holding (LXFT) was the other gainer of note this week up 0.29%. Again with little news being announced the stock moved towards closure of the deal and the spread tightened to 0.70%. We have no position in this stock

Losers

- This week’s worst performer was Redhat (RHT) down 1.03% at $180.71. RHT has had a great run recently and was given an additional boost when it was announced Warren Buffet had made an investment. During this time we announced we were looking to reduce our holding but were happy to stay long following the aforementioned investment. Subsequently, during the week the company received a second request from the DoJ and the stock declined. We had just sold a small portion before this announcement and are already keen to top back up should the stock decline any further.

- This week’s second worst performer was pacific Biosciences of California (PACB) down 0.82%. We have commented many times how have been trading this stock and we continue to do so. Having previously sold the majority of our position we were able to buy some back during the recent dip. There was no new deal related news during the week but the volatile nature of this stock continues to offer up ample opportunities for investment.

Portfolio Performance

We’ve previously added some supplementary information

- The standard deviation of returns for the top 20 in addition to the average return. This gives our readers a better idea as to the movement within the portfolio.

- The change in the VIX (relative percent) is also included as a complimentary figure to the performance of the SPY

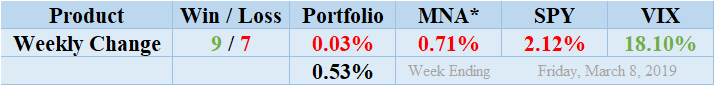

Winners managed to beat out the losers this week by a ratio of 9 winners to 7 losers out of a portfolio of 16 and 4 cash positions due to lack of eligible candidates. Despite this, the portfolio showed a negative performance and finished the week just slightly down by 0.03%. This was mainly due to the performance of RHT and the decline in PACB. The standard deviation of the returns is 0.53%. This is higher than in recent times but still below the longer term average level. PACB once again showed its ability to be a major instigator of portfolio deviation and provided opportunites for financial gain. There was one dividend paid during the week from the T20 list from TRCO for $0.25. The MNA ETF returned a significantly negative performance of 0.71%. The S&P 500 ETF, SPY was also significantly negative as trade deal negotions drag on and with some weaker than expected economic data posted a negative 2.12% during a volatile week. Unsurprisingly, following a volatile negative week for the broader market the VIX index increased by 18.10%.

MNA SPY VIX Returns Table 20190308

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.