Introduction

Traders often ask how to use options in a merger arbitrage strategy. Financial derivatives can be a great way of tailoring a merger arbitrage strategy to suit the needs of individuals or institutions alike. Using Options in Merger Arbitrage to alter the risk reward profile creates a myriad of possibilities to enhance trading performance in merger arbitrage. This article focuses on the reasons why and how to use options within this event driven strategy and the choices available to achieve those goals. In addition, this article also explains the drawbacks and risks of each strategy enhancement. Finally, we answer some frequently asked questions giving the reader a comprehensive overview.

This article is applicable to professionals and non-professionals but some readers may wish to read some of the introductory posts on this site before continuing (we also have a comprehensive book list and an academic resource). Certain technicalities in the pricing of options not deemed to be significant to the final outcome have been omitted for the sake of simplicity and continuity. The reader is also encouraged to refer to the extensive onsite glossary which is specifically designed to interact with this and other articles published on this site.

As the dissemination of information continues, a wider investing audience becomes aware of merger arbitrage (also known as risk arbitrage) and attracted to its complementary nature to a traditional portfolio. This increase in popularity has contributed to the decline in returns for many traditional merger arbitrage funds. Losing months or streaks have become all the more poignant and are no longer softened by the availability of easy excess profits common in previous years. The trade off between risk and reward has become increasing scrutinized as traders look to enhance the efficiency of their portfolios. In merger arbitrage this results in the increased utilization of additional products such as options.

How to Use Options in Merger Arbitrage

The use of options in a merger arbitrage strategy generally falls into one of three groups. These are reward, risk and valuation. The application of each option strategy within these classifications is further specialized by the type of deal to which it is applied. All cash offers have distinctly different properties and requirements to those that involve a partial or full acquirer stock offering which can themselves be further complicated by the use of a collar. The reader will quickly note how some option strategies (and combinations thereof) are not feasible in a stock deal.

The interconnectedness of call options, put options and the underlying stock, (put-call parity) creates degree of overlap between some of these strategies. In which case, with minor adjustments, similar results can be replicated with increased simplicity which may at first confuse the reader. In light of this, we discuss at length the risks and rewards of using options in Merger Arbitrage and uses for each deal type educating the reader on how these can be of practical use.

This comprehensive article has drawn upon various academic resources and extensive market observations and experience by the author. Of special note is a paper entitled “Derivative Strategies in Risk Arbitrage” by Mohsen Mazaheri. For additional background on options we recommend Buying and Selling Volatility by Kevin Connolly as a great introductory text or Natenberg’s Option Volatility and Pricing: Advanced Trading Strategies and Techniques often considered the bible by many options market makers.

How to Use Options in Merger Arbitrage - Reward

Using options in merger arbitrage may enhance the rewards available to stock traders. This can be done by utilizing the leverage in options using either puts or calls or can be done by collecting premium from the sale of options if they expire worthless (or less than the original sale price). We concentrate on plain vanilla options in this article. Additional derivative products such as warrants, futures and binary options are discussed elsewhere on this site.

Sell Puts

Selling target puts in lieu of buying target stock enables the trader to collect time premium (known as Theta) as well as profit from the movement in the spread. As expiration approaches, whilst below the offer price the ITM put starts to behave like stock. As the target stock moves up the put hopefully expires worthless. The opportunity cost of collecting this option decay is foregoing any higher bid as there is effectively no position above the strike price of the put. If the spread does not move up to the strike before expiry, the position can be rolled to the next expiry and avoid taking possession of the actual stock. Selling puts with a lower strike than the offer price may result in higher option decay but increases the chance the stock may finish higher than the strike price – a difference in movement for which the trader will not be rewarded.

This strategy can only be done on a cash deal where the offer price is fixed. In a stock deal the trader would be indirectly selling a put on the acquirer stock and be exposed to market forces acting upon that stock. Therefore, even if the trader was short the required quantity of acquirer stock, the trader would be constantly re-hedging the target position and would endure the P&L profile of a short gamma position.

Short Call

In a cash only deal where the arbitrageur is already long target stock they may wish to enhance returns by selling an OTM call options. The risk lies with selling an option only to see the stock finish above the strike price, the profits from which would not accrue to the trader.

Trader must account for the movement in the underlying market during the time of the offer. The original tender off for NXPI was $110.00 per share but as the market (especially the semi-conductor index) had risen so strongly QCOM had to raise its bid to $127.50. Traders reasoned if a higher bid did not materialize the stock would be worth at least $110.00 anyway and so refused to tender their stock. Therefore, the call options had significant value. Subsequently, near dated options should be preferred as to help avoid the extended run up in stock prices as seen in NXPI. This aside, a call option with a sufficient decay value may be indicative of the likelihood of a higher bid. Alternatively, lower priced call options may not be deemed sufficient for sale due to their low value despite indicating the low probability of higher offers emerging.

Short Call, Short Put

In a stock for stock deal, a long position can be established in the target by selling puts and a short position in the acquirer by selling calls. Decay can be collected on both legs and the correct delta ratio can be maintained by selling (buying) more options or trading the target stock. If the acquirer rises significantly (moving the target price higher) the arbitrageur may be left with a naked short position in the acquirer and no position in the target (the puts expire worthless) and will suffer large losses.

Synthetic Stock Positions

A long synthetic stock position can be created by going long a call and shorting a put option on the same strike in the same expiry month. This position may arise individually following a change of strategy by the arbitrageur or following an expiration of part of a previous strategy. It is unlikely in today’s efficient markets that executing a synthetic stock position would be more profitable than simply buying the underlying stock. If the options have sufficient liquidity and a wide enough spread a trader may choose to sit on the respective bid and offer, but it is simply more efficient to trade the stock if possible. The risk profile for this strategy will therefore be the same as a stock position.

Volatility Arbitrage

This strategy is only available to stock deals. The trader buys delta neutral at-the-money (ATM) straddles on the acquirer and sells the same ratio (as per the offer agreement) of delta neutral straddles on the target. Generally speaking, the target has a higher implied volatility because of the possibility of a merger or acquisition. The difference in the amount received will be the profit. As the deal approaches completion the volatilities of the two stocks harmonize and the arbitrageur can profit from the initial difference. Being short premium on the target will of course incur a large loss if the deal breaks.

The trader must decide on what strike to sell the target straddles. This will depend on the option expiry and where the trader believes the spread will move to by that date. For instance, if identical ATM strikes are chosen, once the spread moves and starts to narrow, the target delta will become more negative due to the short gamma. If the strike is chosen correctly the target will initially start with a delta but expire exactly at the money. Otherwise hedging parameters will need to be observed so the respective deltas of each position can maintained at an acceptable level. To this extent near dated options are the preferred contract.

If all the options expire in the money the stock positions will be a regular merger arbitrage play or position maintenance will be required if only one side of the trade finishes in the money. If the spread has moved against the trader they will have lost money like they would have as if they had a stock position but would have recouped some of the loss due to collecting the option decay.

Target Only Straddles

Once the target volatility has declined following the deal announcement the trader may decide for whatever reason there is an increased chance of a deal break but still wish to participate in the spread. Should the trader no longer wish to hold a long stock position a straddle on the target could be purchased instead. The maximum loss is the cost of the options but the trader can profit should the deal successfully consummate or even from an increase in volatility. In the event of a deal break the trader will profit from a sharp down move and a significant increase in volatility.

ETF Options

How to Use Options in Merger Arbitrage - Risk

Target Risk Reversal v’s Target Long Call

| Variable | Value |

|---|---|

| Pre Offer Price | $117.00 |

| Current Price | $172.24 |

| Offer Price | $190.00 |

| Completion Date | Expected December 31, 2019 |

| Interest Rate | 2.69% |

| 165 Call Price | $22.00 |

| 165 Put Price | $9.30 |

| 190 Call Price | $1.10 |

| Risk Reversal Cost | $-8.20 |

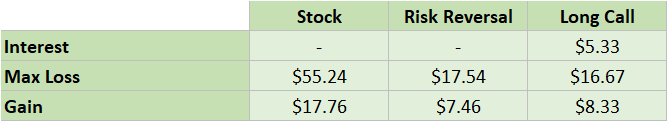

We’ll use Redhat (RHT), the target of an all cash takeover by IBM as an example. The information in Table 1 uses mid-prices from the market close on November 2, 2018. The simple spread is ($190.00 – $172.24 = $17.76). Thus, the current risk reward (RR) from a simple stock position is $55.24/$17.76. The earliest option expiry beyond the expected completion date is Jan 2020. The 165 puts are trading at approximately $9.30 and the 190 calls are at $1.10. Risk reversals can be executed for a cost of $8.20 which would give a new RR of $15.44/$9.56. As the call option has relatively little value we could possibly omit this leg leaving only the long stock + long put position. Many option traders will recognize this as a synthetic long call option on the same strike as the put.

Call option values at the offer price tend to be very low. Buyouts with characteristics of a high Deal Closing Probability (DCP) give little reason for the value of the stock to exceed the offer price as per the current merger agreement. (The possibility of a higher offer would increase the call value but rumors such as these are often widely circulated beforehand by the target its advisers thus making any sale of call options extremely risky). A target with a low DCP means a lower stock price and the call will be extremely out-of-the-money also suggesting a low value. See “short call” strategy discussed earlier.

In our example, put-call parity approximates the price of the call option as $172.24 – $165 + $9.30 + $5.38 = $21.92. (The $5.38 is the interest that would have been earned at the rate of 2.69% for the duration of the deal had the funds been put on deposit and not used for the stock purchase). In fact, the 165 calls currently trade at $22.00 giving a RR of $16.62/$8.38, sufficiently close to the previous example.

You may be wondering why would you not buy the stock and execute the risk reversal? Firstly the trader forgoes the upside of a higher bid or superior proposal. This may be an unlikely scenario but were it to occur it could prove extremely profitable especially if a bidding war ensued. Also, options have a fixed expiry date. Were the deal extended for whatever reason beyond the forecast completion date, the options may expire worthless, resulting in a loss of $8.30. Due to deal extension risk the spread will most probably widen further exaggerating the losses. A new position would have to be initiated at additional cost. At current prices the three month risk reversal (same strikes again) will cost $2.10 thus bringing the RR more into line with the simple stock position. An earlier than anticipated deal closure will improve the annualized return in all three scenarios.

The Stock + Risk Reversal appears at first to be the most appealing but the hidden cost of deal extension risk and the loss of any additional upside puts its profitability somewhere between the Long Stock and the Long call positions. The long call option does not lose any potential upside but does have expiry risk. Trader must therefore be confident in their ability to judge the length of time needed for deal completion and the likelihood of a higher bid.

In the case of a stock deal the delta of the target position will change (because of a change in the target stock price) as the spread changes and as the acquirer stock moves. To maintain the correct ratio as per the deal terms the target stock will have to be repeatedly bought and sold. This could be a profitable, or a losing issue, depending on whether the target is trading near the long or short option. Whether or not the position is long or short gamma. The calls in this instance will tend to have a “normal” value as there is no upper limit to the offer. The price of the target is dependent on the acquirer and could go up indefinitely. The same is true for the down side. This would make selling calls on the target more risky than before as you are effectively selling calls on the acquirer and this would not be a risk reducing strategy.

The long put position on the target is still justified as there is downside risk to be protected. If the short call position on the target is omitted in a stock offer deal and the price continues to rise the put position may have to be “reset” should the trader wish to continue their protection. This involves buying a put at a higher strike but below the target stock price just like in the initial trade. If the target stock falls below the put strike because of a deal break the position can be unwound at its restricted loss levels. General market volatility could take the target stock to the put strike and the trader must decide whether or not to hedge with target stock to maintain the deal ratio. If the trader ends up buying target stock they may then need to consider resetting the hedge by buying a put with a lower strike in the opposite manner to the reset action mention above.

Simply being long a put on the target stock is the simplest way of hedging the risk of a deal break. In a cash offer this means choosing a strike at which the arbitrageur is satisfied with the level of downside protection and comfortable with paying the cost of the option. The trader may select a far dated option so as to mitigate the need for renewing or rolling the position or a near tern option if the trade is to be of a short term nature. In a stock deal the trader has to anticipate where the target stock will end up following a deal break and this could be heavily dependent on the prior movement of the target stock. In this case a straddle may be more appropriate.

A calendar spread in this context requires selling the near dated puts and buying the longer dated puts. For deals with a longer expected completion date such as those involving regulatory hurdles (HSR) or political oversight (CFIUS) it may take some time before any new significant news affecting the deal is released. This may be especially true for deals involving approval from the Chinese State Administration for Market Regulation (SAMR). In this case, one can sell near dated puts which should expire worthless offsetting some of the cost of the long position in the longer dated puts. Following the expiration of the near month, the arbitrageur has protection from the outstanding long put position. If required, this strategy can be rolled by reversing the long position to a short one and opening a new longer dated long put position. In the event of subsequent near month options expiring worthless whilst maintaining the long back month put position the strategy will generate additional income.

In a cash deal if the spread moves up any initial outlay (cost) of the spread will be lost and the protection from the longer dated put will no longer offer sufficient protection. Continued protection buy buying a put with a higher strike, will come at additional cost eating into the stock gains. Should the spread decline in the short term, losses will be suffered on both the stock position and the short put position which heavily outweigh any protection from the long put position in the back month.

A stock deal equates the target calendar spread to placing the spread on the acquirer. This is no longer merger arbitrage. The put position offers no enhancement of protection from the deal. Although a profit from the merger arbitrage is still possible from the long stock position the put spread (which is effectively on the acquirer) is a punt on the direction of the acquirer stock.

Spread Valuation

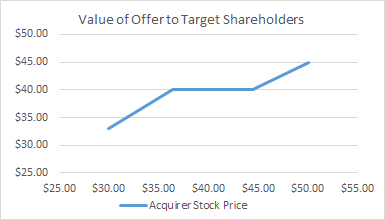

Valuing Collars

An Example

Other Option Trading Issues

What happens to live options at the point of deal completion?

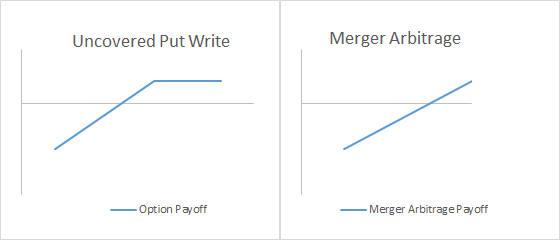

What are the similarities between option payoffs and Merger Arbitrage?

How does deal extension risk effect an options strategy?

What about the lack of option expiry availability?

How do you select the correct option expiry with regards to forecast closure dates?

Conclusion

We have shown how there are a wide variety of options combinations which can be used to enhance performance of merger arbitrage. Some of these require more expertise than others, some are suitable in specific circumstances whilst some may be ineffective because of the specific terms of the deal. It is important that the trader understands that an option position in the target in a stock-for-stock deal is in effect a position in the acquirer. To make these strategies work, an offsetting options position must therefore also be taken in the acquirer

It is important for the trader to understand the additional risks using options in merger arbitrage will bring to the portfolio and what additional costs are involved. Unfortunately, not all stocks have options available and even when they do, liquidity issues may prevent the trader from taking a position. The constant rolling of positions or positions reversals (the same instrument changing from long to short or vice versa) may incur sufficient commission costs to render the strategy unprofitable.

We have shown how the trader can avoid some of these risks by increasing awareness of the pitfalls involved. However, we always recommend obtaining professional advice before entering these markets.

Finding this information useful? Here's what you can do to help...

- Share this page using the toolbar links at the left of your screen or at the bottom for mobile users on your preferred social network

- Sina Weibo

- Twitter etc.

- Follow us on twitter @MergeArbLimited.

- Become friends with us on Facebook

- Register for news alerts and merger arbitrage deal analysis postings via email using the sign up form.

- In addition to these, an RSS feed is also available at the bottom right of the page.

- Contact us using the details given on the Contact Us page.

- Donate using the paypal widget in the sidebar. It’s gladly appreciated and we need the coffee! See the Paypal section for additional incentives

- Share this page using the toolbar links at the left of your screen or at the bottom for mobile users on your preferred social network

Thanks for reading!