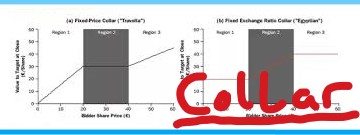

A Collar is a type of payment structure for a target stock during an acquisition or takeover. In a straightforward stock deal, the exchange ratio is known in advance and is fixed throughout the life of the deal. With a collar however, the acquirer stock ratio changes above and below predefined thresholds. This type of structure is designed to reduce the uncertainty of the payoff and can therefore be used in a variety of instruments such as interest rates or derivatives. Although this entry describes the application of a collar to mergers and acquisitions, more information can be found on the collar option trading strategy in our article “How to use Options in a Merger Arbitrage Strategy“.

Payment for target stock using the stock of the acquirer fall into one of three categories

- Fixed exchange ratio – a fixed ratio until closing. Used in a majority of U.S. transactions

- Floating exchange ratio – The ratio floats with the target receiving a fixed dollar value no matter what happens to either acquirer or target shares.

- A combination of a fixed and floating exchange. This may ultimately be a complex arrangement using a combination of both caps and collars.

We shall look into the third option in the example below.

Collar Example

When a deal is announced, the terms of merger consideration are revealed and typically, the target stock price increases. If acquirer stock is used as payment, generally, a fixed ratio is used and arbitrageurs can trade the spread by short selling the required buyer stock using the exchange ratio. However, what if the acquirer stock price move significantly during this time? Collar agreements are utilized when mergers are financed with acquirer stock as opposed to cash. This help negate potential significant changes in the stock’s price and affect the value of the deal to the buyer and seller.

To protect itself from overpaying for the target the acquirer constructs a collar. This will reduce the number of shares required to purchase each target shares above a predetermined threshold. Likewise, to protect the seller, the target, should the stock price of the acquirer fall, the exchange ratio will increase. This of course increases the cost to the buyer, as stock dilution may be difficult for some investors to swallow. However, it protects the seller by helping them receive a higher compensation that they might otherwise had.