Practical Guide to Trading Merger Arbitrage

Do you already have an understanding of how merger arbitrage works? Maybe you have already seen our introductory guides? The next logical question should be “How do I actually initiate trading merger arbitrage?” Once again Merger Arbitrage Limited has the answer with our “Trading Merger Arbitrage – A Practical Guide”.

This practical guide takes the reader through a detailed explanation of the “do’s” and “don’ts” in merger arbitrage trade execution. We show the trader how to open a position in a merger arbitrage stock in your Interactive Brokers trading account. We show step by step examples of using the merger arbitrage window and list the commissions and fees payable. The discussion concludes with how to easily avoid the pitfalls of uninformed trading.

Broker Considerations

At any one time there are a number of discount brokers competing for our business. Of importance to the execution of merger arbitrage are

- Reliable data feed

- Cost of real time market data

- Commissions

- Interest charges (when using leverage)

- Short stock availability

- Costs of borrowing stock for use in a short sale

- Trading platform usability

At Merger Arbitrage Limited we use Interactive Brokers (IBKR)* as they satisfy the above requirements to our satisfaction. We guide the reader through the use of IBKR’s trading platform, “Trader Workstation” (TWS) in the execution of this strategy. It is assumed the trader has, or is in the process of opening an IBKR trading account. Traders must also have the necessary funds to execute live trades and be able to install the IBKR TWS platform.

Deal Structures

We explain in previous articles there are effectively two forms a merger arbitrage deal can take.

- Payment in cash – all cash deal

- Payment in stock or a combination of stock & cash – stock swap deal

The simplest payment form for a target’s stock is a cash payment to the target shareholders upon completion of the deal. The investor needs do nothing more than buy the stock of the target company and wait for deal completion. At this point, the trading account automatically receives the funds paid by the acquirer. Simultaneously, the long stock position in the target ceases to exist. In the event of the deal breaking, the trader sells the position in the stock market generally at a loss. Subsequently, the trader continues looking for a new investment opportunities. To find a list of the current largest cash spreads you can use our Spread Tracker tool.

Complications arise when payment (or part payment) is to be made with the acquirer’s own stock. This not only requires an extra trade, but also an awareness of many of the bullet points listed above. The level (profitability) of the spread is dependent of the value of the relationship between the acquirer and target stock. The arbitrageur needs to trade both stocks in the correct proportion, the “exchange ratio”. In doing so, the trader is able to “lock-in” the value of the spread. This requires a long position in the target stock and a short position in the acquirer stock.

Practical Considerations

When trading a stock swap deal it is important the trader now consider the following points not previously required for an all cash deal

- Commissions – there is an extra set of commissions to be paid

- Increased margin requirement for two stock positions (this may induce the use of leverage to maintain an acceptable level of return on initial capital)

- Interest charge on borrowing for funding long stock position (when using leverage)

- Short stock availability – is there any acquirer stock available to be sold short

- Costs of borrowing stock for use in a short sale – If there are ANY difficulties in borrowing this stock the cost of borrowing will skyrocket

- Trading platform ease of use – How can I execute this in the most efficient manner?

Any combination of the above issues could be devastating to profitability and render the trade unworkable. For example, if the exchange ratio is 2 acquirer shares for each target share, the commission costs will treble. The ongoing cost of borrowing the acquirer stock for the short sale will be primarily dependent on two things. The level of availability of that stock and the $ value of the position. The ongoing daily cost of borrowing stock, and any borrowing costs associated with leverage must also be considered. How long the trader expects to hold the position will effect profitability calculations.

Additional Considerations

Trading Merger Arbitrage - Configuration

Fortunately, IBKR has a tool for checking the availability of stock for shorting or “selling short” and the cost of that will incur. By right clicking the column header go to customize layout. From the menu on the right of the “Trader Workstation Configuration” window. Under “Short Selling” the trader can select “Shortable Shares” and “Fee Rate“. These two new columns will show the number of shares currently available and can be borrowed through IBKR. These can be sold short and the cost of borrowing the stock expressed as an annual percentage or annualized rate.

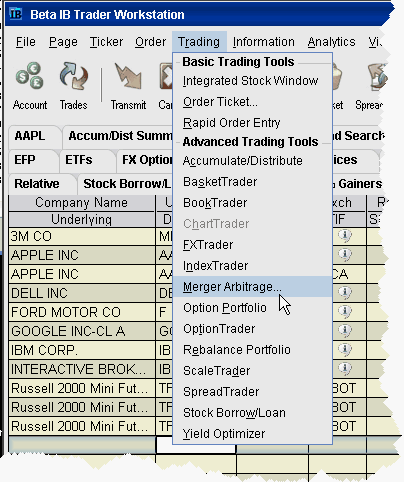

In order to proceed with the merger arbitrage trade execution, the trader can take advantage of the merger arbitrage trading tool built-in to TWS. To use this tool the trader needs both the acquirer and target ticker symbols and the deal ratio. Firstly, open TWS on your desktop/laptop. Then click on the “Trading Tools” menu header at the top and scroll down to select Merger Arbitrage. If this is not visible, hover over the arrow at the bottom of the menu to reveal hidden menu items.

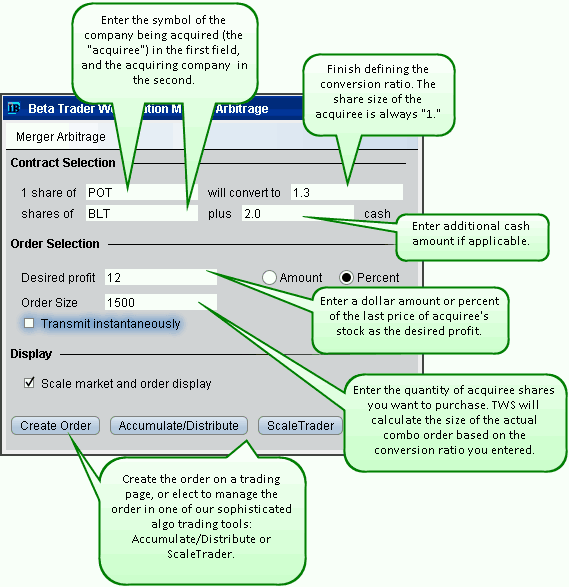

TWS Merger Arbitrage Trading Execution Tool

When the “Trader Workstation Merger Arbitrage” windows appears, enter the data as follows**. All fields highlighted pink require a mandatory input. In the “Contract Selection” section, moving from left to right enter the target ticker, deal ratio, acquirer ticker and any cash portion of the offer (if applicable). In the “Order Selection” section enter “1“, select the “amount” radio button and enter 100 into the “order size” box. Check the “Scale market and order display” option and click “create order“. This button becomes active only when the required fields have been populated.

The trader needs to manually account for dividends as there is no provision for their adjustment using this tool. To calculate a stock swap spread with dividends the trader can download our free spreadsheet from the Spread Calculator page.

Setting the Exchange Ratio

One common issue with this function is the complexity of the deal ratio. You may have to change the order size as explained in the next paragraph. A ratio with decimals requires a large minimum position as neither side of the trade can trade in fractions of shares. If the ratio of acquirer shares to 1 target share was given as 5-to-3 the decimal figure might be reported as 1.667:1. This results in a minimum position of 1000 target shares per trade as the lowest acquirer position size would be 1,667. If the order size was not set to a multiple of 1000 (we just set it to 100!), a warning message appears stating “Invalid Order Size: order size must be a multiple of 1000.0“. To reduce the minimum trading position as per this rule the trader needs to round off the deal ratio to an acceptable number.

Accounting for Exchange Ratio Differences

Practical Trade Execution

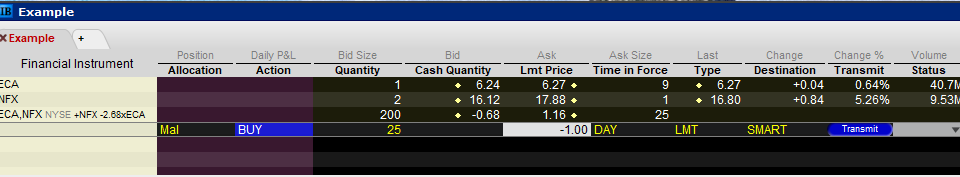

If the trader enters the above data successfully, a variant of the following contract appears in your trading window with an example order. You are now ready to execute a merger arbitrage trade.

In this example we used the ECA-NFX deal. The original deal ratio was 2.6719 and this would have resulted in trading a minimum of 10,000 target shares. The ratio was changed to 2.68 so we can now trade in multiples of 25 (being the lowest common multiple). The market for the spread (using post-close prices) is an extremely wide -$0.68 at $1.16. This will of course narrow during normal market hours. The default trade price is automatically set to -1.00. The trader can now alter this price to something more commensurate with the market prices to initiate a trade. Clicking on the transmit button will enter the order into the market.

Simply enter a sell order to exit the position in the market if desired. On completion of the deal, IBKR automatically removes the target stock and replaces it with the acquirer stock. This in turn automatically offsets the short position. Neutralizing this position may need a minor manual adjustment in light of the decimal point issues noted previously.

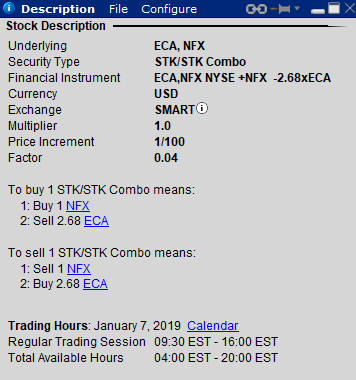

Contract Description

To review the combination description, right click on the contract in the left hand column. Then scroll down to “Financial Instrument Info” and then choose description. At any time, traders can delete this synthetic contract and start afresh with new inputs. A bidding war may cause such amendments to be made to the merger agreement and alter the terms of the deal as mentioned above. This action will not of course alter and existing stock position (if there is one).

In addition to the merger arbitrage trading tool IBKR also provides functionality to create a virtual security. Although this is not a tradeable security as we referred to above, the trader is able to quickly construct a list of stock swap spreads. The following video from IBKR explains how this works.

One advantage of this monitoring method which the video does not address, is that the trader can include dividends in the equation. Continuing on from the example above, if NFX was due to pay a dividend of $0.05 (it’s not by the way) the equation would be written as,

“ECA” * 2.6719 – “NFX” – 0.05

Thus increasing the value of the spread (making it more negative) to show the greater level of profitability now that the dividend is included.

Conclusion

This concludes our practical guide to merger arbitrage trade execution on the IBKR Trader Workstation platform. Like all investment strategies, merger arbitrage can be as complex as you wish to make it, but by harnessing the power of tools such as these, it doesn’t need to be as difficult as what it might have been otherwise.

* MergerArbitrageLimited.com has NO business relationship with IBKR at the time of publication of this article, neither does it foresee a relationship in the near future, other than the provision of standard brokerage services

** Additional instructions can be found by enlarging the “Trader Workstation Merger Arbitrage Window” image

Finding this information useful? Here's what you can do to help...

- Share this page using the toolbar links at the left of your screen or at the bottom for mobile users on your preferred social network

- Sina Weibo

- Twitter etc.

- Follow us on twitter @MergeArbLimited.

- Become friends with us on Facebook

- Register for news alerts and merger arbitrage deal analysis postings via email using the sign up form.

- In addition to these, an RSS feed is also available at the bottom right of the page.

- Contact us using the details given on the Contact Us page.

- Donate using the paypal widget in the sidebar. It’s gladly appreciated and we need the coffee! See the Paypal section for additional incentives

- Share this page using the toolbar links at the left of your screen or at the bottom for mobile users on your preferred social network

Thanks for reading!