This is the weekly analysis of Merger Arbitrage Spread Performance December 29, 2019. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 23rd – 27th December. The first section of this report discusses the biggest winners & losers from the T20 portfolio. Then we detail the performance of the overall portfolio. To conclude, we compare this performance with the broader market and the IQ Merger Arbitrage Exchange Traded Fund – MNA. The information contained in this weekly analysis & review assists traders in their merger arbitrage investment decision making.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Portfolio. A list of pending cash merger arbitrage spreads available as at 22nd December. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Portfolio. Click this link for the spread performance analysis from the previous week.

Merger Arbitrage Spread Performance December 29, 2019

Red Robin Gourmet Burgers (RRGB)

Red Robin Gourmet Burgers retained is place amongst the largest movers this week and continued its upward momentum. Without any new deal news in the popular press, the stock continued its recovery by an additional $0.85 to close at $31.03. This leaves the simple spread at 28.91%. This caps an impressive performance since the start of December when the stock dipped below $27. Our intention was to trade the volatility of this spread rather than hold until deal completion. In light of this, we will be looking to unload a small part of our position if this performance continues especially if no news has been forthcoming. However, in light of the recent strong positive performance, we would expect some kind of announcement or deal update soon.

Mellanox (MLNX)

Also performing well this week and like most stocks did so on little to no new news was Mellanox. Mellanox has been affected by the U.S. – China trade dispute but has recovered strongly since the negotiations began to produce some solid foundations. The stock advanced by $1.84 to $117.86. This gives a simple spread of 6.06%. The regulatory review in China, conducted by the SAMR is expected to conclude in February. It is very rare if at all that these reviews are concluded early. Although we have positive feeling about this deal and the wider trade deal, we have decided to trim our position to reduce exposure to any further twists in the trade negotiations. Should these negotiations continue in a positive manner we expect we could re-enter the position without too much disruption to profitability.

Kemet (KEM)

Kemet was the third largest gainer this week. On December 26, the firm filed a PREM14A – PRELIMINARY PROXY STATEMENTS RELATING TO MERGER OR ACQUISITION. This indicates the date for the special meeting for the shareholders vote on the acquisition will be announced soon. The stock rose by 1.52% to close at $26.80. Excluding the quarterly dividends of $0.05, this gives a simple spread of 1.49%. Although the original expected closing date was given as the end of 2020 it appears this deal will close significantly early thus providing an attractive return.

The last time the stock was at this level we said we had missed to boat. Unfortunately, during the recent decline we were unable to take advantage. We suspect however, since the recent filing that was the last chance to make a decent return on this deal. We currently have no position and at these levels do not plan to initiate an investment in the near future.

Wright Medical (WMGI)

Wright Medical was also a strong performer during this shortened trading week. The previous week saw the emergence of a rumor that sent WMGI racing higher of a potentially higher bid from Smith & Nephew. It appears this momentum has continued as the stock mover $0.43 higher to close at $30.58. We have not taken a position in this stock but may initiate one if a higher offer emerges.

Bitauto Holdings (BITA)

Bitauto Holdings (BITA) trended downward throughout the week. Despite there being no new deal news announced during the week, the stock continuously fell to close on Friday at $14.75. A fall of 1.27% for the week. This leaves the arbitrage simple spread at 8.47%. We still believe movements of this magnitude indicate some news or an announcement will be forthcoming. We maintain our position as we await news from Tencent Holdings as to their intentions.

Pacific Biosciences of California (PACB)

Just to spite us, following last week’s comments of how the previous two best performers became to two worst performers the following week, it appears that both these laggards again top the losers list in this shortened holiday trading week. Despite only declining $0.05 on no news the drop still equates to almost 1%. This leaves the simple spread at 52.67%. We expect more volatility to come in this spread following the announcement by the U.S. Federal Trade Commission authorizing a legal action to block the Merger. We will continue to hold our position until further details are disclosed.

Merger Arbitrage Portfolio Performance

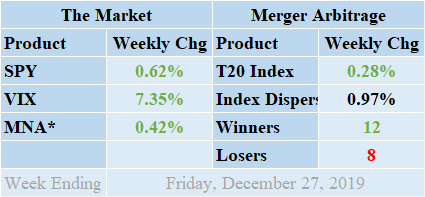

For yet another week, the winners again led the losers by a respectable margin of 12 to 8 with 0 non-movers. The portfolio has now been operating consistently with a full complement of 20 cash merger arbitrage and 0 cash positions and there remains many more to choose from should any more deals close in the near future. The index builds on a run of consistent gains to finish the week and the year in positive territory up by 0.28%. This week’s gain was attributable to gains made by a number of deals including RRGB, MLNX, KEM & WMGI.

Additional live news updates for these deals can be found on our customized T20 Index news feed. For even more specific merger details & news see also the dedicated news and merger information pages on recently announced deals including TGE, LOGM, ARQL, INST, FIT, & KEM. The standard deviation of the individual index returns for the past week was 0.97%. This figure is significantly below both the short-term and long-term averages.

MNA SPY VIX Returns Table 20191227

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The IQ Merger Arbitrage ETF, MNA, regained its upward momentum and achieved yet another positive week to finish the year strongly. By the end of the week, the ETF was in positive territory by 0.42%. This completes a final quarter run which saw just one negative performance. The broader market also managed to produce a positive return over the week. The shortened holiday week has not provided much opportunity for domestic political or economic issues to dictate market direction. Positive sentiment guided the markets higher to new all-time highs as traders anticipate economic resolutions in the New Year. The SPDR S&P 500 ETF, SPY, finished up 0.62%. Surprisingly however, the VIX index moved higher and by Friday had risen 7.35%.

As market remains quiet over the New Year period, we continue to expect volatility to remain subdued especially following the recent progress in the trade negotiations. With interest rate policy clarified, we continue to see no reason why merger activity should not continue at its current level.

And finally...

The most recent list of the largest spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. This can be used to value the arbitrage spread of any stock-for-stock merger deals you may be interested in trading or additionally used in a pairs trading investment strategy.