This is the weekly analysis of Merger Arbitrage Spread Performance March 29, 2020. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 23rd March – 27th March. The first section of this report discusses the biggest winners & losers from the T20 portfolio. Then we detail the performance of the overall portfolio. To conclude, we compare this performance with the broader market and the IQ Merger Arbitrage Exchange Traded Fund – MNA. The information contained in this weekly analysis & review assists traders in their merger arbitrage investments and trading.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Index. A list of the largest pending cash merger arbitrage spreads available as at 22nd March. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Index. Click this link for an analysis of the spread performances from the previous week.

Merger Arbitrage Spread Performance March 29, 2020

Red Robin Gourmet Burgers (RRGB)

Red Robin rebounded strongly this week, cementing its place as the most volatile merger arbitrage spread. This week the stock managed to more than recoup the prior week’s losses that saw shares trade at under $5. Despite some profit taking at the end of the week following the initial rally, the stock closed at the end of the week up $3.72 at $10.27, a gain of 56.79% that still leaves the simple spread at a whopping 289.48%. This is against the original bid from Vintage Capital for $40 per share.

The restaurant sector continues to suffer from uncertainty surrounding the length of the coronavirus lock down. This has led some to believe a number of weaker restaurants may be forced to close. Even after the population is allowed to move freely and supply lines reopen, this may prove to be too little too late for some operators. It is also considered unlikely restaurant traffic will return to previous levels following the lifting of restrictions. At least not for a significant period of time. However, the broader market upturn has in the near term provided a boost for stock prices. As can be imagined, we are not actively trading this stock at these levels. We do however take a small crumb of comfort to know our interests are aligned with those of Vintage Capital.

Tallgrass Energy (TGE)

Tallgrass Energy was also a significant gainer during the week. Despite no new deal news being announced investor fears that Blackstone’s Saudi-backed oil pipeline deal may be an issue appear to have subsided. This caused this stock to move higher throughout the week even as the broader market suffered a “mild” sell-off. By Friday’s close, the stock was up $3.34 at $17.44, a fall of 23.69%. We have no position in this spread although we have previously remarked how we may take a small positon at these levels. It is increasingly likely we shall implement a trade in this stock in the very near future.

Adesto Technologies (IOTS)

Adesto Technologies was also a significant gainer during the week. The definitive proxy statement was filed with the SEC during the week. Smaller deals such as these, where there is traditionally less risk, have provided some attractive opportunities in recent weeks. Whilst some deals are still awaiting the filing of the definitive proxy statement, an action such as this appears to be sufficient evidence for traders that the deal will consummate successfully. By Friday’s close, the stock was up $2.10 at $11.20, a rise of 23.08%. The simple spread is still over 12% in this deal and provides an attractive return.

Tech Data Corporation (TECD)

Tech Data Corporation makes another “rare” appearance in the largest moves this week. The firm is subject to a takeover from Apollo Global for $145 per share. An 8-K filing on Tuesday followed by a 10-K filing on Wednesday gave investors some light reading in the middle of the week. At the start of the week however, the company announced it would be appealing the French competition authority’s decision with regards to the alleged non compete clause with Apple and another U.S. company. By Friday’s close, the stock was up $16.64 at $130.64, a rise of 14.60%. With the spread now in at 10.99% we are yet to initiate a position.

Losers

…next time… 🙂

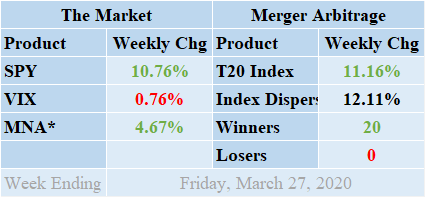

Merger Arbitrage Portfolio Performance

Cash merger arbitrage spreads raced ahead this week more than reversing the extensive losses endured over the two weeks prior. The past week saw multiple double digit gains from a number of spreads which have caused the index to rise sharply. This time out, it was the losers that failed to register a score as the winners triumphed with a clean sweep with a score of to 20 to 0 with 0 non-movers. The index was comprised of a full selection of 20 merger arbitrage deals and 0 cash positions. The index closed up for the week by an impressive 11.16%. This gain was primarily attributable to the rebound in RRGB whilst being accompanied by IOTS, TGE, TECD, BREW, MLNX, FSCT & AXE. The standard deviation of the individual index returns for the past week was a phenomenal 12.11%. However, this week it was due to there being no negative returns! As expected, this figures recorded in this new market environment continue to be significantly above the historical averages.

Additional live news updates for these deals can be found on our customized T20 Index news feed. Even more specific merger details & news can be found on the dedicated news and merger information pages for recently announced deals including AON, TGNA, MEET, & RRGB.

MNA SPY VIX Returns Table 20200327

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The IQ Merger Arbitrage ETF, MNA, rose sharply in the beginning of the week and managed to more or less hold on to those gains by the close on Friday. This was showed a strong recovery for the MNA which had plunged to multi-year lows over the past two weeks. By the close on Friday, the IQ Merger Arbitrage ETF was up 4.67%. The broader market however was even more impressive. Fueled by the Fed’s announcement to begin an open ended asset repurchase program to support the credit market, all major indices raced higher. Despite tailing off towards the end of the week as some profit taking set in, the markets were still significantly higher for the week. The SPDR S&P 500 ETF, SPY, managed to finish up 10.76% for the week. The VIX index stubbornly remained at an elevated level. By Friday the index had declined marginally by 0.76%.

The U.S. continues to make slow progress in preventing the spread of the virus. The effect in New York has been particularly devastating. It is still too early to assess the effect this will have on the domestic economy. Restaurant stocks, although demonstrating a rebound this week, continue to be particularly hard hit as additional restrictions on free movement come into force across the country.

In light of popular feedback from previous postings (thank you very much) we shall continue to repeat the following section from our previous analysis

- It is important for traders of merger arbitrage to consider how each of their individual positions will be affected by a continued spread of the coronavirus.

- How can this affect the granting of regulatory approval in China?

- Are delays inevitable?

- Will a slowdown in the global economy lead acquirers to rethink their acquisition strategy?

- Also important is that merger arbitrage stocks which were supported by higher floor prices may now have some of that protection removed.

And finally...

Traders will find the most recent list of the largest merger arbitrage spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. Traders can use this tool to value the arbitrage spread of any stock-for-stock merger deals you may wish to invest in or trade. Additionally, the spreadsheet also functions as a valuation tool for a pairs trading or relative value investment strategy for stocks