This is the weekly analysis of Merger Arbitrage Spread Performance March 15, 2020. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 9th March – 13th March. The first section of this report discusses the biggest winners & losers from the T20 portfolio. Then we detail the performance of the overall portfolio. To conclude, we compare this performance with the broader market and the IQ Merger Arbitrage Exchange Traded Fund – MNA. The information contained in this weekly analysis & review assists traders in their merger arbitrage investments and trading.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Index. A list of the largest pending cash merger arbitrage spreads available as at 8th March. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Index. Click this link for an analysis of the spread performances from the previous week.

Merger Arbitrage Spread Performance March 15, 2020

Cypress Semiconductor (CY)

The one bright spark in the merger arbitrage space this week was Cypress Semiconductor. Although this was more to do with rectifying speculation from the previous week that CFIUS members were poised to recommend blocking the deal with Infinion. Unsubstantiated reports of this kind can be extremely damaging in normal circumstances but in times of market turmoil such as these, they can be ruinous. After the market close on Monday CY filed paperwork stating CFIUS clearance had been granted and the deal was to proceed towards closing. The stock rose 41.17% to close at $23.11. This leaves the simple spread at 3.20%.

These events show that regardless of how much research or analysis is completed on a particular deal, misleading information, and an overreaction to that information can prove disastrous to an investment. In market environments such as these, the effect is magnified. The initial report quoted unnamed sources and Cypress itself had no commented. However, as many traders will attest, selling first reduces the risk of being caught out and holding a falling stock. Which of course exaggerates the decline. For those not in a positon to take advantage of a sufficient reaction time, common sense will have to suffice.

Firstly, could a possible decline in the stock, warranted or otherwise force the trader to make an unexpected trade? That is, would the decline invoke a margin call? or require the reduction of the position. The point is, traders often forget that when a takeover moves down, it does so rapidly. Complacency often creeps into portfolios and leverage increases as a result. Traders then find themselves at the mercy of unexpected events and forced out of a position such as Cypress Semiconductors at the exact time when they could have been buying.

Secondly, is the trader capable of making a reasonable and balanced decision based on the new set of events? That is, Cypress dropped in value close to where we were calculating the floor price (see last week’s article). What is the marginal risk of continuing to hold this stock in your portfolio at this level? Many investors would have been forced out of their positions or sold in panic following last week’s news. If this is the case, we suggest traders review their merger arbitrage trading strategy to accommodate the risk that can be thrown upon us from the other side of the fence.

Red Robin Gourmet Burgers (RRGB)

Red Robin suffered the worst decline in its history, now for the third week running! Eat-in restaurants again got stuffed(!) as the economic effects of the spread of the coronavirus begin to take hold. There was little deal news however with the only official announcement being the appointment of Kristi Belhumeur as Chief Accounting Officer. At one stage during the broad recovery on Friday the stock plummeted new depths to trade at $7.75 before embarking on a rally. By the end of the week, RRGB had closed down $9.33 at $9.17, a fall of 50.43% leaving the simple spread at a whopping 336.21%. As can be imagined, we are not actively trading this stock at these levels. We will hold our positon although we expect further volatility in this sector.

Tallgrass Energy (TGE)

Tallgrass Energy was also a significant decliner during the week. Monday saw a significant decline following a story in the Financial Times that investors were less than pleased about Blackstone’s Saudi-backed oil pipeline deal. This caused this stock to move lower and independently from the broader market for the rest of the week. By Friday’s close, the stock was down $4.01 at $16.60, a fall of 19.46%.

Blackstone has stated that it is still committed to the deal but investors remain wary. The sharp drop in oil prices has led some investors to fear the deal may not be consummated. We stated last week we will watch this deal following the widening of the spread. We continue to do so keeping one eye on the oil price and the other on Blackstone.

Bitauto Holdings (BITA)

Deals with Chinese connections also continue to experience high volatility. Following the broader market, BITA declined heavily on Thursday only to rebound on Friday. The stock closed up for the week at $12.307. A fall of $1.98 or 13.87%. This leaves the arbitrage simple spread at 30.08%. We remain holders of our small position in this stock.

Merger Arbitrage Portfolio Performance

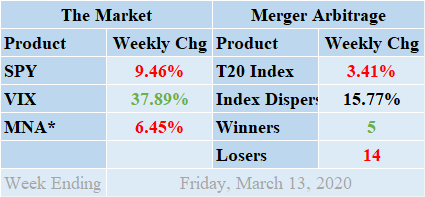

Another uniquely difficult week saw cash merger arbitrage spreads come under pressure yet again. Although not quite the disastrous performance levels of last week, losers once again triumphed over the winners by a margin of 14 to 5 with 1 non-mover. The portfolio operates with a full selection of 20 merger arbitrage deals and 0 cash positions. The index closed on Friday down by a disastrous 3.41% for the week. This loss was attributable to the catastrophic fall in RRGB despite the reversal in Cypress Semiconductor following the green light from CFIUS. The standard deviation of the individual index returns for the past week was a phenomenal 15.77%. As expected, this figure is in a league of its own when compared to previous recordings.

Additional live news updates for these deals can be found on our customized T20 Index news feed. Even more specific merger details & news can be found on the dedicated news and merger information pages for recently announced deals including TGNA, MEET, FTSV, GCAP, IOTS & RRGB.

MNA SPY VIX Returns Table 20200313

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The IQ Merger Arbitrage ETF, MNA, held up reasonably well during the first half of the week but succumbed to the global sell off on Thursday. A recovery inline with global markets was on the cards for Friday but a late sell off saw the ETF tumble in the last hour of trading. By the close on Friday, the IQ Merger Arbitrage ETF was down 2.67%, having been down over 5% at one stage during the week. The broader market however, troubled by the domestic increased spread of the coronavirus had one of its most volatile weeks on record. Despite a strong recovery rally on Friday which saw all three major indices up by around 10%, the markets were still significantly in the red for the week. Quite incredibly, the SPDR S&P 500 ETF, SPY, managed to finish down 9.46% for the week. The VIX index naturally continued its climb and by Friday had risen an additional 37.89%.

The U.S. has taken significant action to prevent the spread of the virus. Action which will have far reaching effects on the economy. Some areas being effected disproportionately more than others. Tourism, especially airlines, and restaurant stocks have been particularly hard hit. It should be noted however, almost three quarters of the drop this week in the T20 portfolio was due to RRGB alone.

In light of popular feedback from previous postings (thank you very much) we shall continue to repeat the following section from our previous analysis

- It is important for traders of merger arbitrage to consider how each of their individual positions will be affected by a continued spread of the virus.

- How can this affect the granting of regulatory approval in China?

- Are delays inevitable?

- Will a slowdown in the global economy lead acquirers to rethink their acquisition strategy?

- Also important is that merger arbitrage stocks which were supported by higher floor prices may now have some of that protection removed.

And finally...

Traders will find the most recent list of the largest merger arbitrage spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. Traders can use this tool to value the arbitrage spread of any stock-for-stock merger deals you may wish to invest in or trade. Additionally, the spreadsheet also functions as a valuation tool for a pairs trading or relative value investment strategy for stocks