This is the weekly analysis of Merger Arbitrage Spread Performance March 8, 2020. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 2nd March – 6th March. The first section of this report discusses the biggest winners & losers from the T20 portfolio. Then we detail the performance of the overall portfolio. To conclude, we compare this performance with the broader market and the IQ Merger Arbitrage Exchange Traded Fund – MNA. The information contained in this weekly analysis & review assists traders in their merger arbitrage investments and trading.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Index. A list of the largest pending cash merger arbitrage spreads available as at 1st March. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Index. Click this link for an analysis of the spread performances from the previous week.

Merger Arbitrage Spread Performance March 8, 2020

Pattern Energy Group (PEGI)

One tiny bright spark of hope in the cash merger arbitrage world that shone out above the rest this week was Pattern Energy Group (PEGI). Making a rare appearance in the largest movers category the stock announced earnings on Monday along with declaring a dividend of $0422. A solid earnings performance has helped underlie the stock that has rarely traded below the offer price of $26.75 from the Canada Pension Plan Investment Board.

A report by Raymond James midweek suggested no higher offers would be made for the company. In light of the recent economic turmoil, this appears a rather obvious piece of analysis. However, despite this conclusion the stock drifted upwards through the week and even after a drop on Friday, closed up $0.13 at $27.18. This is $0.43 above the $26.75 offer price from the Canada Pension Plan Investment Board. We had previously noted the SC 13G filings suggesting that hedge fund positioning could suggest a higher bid is a possibility, however, in the current environment this would be an extremely brave call.

Red Robin Gourmet Burgers (RRGB)

Red Robin suffered the worst decline in its history (for the second week running) last week as the markets began to price in the effect the coronavirus will have on eat-in restaurants. Things started bad in line with the broader market, but as the week progressed the spread of the virus in the U.S. caused investors to bail from the sectors on mass. Thursday saw the largest declines which spilled over into Friday. By the end of the week, RRGB had closed down $9.00 at $18.50, a fall of 32.73% leaving the simple spread at a whopping 116.22%.

The speed and pace of change of the market in this environment makes it difficult to remain current in terms of investment analysis. As can be expected, we have taken a severe loss on our RRGB position although the P&L is somewhat mitigated via the employment of our active arbitrage strategy. By a strange irony, it is possible RRGB management, in combination with the coronavirus may have pushed the firm into such a position that Vintage Capital may choose to walk away under these circumstances. A situation pleasing to management but disastrous for the arbs. If they don’t, should things continue as they are, it is highly likely the offer will be revised lower. Should the wider economic scene return to “normal”, sooner rather than later (a situation we highly doubt), Vintage could resume their hostile takeover approach under their initial analysis. For the time being we will hold our positon although we expect further volatility for the restaurant sector.

Cypress Semiconductor (CY)

Another significant decliner this week was Cypress Semiconductor. The stock fell 29.10% to close at $16.37. This leaves the simple spread at 45.69%. The offer from Infineon (IFNNY) is for $23.85. We now have a reason which may in part explain last weeks decline. On Thursday MLex reported that “Infineon has pulled and refiled paperwork at least once with the Committee on Foreign Investment in the United States (CFIUS)”. A source was not given. Then later on AMC, Bloomberg also reported officials are recommending blocking the deal.

Following an upgrade on Friday the stock still declined further. We feel this level is now close to the floor price. Although we feel there is more to come on this story, we are in agreement with Craig-Hallum in that there is upside in this potential deal for little risk. We may look to reopen a position in this stock in the near future.

Tallgrass Energy (TGE)

Tallgrass Energy was also a significant decliner during the week. By Friday’s close, the stock was down $1.46 at $20.61, a fall of 6.62%. Despite announcing during the week that a special meeting of shareholders of TGE will be held on April 16, 2020 the markets were not sufficiently impressed. As such the stock was treated along with the rest of the energy sector to a drubbing. As the spread now stands at 8.93% we will be following the deal more closely in the immediate future.

Merger Arbitrage Portfolio Performance

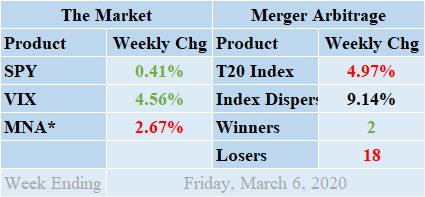

Another extremely difficult week saw cash merger arbitrage spreads come under intense pressure. Losers once again trounced the winners during the previous week by a margin of 18 to 2 with 0 non-movers. The portfolio operates with a full selection of 20 merger arbitrage deals and 0 cash positions. Earnings season has finished and seems like a distant memory despite the positive news generated by PEGI. The index closed on Friday down by a disastrous 4.97% for the week. This loss was attributable to the continued fall in RRGB and the potentially damaging negative recommendation from CFIUS on the Cypress Semiconductor deal. The standard deviation of the individual index returns for the past week was a huge 9.14%. As expected, this figure is in a league of its own when compared to previous recordings.

Additional live news updates for these deals can be found on our customized T20 Index news feed. Even more specific merger details & news can be found on the dedicated news and merger information pages for recently announced deals including MEET, FTSV, GCAP, IOTS, MS & RRGB.

MNA SPY VIX Returns Table 20200306

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The IQ Merger Arbitrage ETF, MNA, once again desperately tried to remain in positive territory during the week. Offering just a slow decline, it was not until the end of the week when the real collapse set in. By the close on Friday, the IQ Merger Arbitrage ETF was down 2.67%. The broader market itself however, troubled by the domestic increased spread of the coronavirus and its effect on the global economy moved in a much more random nature. A strong recovery rally fueled by a cut in interest rates was followed by a sharp sell off as traders weighed the significance of the emergency rate reduction. Quite incredibly, the SPDR S&P 500 ETF, SPY, managed to finish up 0.41% for the week. The VIX index also increased and by Friday had risen 4.56%.

The domestic spread of the virus has forced markets to reconsider the effect on the domestic economy. What had been seen by some as “someone else’s problem” is now very much in the back yard. The effect to the global economy is now a very real threat as multiple new cases are reported in multiple countries. Restaurant stocks have been particularly hard hit. It should be noted however, three fifths of the drop this week from the T20 portfolio was due to RRGB and the possible CFIUS recommendation regarding Cypress Semiconductor. We repeat our analysis from last week

- It is important for traders of merger arbitrage to consider how each of their individual positions will be affected by a continued spread of the virus.

- How can this affect the granting of regulatory approval in China?

- Are delays inevitable?

- Will a slowdown in the global economy lead acquirers to rethink their acquisition strategy?

- Also important is that merger arbitrage stocks which were supported by higher floor prices may now have some of that protection removed.

And finally...

The most recent list of the largest spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. Traders can use this tool to value the arbitrage spread of any stock-for-stock merger deals you may be interested in trading. Additionally, the spreadsheet also functions as a valuation tool for a pairs trading or relative value investment strategy.