This is the weekly analysis of Merger Arbitrage Spread Performance December 15, 2019. This reports covers the top 20 investable US cash based merger arbitrage spreads for the week 9th – 13th December. The first section of this report discusses the biggest winners & losers from the T20 portfolio. Then we detail the performance of the overall portfolio. To conclude, we compare this performance with the broader market and the IQ Merger Arbitrage Exchange Traded Fund – MNA. The information contained in this weekly analysis & review assists traders in their merger arbitrage investment decision making.

In this report, Merger Arbitrage Limited reviews a selection of merger and acquisition deals from the T20 Portfolio. A list of pending cash merger arbitrage spreads available as at 8th December. Investors and traders can follow our latest Top 20 (T20) list each week here. Regular followers will already be familiar with our rules for inclusion on the T20 Portfolio. Click this link for the spread performance analysis from the previous week.

Merger Arbitrage Spread Performance December 15, 2019

Pacific Biosciences of California (PACB)

PACB was again amongst the largest movers this week. Despite a slow start to the week, Wednesday saw the start of a rise which took the stock higher until the close on Friday. This preceded the announcement of Illumina’s response to the CMA’s remedies working paper on Thursday.

The stock ended the week at $5.52, up $0.52 or 10.40%. This advance still leaves a spread of 44.93%. The deal is expected to close by March 31, 2020 although this date has neither been confirmed nor revised during the latest interactions with the CMA. We are extremely pleased with these latest developments and will maintain our holding pending further developments.

Bitauto Holdings (BITA)

Bitauto Holdings (BITA) continues its recovery following a poor set of results announced two weeks ago. Despite there being no new deal news announced during the week, the stock rose throughout the period to close on Friday at $15.18. A rise of 3.20% for the week. This leaves the arbitrage simple spread at just 5.40%. Although there is a certain amount of influence from the U.S. – China trade deal holding sway over the movement of this spread, we believe a movement of this magnitude indicates some news or an announcement will be forthcoming. We maintain our position as we await news from Tencent Holdings as to their intentions.

Arqule (ARQL)

Arqule was a new deal announced during the week and subsequently went on to have a strong performance. The stock was comfortably available at $19.63 on Monday and went on to close Friday up $0.44 at $20.07. This is $0.07 above the $20.00 tender offer price from Merck. We did not take a position in this stock and do not anticipate initiating one whilst the possibility of a higher offer remains a possibility.

Fitbit (FIT)

We hypothesized last week about the possibility of a review of the Fitbit acquisition by Google following the CMA’s announcement it had issued an initial enforcement order regarding the $2.6 billion takeover of Looker Data Sciences. Since that commentary, the U.S. Justice Department announced it will review plans by Google to buy Fitbit for possible antitrust issues. This is according to an unnamed source in a Reuters article printed on Tuesday.

The stock closed on Friday to finish the week at $6.59 down an additional $0.15. This gives a simple spread 11.53%. Our initial in depth analysis of this deal was when FIT was trading above $7. We have also stated that we believe this deal will consummate successfully but will be delayed due to an investigation. In this case, with the clarity of this situation now known, we shall consider taking a small position, at or close to these levels. If this deal takes a full year to complete the annualized return is 11.53%. There is still significant downside although were the deal to break but the stock price may be supported by the stock remaining “in-play”. This is however not for the faint hearted and we stress the point of only taking a small position.

Merger Arbitrage Portfolio Performance

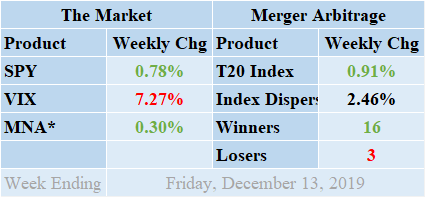

Winners trounced the losers this week by a comfortable margin this week by 16 to 3 with 1 non-mover. The portfolio remains fully stocked with a complement of 20 cash merger arbitrage and 0 cash positions. The portfolio immediately reversed last week’s losses and finished in positive territory up by 0.91%. This week’s gain was primarily attributable to the impressive rise in PACB, although BITA & ARQL also performed well. Additional live news updates for these deals can be found on our customized T20 Index news feed. This shows the latest mergers and acquisitions news updates focusing exclusively on the pending cash mergers in our merger arbitrage spread tracker list. Deals that we consider eligible for investment and trading. For even more specific merger details & news see also the dedicated news and merger information pages on deals such as CISN, FIT, GWR, KEM, ONCE, PEGI, TIF & WMGI. The standard deviation of individual returns for the past week was 2.46%. This figure is substantially above both the short-term and long-term averages due to the outsized return by PACB.

MNA SPY VIX Returns Table 20191213

*We have not included MRGR ETF for liquidity reasons. Click the table to read our Merger Arbitrage ETF Review and see a discussion of how liquidity and other factors affect the performance of these products.

Market Performance

The IQ Merger Arbitrage ETF, MNA, yet again finished in positive territory following another solid week. Modest rises throughout the week secured a positive momentum. By Friday, the ETF was in positive territory to the tune of 0.30%. This continues a positive run extending back for almost 3 months. The broader market also produced a positive return over the same period. However, conflicting trade deal rumors made the start to the week a negative one. This was reversed during late Wednesday / early Thursday as it became clear some kind of Phase One trade deal was to be announced. Clarification of the Fed’s interest rate policy also helped fuel the market to fresh all-time highs. The SPDR S&P 500 ETF, SPY, finished up 0.78%. Unsurprisingly however, the VIX index moved lower and by Friday had fallen 7.27%.

As market activity traditionally quietens down for the festive period, we would expect volatility to remain subdued following the progress in the trade negotiations. With interest rate policy clarified and inflation not being a concern (at least for the time being), we expect the major potential source of volatility to come from the White House. We shall therefore focus our attention in this direction for clues as to how this will affect merger arbitrage investing.

And finally...

The most recent list of the largest spreads is already available. Our merger arbitrage spread calculator is also available for FREE download. This can be used to value the arbitrage spread of any stock-for-stock merger deals you may be interested in trading or additionally used in a pairs trading investment strategy.